FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

| DATE | TRANSACTIONS | |

| Jan. | 2 | Purchased supplies for $14,000; issued Check 1015. |

| 2 | Purchased a one-year insurance policy for $16,800. | |

| 7 | Sold services for $30,000 in cash and $20,000 on credit during the first week of January. | |

| 12 | Collected a total of $8,000 on account from credit customers during the first week of January. | |

| 12 | Issued Check 1017 for $7,200 to pay for special promotional advertising to new businesses on the local radio station during the month. | |

| 13 | Collected a total of $9,000 on account from credit customers during the second week of January. | |

| 14 | Returned supplies that were damaged for a cash refund of $1,500. | |

| 15 | Sold services for $41,400 in cash and $4,600 on credit during the second week of January. | |

| 20 | Purchased supplies for $10,000 from White’s, Inc.; received Invoice 2384 payable in 30 days. | |

| 20 | Sold services for $25,000 in cash and $7,000 on credit during the third week of January. | |

| 20 | Collected a total of $11,200 on account from credit customers during the third week of January. | |

| 21 | Issued Check 1018 for $14,130 to pay for maintenance work on the office equipment. | |

| 22 | Issued Check 1019 for $7,200 to pay for special promotional advertising to new businesses in the local newspaper. | |

| 23 | Received the monthly telephone bill for $2,050 and paid it with Check 1020. | |

| 26 | Collected a total of $3,200 on account from credit customers during the fourth week of January. | |

| 27 | Issued Check 1021 for $6,000 to Office Plus as payment on account for Invoice 2223. | |

| 28 | Sent Check 1022 for $5,350 in payment of the monthly bill for utilities. | |

| 29 | Sold services for $38,000 in cash and $5,500 on credit during the fourth week of January. | |

| 31 | Issued Checks 1023–1027 for $65,600 to pay the monthly salaries of the regular employees and three part-time workers. | |

| 31 | Issued Check 1028 for $24,000 for personal use. | |

| 31 | Issued Check 1029 for $8,300 to pay for maintenance services for the month. | |

| 31 | Purchased additional equipment for $30,000 from Contemporary Equipment Company; issued Check 1030 for $20,000 and bought the rest on credit. The equipment has a five-year life and no salvage value. | |

| 31 | Sold services for $15,200 in cash and $3,240 on credit on January 31. | |

| ADJUSTMENTS | ||

| 31 | Compute and record the adjustment for supplies used during the month. An inventory taken on January 31 showed supplies of $9,400 on hand. | |

| 31 | Compute and record the adjustment for expired insurance for the month. | |

| 31 | Record the adjustment for one month of expired rent of $4,000. | |

| 31 | Record the adjustment for |

Required:

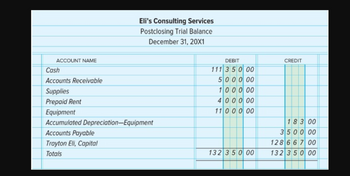

- General Ledger tab: Enter the account balances for January 1, 20X2 from the postclosing

trial balance prepared on December 31, 20X1, which appears in Figure 6.3. - General Journal tab: Analyze each of the transactions listed for January and record it in the general journal.

- General

Ledger tab: Post the transactions to the general ledger accounts. - Worksheet tab: Prepare the Trial Balance section of the worksheet.

- Worksheet tab: Prepare the Adjustments section of the worksheet using the adjusting transactions.

- Worksheet tab: Complete the worksheet.

- Income Statement tab: Prepare an income statement for the month.

- Stmt of OE tab: Prepare a statement of owner’s equity.

Balance Sheet tab: Prepare a balance sheet.- Adjusting and Closing tab: Record the

adjusting entries and the closing entries in the general journal. - General Ledger tab: Post the adjusting entries and the closing entries to the general ledger accounts.

- Post Closing tab: Prepare a postclosing trial balance.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

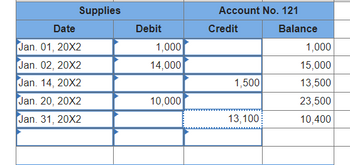

the general ledger also has 1,000 debited for supplies on Jan. 1, does this change the adjusting numbers for supplies in the journal or the worksheet?

without the 1,000 on jan. 1, the adjusting number (13,100), when entered in the ledger as a credit, leaves 9,400 on hand for supplies.

