FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

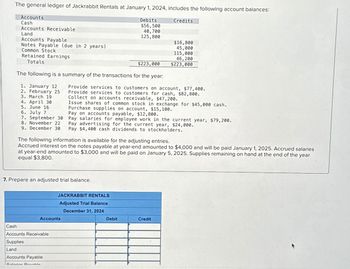

Transcribed Image Text:The general ledger of Jackrabbit Rentals at January 1, 2024, includes the following account balances:

Debits

$56,500

40,700

125,800

Accounts

Cash

Accounts Receivable

Land

Accounts Payable

Notes Payable (due in 2 years)

Common Stock

Retained Earnings

Totals

$223,000

The following is a summary of the transactions for the year:

1. January 12

2. February 25

3. March 19

4. April 30

5. June 16

6. July 7

7. September 30

8. November 22

9. December 30

Accounts

Cash

Accounts Receivable

Supplies

Land

Accounts Payable

Salories Dovohle

Provide services to customers on account, $77,400.

Provide services to customers for cash, $82,800.

ollect on accounts receivable, $47,200.

Issue shares of common stock in exchange for $45,000 cash.

Purchase supplies on account, $15,100.

7. Prepare an adjusted trial balance.

Credits

Pay on accounts payable, $12,800.

Pay salaries for employee work in the current year, $79,200.

The following information is available for the adjusting entries.

Accrued interest on the notes payable at year-end amounted to $4,000 and will be paid January 1, 2025. Accrued salaries

at year-end amounted to $3,000 and will be paid on January 5, 2025. Supplies remaining on hand at the end of the year

equal $3,800.

$16,800

45,000

115,000

46,200

$223,000

Pay advertising for the current year, $24,000.

Pay $4,400 cash dividends to stockholders.

JACKRABBIT RENTALS

Adjusted Trial Balance

December 31, 2024

Debit

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The financial statements of the Sunland Company report net sales of $384000 and accounts receivable of $50400 and $33600 at the beginning of the year and the end of the year, respectively. What is the average collection period for accounts receivable in days?arrow_forwardThe following are taken from the financial statements of Curry Company as of December 2021. Assets: Cash 341,600 Account Receivable 200,000 Inventory 308,400 Property, Plant, Equipment 500,000 Liabilities: Notes payable 280,000 Accounts Payable 781,700 Bonds payable 2,000,000 6. What is the company's current ratio? a. 0.80 b. 0.51 c. 0.21 d. 3.03 7. What is the company's quick ratio? a. 0.51 b. 0.80 c. 1.93 d. 0.32arrow_forwardOn January 1, 2021, the general ledger of Big Blast Fireworks includes the following account balances:Accounts Debit CreditCash $ 21,900Accounts Receivable 36,500Allowance for Uncollectible Accounts $ 3,100Inventory 30,000Land 61,600Accounts Payable 32,400Notes Payable (8%, due in 3 years) 30,000Common Stock 56,000Retained Earnings 28,500Totals $150,000 $150,000The $30,000 beginning balance of inventory consists of 300 units, each costing…arrow_forward

- On January 1, 2021, the general ledger of ACME Fireworks includes the following account balances:Accounts Debit CreditCash $ 25,100Accounts Receivable 46,200Allowance for Uncollectible Accounts $ 4,200Inventory 20,000Land 46,000Equipment 15,000Accumulated Depreciation 1,500Accounts Payable 28,500Notes Payable (6%, due April 1, 2022) 50,000Common Stock 35,000Retained Earnings…arrow_forwardOn January 1, 2024, the general ledger of Big Blast Fireworks includes the following account balances: Accounts Debit Credit Cash $24,300 Accounts Receivable 42,500 Allowance for Uncollectible Accounts $2,700 Inventory 42,000 Land 79,600 Accounts Payable 29,200 Notes Payable (8%, due in 3 years) 42,000 Common Stock 68,000 Retained Earnings 46,500 Totals $188,400 $188,400 The $42,000 beginning balance of inventory consists of 420 units, each costing $100. During January 2024, Big Blast Fireworks had the following inventory transactions: January 3 Purchase 1,050 units for $115,500 on account ($110 each). January 8 Purchase 1,150 units for $132,250 on account ($115 each). January 12 Purchase 1,250 units for $150,000 on account ($120 each). January 15 Return 160 of the units purchased on January 12 because of defects. January 19 Sell 3,600 units on account for $576,000. The cost of the units sold is determined using a FIFO…arrow_forwardThe following data were taken from the balance sheet of Nilo Company at the end of two recent fiscal years: Line Item Description Current Year Previous Year Current assets: Cash $417,200 $318,000 Marketable securities 483,100 357,800 Accounts and notes receivable (net) 197,700 119,200 Inventories 1,167,500 905,200 Prepaid expenses 601,500 578,800 Total current assets $2,867,000 $2,279,000 Current liabilities: Accounts and notes payable (short-term) $353,800 $371,000 Accrued liabilities 256,200 159,000 Total current liabilities $610,000 $530,000 a. Determine for each year (1) the working capital, (2) the current ratio, and (3) the quick ratio. Round ratios to one decimal place. Line Item Description Current Year Previous Year 1. Working capital ? ? 2. Current ratio ? ? 3. Quick ratio ? ? from the preceding year to the current year. The working capital, current ratio, and quick…arrow_forward

- On January 1, 2021, the general ledger of Big Blast Fireworks includes the following account balances: Debit $ 23, 300 40, e0e Accounts Credit Cash Accounts Receivable Allowance for Uncollectible Accounts $ 4, 5e0 Inventory Land Accounts Payable Notes Payable (6%, due in 3 ycars) 37,e00 72,100 28,98e 37, eee 63, 0ee Common Stock Retained Earnings 39. eee Totals $172,488 $172,488 The $37,000 beginning balance of inventory consists of 370 units, each costing $100. During Janusry 2021, Big Blast Fireworks had the following inventory transections: January 3 Purchase 1,680 units for $168,888 on account ($18s cach). January 8 Purchase 1,78e units for $187,800 on account ($110 cach). January 12 Purchase 1,88e units for $207, Bee on account ($115 cach). January 15 Return 135 of the units purchased on January 12 because of defects. January 19 Sell 5,200 units on account for $780,8ee. The cost of the units sold is deternined using a FIFD perpetual inventory systen. January 22 Receive $753,eee…arrow_forwardSagararrow_forwardCalculate the allowance ratio for the year ending 30 June 2020. Assume the number of days in the year is 365. Round the percentage change to one decimal placearrow_forward

- Please SHOw your workarrow_forwardThe following data are taken from the financial statements of Outdoor Patio Inc. Terms of all sales are 2/10, n/60. Year 3 Year 2 Year 1 Accounts receivable, end of year $190,200 $204,000 $219,400 Sales 1,084,050 994,990 a. For Years 2 and 3, determine (1) the accounts receivable turnover and (2) the number of days' sales in receivables. Assume there are 365 days in the year. Round intermediate calculations to the nearest whole dollar and final answers to one decimal place. Year 3 Year 2 1. Accounts receivable turnover fill in the blank 1 fill in the blank 2 2. Number of days' sales in receivables fill in the blank 3 days fill in the blank 4 daysarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education