FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:K

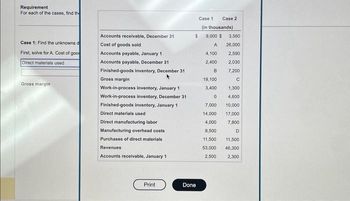

An auditor for the Internal Revenue Service is trying to reconstruct some partially destroyed records of two taxpayers.

(Click the icon to view the records.)

Requirement

For each of the cases, find the unknowns designated by the letters A and B for Case 1 and C and D for Case 2.

Case 1: Find the unknowns designated by the letters A and B.

First, solve for A. Cost of goods sold.

Direct materials used

Gross margin

14000

Transcribed Image Text:Requirement

For each of the cases, find the

Case 1: Find the unknowns d

First, solve for A. Cost of good

Direct materials used

Gross margin

Accounts receivable, December 31

Cost of goods sold

Accounts payable, January 1

Accounts payable, December 31

Finished-goods inventory, December 31

Gross margin

Work-in-process inventory, January 1

Work-in-process inventory, December 31

Finished-goods inventory, January 1

Direct materials used.

Direct manufacturing labor

Manufacturing overhead costs

Purchases of direct materials

Revenues

Accounts receivable, January 1

Print

$

Done

Case 1 Case 2

(in thousands)

9,000 $ 3,560

A

26,000

2,590

2,030

7,200

C

4,100

2,400

B

19,100

3,400

0

7,000

14,000

4,000

8,500

11,500

53,000

2,500

1,300

4,600

10,000

17,000

7,800

D

11,500

46,300

2,300

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please do not give solution in image formatarrow_forwardCost of Goods Manufactured for a Manufacturing Company Two items are omitted from each of the following three lists of cost of goods manufactured statement data. Determine the amounts of the missing items, identifying them by letter. Work in process inventory, August 1 $2,100 $18,500 (e) Total manufacturing costs incurred during August 14,700 (c) 108,800 Total manufacturing costs (a) $216,500 $118,100 Work in process inventory, August 31 3,200 45,500 (f) Cost of goods manufactured (ь) (d) $99,200 a. b. $ C. d. e. f.arrow_forwardAccounting records for Antoinette Designs (AD) for November show the following (each entry is the total of the actual entries for the account for the month): Account Titles Work-in-Process Inventory (Direct Labor) Wages Payable Direct Materials Inventory Accounts Payable Finished Goods Inventory Work-in-Process Inventory Cost of Goods Solda Finished Goods Inventory Debit 7,200 122,130 136,800 131,400 Credit 7,200 Required: a. What was the finished goods inventory balance on November 30? b. How much manufacturing overhead was applied for November? c. What was the manufacturing overhead rate for November? d. How much manufacturing overhead was incurred for November? e. What was the Work-in-Process Inventory on November 1? f. What was the Work-in-Process Inventory on November 30? 122,130 136,800 131,400 aThis entry does not include any over- or underapplied overhead. Over- or underapplied overhead is written off to Cost of Goods Sold once for the month. For November, the amount written…arrow_forward

- Needed helparrow_forwardRaw materials Beginning inventory $344 Purchases 1,533 Materials available for use Ending inventory 322 Materials used in production $ Work in process inventory Beginning inventory $934 Materials used in production Direct labor 1,536 Overhead applied Manufacturing costs incurred $22,457 Ending inventory 936 Cost of goods manufactured $ Finished goods inventory Beginning inventory Cost of goods manufactured Goods available for sale $25,016 Ending inventory Cost of goods sold $21,801arrow_forwardOFF COMPANY STEP BY STEP PLEASEarrow_forward

- Cost of Goods Manufactured for a Manufacturing Company Two items are omitted from each of the following three lists of cost of goods manufactured statement data. Determine the amounts of the missing items, identi Work in process inventory, August 1 $19,660 $41,650 (e) Total manufacturing costs incurred during August 332,750 (c) 1,075,000 Total manufacturing costs (a) $515,770 $1,240,000 Work in process inventory, August 31 23,500 54,000 (f) Cost of goods manufactured (b) (d) $1,068,000 a. $ EA b. $ C. d. $ e. f. $ $ 69arrow_forwardNeed help with this questionarrow_forwardCost of Goods Manufactured for a Manufacturing Company Two items are omitted from each of the following three lists of cost of goods manufactured statement data. Determine the amounts of the missing items, identifying them by letter. Work in process inventory, August 1 $2,200 $18,900 (e) Total manufacturing costs incurred during August 15,200 (c) 111,200 Total manufacturing costs (a) $221,100 $120,700 Work in process inventory, August 31 3,300 46,400 (f) Cost of goods manufactured (b) (d) $101,400 a. b. c. d. e. f.arrow_forward

- Give typing answer with explanation and conclusion nvex Mechanical Supplies produces a product with the following costs as of July 1, 20X1: Material $6 Labor 4 Overhead 3 $13 Beginning inventory at these costs on July 1 was 6,100 units. From July 1 to December 1, Convex produced 17,000 units. These units had a material cost of $10 per unit. The costs for labor and overhead were the same. Convex uses FIFO inventory accounting. a. Assuming that Convex sold 19,000 units during the last six months of the year at $20 each, what would gross profit be? b. What is the value of ending inventory?arrow_forwardA-5arrow_forwardCost of Goods Manufactured for a Manufacturing Company Two items are omitted from each of the following three lists of cost of goods manufactured statement data. Determine the amounts of the missing items, identifying them by letter. Work in process inventory, August 1 $3,100 $25,700 (e) Total manufacturing costs incurred during August 21,400 (c) 150,900 Total manufacturing costs (a) $300,700 $163,800 Work in process inventory, August 31 4,700 63,100 (f) Cost of goods manufactured (b) (d) $137,600 a. b. C. d. e. f.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education