FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

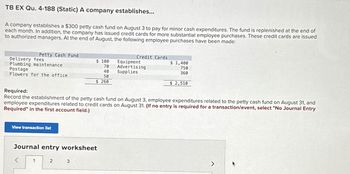

Transcribed Image Text:TB EX Qu. 4-188 (Static) A company establishes...

A company establishes a $300 petty cash fund on August 3 to pay for minor cash expenditures. The fund is replenished at the end of

each month. In addition, the company has issued credit cards for more substantial employee purchases. These credit cards are issued

to authorized managers. At the end of August, the following employee purchases have been made:

Petty Cash Fund

Delivery fees

Plumbing maintenance

Postage

Flowers for the office

View transaction list

1

Journal entry worksheet

$ 100

70

40

50

$ 260

2

Required:

Record the establishment of the petty cash fund on August 3, employee expenditures related to the petty cash fund on August 31, and

employee expenditures related credit cards on August 31. (If no entry is required for a transaction/event, select "No Journal Entry

Required" in the first account field.)

3

Credit Cards

Equipment

Advertising

Supplies

$1,400

750

360

$2,510

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On May 1, a petty cash fund was established for $200. The following vouchers were issued during May. Date Voucher Purpose Amount May 1 1 Office supplies $ 3.00 3 2 Birthday gift for office worker (misc. exp.) 15.00 5 3 Mileage reimbursement 5.00 7 4 Postage due 2.00 8 5 Office supplies 4.00 11 6 Donation—Goodwill (contribution exp.) 10.00 15 7 Telephone call (telephone exp.) 5.00 21 8 Mileage reimbursement 11.00 23 9 Withdrawal by owner (Carla Sanchez) 20.00 25 10 Postage due 3.50 26 11 Office supplies 17.00 28 12 Copier repair (misc. exp.) 18.50 Required: 1. Prepare the journal entry to establish the petty cash fund on May 1. 2. Record the vouchers in the petty cash record. Total and rule the petty cash record. 3. Prepare the journal entry to replenish the petty cash fund. Make…arrow_forwardThe custodian of a $735 petty cash fund discovers that the fund has $157.50 in coins and currency plus $553.50 in receipts at the end of the month. The entry to replenish the petty cash fund will include: Multiple Choice A debit to Cash for $530. A debit to Petty Cash for $553.50. A credit to Cash Over and Short for $578. A credit to Cash for $553.50 A dohit to Cach Over and Short for $24.00 Help I Save & Exitarrow_forwardDon't give answer in image formatarrow_forward

- 000 Debit Cash $250; credit Accounts Payable $250. Havermill Co. establishes a $250 petty cash fund on September 1. On September 30, the fund is replenished. The accumulated receipts on that date represent $73 for Office Supplies, $137 for merchandise inventory, and $22 for miscellaneous expenses. The fund has a balance of $18. On October 1, the accountant determines that the fund should be increased by $50. The journal entry to record the establishment of the fund on September 1 is: Debit Petty Cash $250; credit Cash $250. Debit Petty Cash $250; credit Accounts Payable $250. Debit Cash $250; credit Petty Cash $250. Debit Miscellaneous Expense $250; credit Cash $250.arrow_forwardA company established a petty cash fund in April of the current year and experienced the following transactions affecting the fund during April. Prepare journal entries to establish the fund on April 1, to replenish it on April 25, and to record the increase in the fund on April 25. April 1 Prepared a company check for $300.00 to establish the petty cash fund. April 25 Prepared a company check to replenish the fund for the following expenditures made since April 1. Paid $84.50 for cleaning services. Paid $84.00 for postage expense. Paid $103.15 for office supplies. Counted $23.35 remaining in the petty cash box. April 25 The company decides to increase the fund by $100.arrow_forward6arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education