Transcribed Image Text:ACCOUNT NAME

Cash

Accounts Receivable

Supplies

Prepaid Rent

Eli's Consulting Services

Postclosing Trial Balance

December 31, 20X1

Equipment

Accumulated Depreciation-Equipment

Accounts Payable

Trayton Eli, Capital

Totals

DEBIT

111 350 00

5000 00

100000

400000

110 00 00

132 350 00

CREDIT

183 00

3500 00

128 6 6 7 00

132 350 00

Transcribed Image Text:Supplies

Date

Jan. 01, 20X2

Jan. 02, 20X2

Jan. 14, 20X2

Jan. 20, 20X2

Jan. 31, 20X2

Debit

1,000

14,000

10,000

Account No. 121

Credit

1,500

13,100

Balance

1,000

15,000

13,500

23,500

10,400

Solution

by Bartleby Expert

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

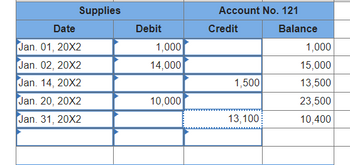

the general ledger also has 1,000 debited for supplies on Jan. 1, does this change the adjusting numbers for supplies in the journal or the worksheet?

without the 1,000 on jan. 1, the adjusting number (13,100), when entered in the ledger as a credit, leaves 9,400 on hand for supplies.

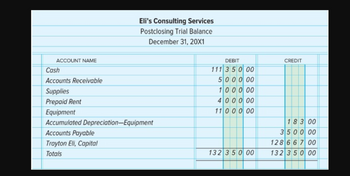

Transcribed Image Text:ACCOUNT NAME

Cash

Accounts Receivable

Supplies

Prepaid Rent

Eli's Consulting Services

Postclosing Trial Balance

December 31, 20X1

Equipment

Accumulated Depreciation-Equipment

Accounts Payable

Trayton Eli, Capital

Totals

DEBIT

111 350 00

5000 00

100000

400000

110 00 00

132 350 00

CREDIT

183 00

3500 00

128 6 6 7 00

132 350 00

Transcribed Image Text:Supplies

Date

Jan. 01, 20X2

Jan. 02, 20X2

Jan. 14, 20X2

Jan. 20, 20X2

Jan. 31, 20X2

Debit

1,000

14,000

10,000

Account No. 121

Credit

1,500

13,100

Balance

1,000

15,000

13,500

23,500

10,400

Solution

by Bartleby Expert

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Jumbotron Inc. collects its receivables in 15 days and pays its payables in 20 days. All sales and purchases are on credit. All months have 30 days. December purchases were $7,000, January purchases were $8,700, February purchase were $6,600 and March purchases were $6,000. What were Jumbotron's total cash disbursements in February? (To the nearest $) ● ● $7,667 $8,000 $1,867 $6,533 $5,600arrow_forwardJournalize the transactions shown below in the two-column general journal that follows. Calculate HST (13%) on all sales transactions. | Oct. 2 Cash Sales Slip No. 102 to S. Stewart, $102.50 plus taxes. 6 Sales Invoice No. 617 to Jack Morrison, $250.90 plus taxes. Cheque Copy 10 No. 910 to Industrial Suppliers, $500 on account. Cash Receipt From Jack Mahoney, $322.50 on account. 12 18 Purchase Invoice From Grand's Stationers, S60.50 for office supplies taxes. 20 Cheque Copy No. 911 to Jack Whitcombe, $525 for personal use. 24 Bank Debit Memo $31.90 for bank service charge. Cash Sales Slip No. 103 to J. Beck, $450 plus taxes. 31arrow_forwardThe following accounts, with the balances indicated, appear in the ledger of Garcon Co. on December 1 of the current year: 211 Salaries Payable 212 Social Security Tax Payable 213 Medicare Tax Payable 214 Employees Federal Income Tax Payable 215 Employees State Income Tax Payable 216 State Unemployment Tax Payable 217 Federal Unemployment Tax Payable 218 Retirement Savings Deductions Payable $ 9,273 $ 3,400 219 Medical Insurance Payable 411 Operations Salaries Expense 511 Officers Salaries Expense 512 Office Salaries Expense 519 Payroll Tax Expense 27,000 2,318 15,455 950,000 13,909 600,000 1,400 150,000 500 137,951 The following transactions relating to payroll, payroll deductions, and payroll taxes occurred during December: Dec. 2. Issued Check No. 410 for $3,400 to Jay Bank to invest in a retirement savings account for employees. 2. Issued Check No. 411 to Jay Bank for $27,046, in payment of $9,273 of social secu- rity tax, $2,318 of Medicare tax, and $15,455 of employees' federal…arrow_forward

- 4. Jill Hamlin borrowed $40,000 from the bank on August 16, issuing the bank a 12% note. The entry to record accrued interest on the note on August 31 (15 days later) would include: a . debit Interest Expense for $197.26 b. debit Interest Payable for $197.26 c. credit Interest Expense for $407.67 d. credit Interest Payable for $407.67 d. debit Cash for $18,000arrow_forward. Determine the due date of the note. September 21 b. Determine the maturity value of the note. Assume 360 days in a year. Linstrum Company received a 60-day, 9% note for $56,000, dated July 23, from a customer on account. CHART OF ACCOUNTS Linstrum Company General Ledger ASSETS 110 Cash 111 Petty Cash 120 Accounts Receivable 129 Allowance for Doubtful Accounts 132 Notes Receivable 141 Merchandise Inventory 145 Office Supplies 146 Store Supplies 151 Prepaid Insurance 181 Land 191 Store Equipment 192 Accumulated Depreciation-Store Equipment 193 Office Equipment 194 Accumulated Depreciation-Office Equipment LIABILITIES 210 Accounts Payable 211 Salaries Payable 213 Sales Tax Payable 214 Interest Payable 215 Notes Payable EQUITY 310 Owner, Capital 311 Owner, Drawing 312 Income Summary REVENUE 410 Sales 610 Interest Revenue EXPENSES 510 Cost of Merchandise Sold…arrow_forwardBANK RECONCILIATION AND RELATED JOURNAL ENTRIES The book balance in the checking account of Lyle's Salon as of Novemeber 30 is $3,282.95. The bank statement shows an ending balance of $2,127. By examining last month's bank in novemeber and noting the service charges and other debit and credit memos shown on the bank statement, the following were found: a) An ATM withdrawl of $150 on November 18 by Lyle for personal use was not recorded in the books b) A bank debit memo issued for an NSF check from a customer of $19.50 c) A bank credit memo issued for interest of $19 earned during the month d) on November 30, A deposit of 1,177 was made which is not shown on the bank statement. e) A bank debit memo issued for $17.50 for bank service charges. f) checks No. 549,561 and 562 for the amounts of $185, $21 and $9.40, respectively, were written during november but have not yet been received by the bank. g) The reconciliation from the previous month showed outstanding checks totaling $271.95…arrow_forward

- Recording Note Transactions The following information is extracted from Tara Corporation’s accounting records: May 1 Received a $6,000, 12%, 90-day note from V. Leigh, a customer. May 6 Received a $9,000, 10%, 120-day note from C. Gable, a customer. May 11 Sold the Leigh and Gable notes with recourse at the bank at 13%. In addition, borrowed $10,000 from the bank for 90 days at 12%. The bank remits the face value less the interest. The estimated recourse liability for Leigh and Gable is $84 and $110, respectively. July 31 The July bank statement indicated that the Leigh note had been paid. Aug. 10 Repaid the $10,000 borrowed on May 11. Sept. 4 Received notice that Gable had defaulted on the May 6 note. The bank charged a fee of $10. Paid the amount due on the Gable note to the bank. Informed Gable to pay Tara the entire amount due plus 11% interest on the total of the face amount of the note, the accrued interest, and the fee from the maturity date until Gable remits the amount owed.…arrow_forwardWould you help mearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education