EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

Financial Accounting Question

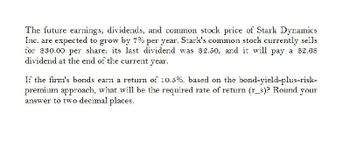

Transcribed Image Text:The future earnings, dividends, and common stock price of Stark Dynamics

Inc. are expected to grow by 7% per year. Stark's common stock currently sells

for $30.00 per share; its last dividend was $2.50, and it will pay a $2.68

dividend at the end of the current year.

If the firm's bonds earn a return of 10.5%, based on the bond-yield-plus-risk-

premium approach, what will be the required rate of return (r_s)? Round your

answer to two decimal places.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The future earnings, dividends, and common stock price of Callahan Technologies Inc. are expected to grow 3% per year. Callahan's common stock currently sells for $22.75 per share; its last dividend was $2.00; and it will pay a $2.06 dividend at the end of the current year. If the firm's bonds earn a return of 9%, based on the bond-yield-plus-risk-premium approach, what will be rs? Use the midpoint of the risk premium range discussed in Section 10-5 in your calculations. Round your answer to two decimal places. % If you have equal confidence in the inputs used for the three approaches, what is your estimate of Callahan's cost of common equity? Do not round intermediate calculations. Round your answer to two decimal places. %arrow_forwardBarton Industries estimates its cost of common equity by using three approaches: the CAPM, the bond-yield-plus-risk-premium approach, and the DCF model. Barton expects next year's annual dividend, D1, to be $2.40 and it expects dividends to grow at a constant rate gL = 5.8%. The firm's current common stock price, P0, is $21.00. The current risk-free rate, rRF, = 4.8%; the market risk premium, RPM, = 6.1%, and the firm's stock has a current beta, b, = 1.2. Assume that the firm's cost of debt, rd, is 10.57%. The firm uses a 4.1% risk premium when arriving at a ballpark estimate of its cost of equity using the bond-yield-plus-risk-premium approach. What is the firm's cost of equity using each of these three approaches? Do not round intermediate calculations. Round your answers to two decimal places. CAPM cost of equity: % Bond-Yield-Plus-Risk-Premium: % DCF cost of equity: % If you are equally confident of all three methods, then what is the best estimate of the firm’s cost of…arrow_forwardBarton Industries estimates its cost of common equity by using three approaches: the CAPM, the bond-yield-plus-risk-premium approach, and the DCF model. Barton expects next year's annual dividend, D1, to be $2.10 and it expects dividends to grow at a constant rate g = 4.4%. The firm's current common stock price, P0, is $25.00. The current risk-free rate, rRF, = 4.7%; the market risk premium, RPM, = 6.0%, and the firm's stock has a current beta, b, = 1.15. Assume that the firm's cost of debt, rd, is 11.00%. The firm uses a 3.0% risk premium when arriving at a ballpark estimate of its cost of equity using the bond-yield-plus-risk-premium approach. What is the firm's cost of equity using each of these three approaches? Round your answers to two decimal places. CAPM cost of equity: % Bond yield plus risk premium: % DCF cost of equity: % What is your best estimate of the firm's cost of equity?arrow_forward

- What is the average return in the market (Rm)?arrow_forwardGiant Enterprises' stock has a required return of 13.1%. The company, which plans to pay a dividend of $1.65 per share in the coming year, anticipates that its future dividends will increase at an annual rate consistent with that experienced over 2013-2019 period, when the following dividends were paid: ( see attached chart ) a. If the risk-free rate is 4%, what is the risk premium on Giant's stock? b. Using the constant-growth model, estimate the value of Giant's stock. (Hint: Round the computed dividend growth rate to the nearest whole percent.) c. Explain what effect, if any, a decrease in the risk premium would have on the value of Giant's stock.arrow_forwardDyer Furniture is expected to pay a dividend of D1 = $1.65 per share at the end of the year, and that dividend is expected to grow at a constant rate of 6.8% per year in the future. The company's beta is 1.19, the market risk premium is 5.55%, and the risk-free rate is 4.00%. What is Dyer's current stock price? (Round your answer to 2 decimal places.) Please work out the problem, do not use excel.arrow_forward

- A company currently pays a dividend of $2 per share (D0 = $2). It is estimated that the company’s dividend will grow at a rate of 20% per year forthe next 2 years and then at a constant rate of 7% thereafter. The company’sstock has a beta of 1.2, the risk-free rate is 7.5%, and the market risk premium is 4%. What is your estimate of the stock’s current price?arrow_forwardWeber Integrated Systems Inc. is expected to pay a year-end dividend of $0.90 per share (i.e. D1 = $0.90), and that dividend is expected to grow at a constant rate of 4.00% per year in the future. The company's beta is 1.20, the market risk premium is 5.00 %, and the risk - free rate is 4.00 % . What is the company's current stock price? a. $15.00 b. $15.60 c. $16.33 d. $17.77 e. $ 18.20arrow_forwardWestsyde Tool Company is expected to pay a dividend of $1.50 in the upcoming year. The risk-free rate of return is 6%, and the expected return on the market portfolio is 14%. Analysts expect the price of Westsyde Tool Company shares to be $22 a year from now. The beta of Westsyde Tool Company's stock is 1.1. Compute the intrinsic value of Westsyde Tool Company's stock. Round your answer to 2 decimal places, and enter your answer without the dollar sign.arrow_forward

- Crisp Cookware’s common stock is expected to pay a dividend of $3 a share at the end of this year (D1 = $3.00); its beta is 0.8. The risk-free rate is 5.2%, and the market risk premium is 6%. The dividend is expected to grow at some constant rate g, and the stock currently sells for $40 a share. Assuming the market is in equilibrium, what does the market believe will be the stock’s price at the end of 3 years (i.e., what is P3)?arrow_forwardThe future earnings, dividends, and common stock price of Callahan Technologies Inc. are expected to grow 6% per year. Callahan's common stock currently sells for $22 per share; its last dividend was $2.00; and it will pay a $2.12 dividend at the end of the current year. 1. Using the DCF approach, what is its cost of common equity? 2. If the firm's beta is 1.2, the risk-free rate is 6%, and the average return on the market is 13%, what will be the firm's cost of common equity using the CAPM approach? Round your answer to two decimal places. 3. If the firm's bonds earn a return of 11%, based on the bond-yield-plus-risk-premium approach, what will be rs? Use the midpoint of the risk premium range discussed in Section 10-5 in your calculations.arrow_forwardA financial analyst estimates that the current risk-free rate for NN company is 6.25 percent, the market risk premium is 5 percent, and NN's beta is 1.75. The current earnings per share (EPS0) is RM2.50. The company has a 40 percent payout ratio. The analyst estimates that the company's dividend will grow at a rate of 25 percent this year, 20 percent next year, and 15 percent the following year. After three years the dividend is expected to grow at a constant rate of 7 percent a year. The company is expected to maintain its current payout ratio. The analyst believes that the stock is fairly priced. a) What is the required rate of return for the stock? b) What are the dividends for 4 years? c) What is the stock price at the end of year 3?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT