Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

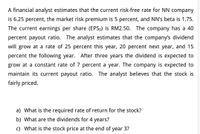

Transcribed Image Text:A financial analyst estimates that the current risk-free rate for NN company

is 6.25 percent, the market risk premium is 5 percent, and NN's beta is 1.75.

The current earnings per share (EPS0) is RM2.50. The company has a 40

percent payout ratio. The analyst estimates that the company's dividend

will grow at a rate of 25 percent this year, 20 percent next year, and 15

percent the following year. After three years the dividend is expected to

grow at a constant rate of 7 percent a year. The company is expected to

maintain its current payout ratio. The analyst believes that the stock is

fairly priced.

a) What is the required rate of return for the stock?

b) What are the dividends for 4 years?

c) What is the stock price at the end of year 3?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Analysts forecast that Dixie Chicks, Inc. (DCI) will pay a dividend of $3.00 a share now, continuing a long-term growth trend of 8% per year. If this trend is expected to continue indefinitely, and investors' required rate of return for DCI is 14%: a) What is the market value per share of DCI's common stock? b) What is the market value per share of DCI's common stock if required rate of return is 11%? c) If there is expected to be non-constant growth of 30% for the first year, then 24% for the next year, then 14% for next year, finally stabilizing to a constant growth of 9% per year in the 4th year what is the market value per share with the original required rate of return?arrow_forwardAn analyst has gathered the following information for the Oudin Corporation: Expected earnings per share = €5.49 Expected dividends per share = €2.13 Dividends are expected to grow at 2.53 percent per year indefinitely The required rate of return is 7.74 percent Based on the information provided, compute the price/earnings multiple for Oudin (Enter your answer as a number with two decimal places, like this: 12.34)arrow_forwardGiant Enterprises' stock has a required return of 13.1%. The company, which plans to pay a dividend of $1.65 per share in the coming year, anticipates that its future dividends will increase at an annual rate consistent with that experienced over 2013-2019 period, when the following dividends were paid: ( see attached chart ) a. If the risk-free rate is 4%, what is the risk premium on Giant's stock? b. Using the constant-growth model, estimate the value of Giant's stock. (Hint: Round the computed dividend growth rate to the nearest whole percent.) c. Explain what effect, if any, a decrease in the risk premium would have on the value of Giant's stock.arrow_forward

- Banco Tech is an early stage financial technology firm. Earnings this year where $20 per share and are expected to grow at 20% per year for the next three years. Banco does not plan to pay a dividend until three years time, when the payout ratio will be 43%. Dividends are expected to grow at 6% thereafter. The required rate of return is 9%. Calculated intrinsic value.arrow_forwardVonderboom Company just paid a dividend of $1.67 per share to its stocholders. Market analysts believe Vonderboom Company will grow by 19% next year, 13.75% the following year, and 13% the year after. Then, it is projected that Vonderboom Compnay will grow at a constant rate of 4.75% per year indefinitely. The current rate of interest on risk - free assets is 2.51 %, and the rate of return on market portfolio is 11.25 %. Vonderboom Company's beta is estimate to be 1.09. What is the estimate of the current market price of Vonderboom Company's stock?arrow_forwardPortman Industries just paid a dividend of $1.92 per share. The company expects the coming year to be very profitable, and its dividend is expected to grow by 16.00% over the next year. After the next year, though, Portman’s dividend is expected to grow at a constant rate of 3.20% per year. The risk-free rate (rRFrRF) is 4.00%, the market risk premium (RPMRPM) is 4.80%, and Portman’s beta is 2.00. What is the dividents one year from now? What is the Horizon value? What is the Intrinsic value?arrow_forward

- The expected return on the market is 12.36 %, the risk-free rate is 4.88 %, and the tax rate is 18.00 %. Semper Fun Sports has 310,000 common shares outstanding that are priced at $40.20 per share and have an expected return of 16.96 % and an expected real return of 14.62 %. Last year, Semper Fun Sports common stock had a return of 11.66 %. The company also has 411,000 shares of preferred stock outstanding that are priced at $15.50 per share and have an expected return of 13.36 % and an expected real return of 11.81%. Last year, Semper Fun Sports preferred stock had a return of 13.36%. Finally, the company has 10,000 bonds outstanding with a coupon rate of 9.69 %, yield-to-maturity of 4.70%, current yield of 8.44%, face value of $1,000.00, and price of $1,260.00. What is the weighted average cost of capital for Semper Fun Sports? 9.73% (plus or minus 0.02 percent) O 11.32% (plus or minus 0.02 percent) 12.21% (plus or minus 0.02 percent) 10.98% (plus or minus 0.02 percent) None of the…arrow_forwardThe future earnings, dividends, and common stock price of Core-Tech, Inc. are expected to grow 6% per year. Core-Tech's common stock currently sells for $21 per share; its last dividend was $2.00; and it will pay a $2.30 dividend at the end of the current year. If the firms beta is 1.9, the risk free rate is 8%, and the average return on the market is 14%, what is the firms cost of common equity (retained earnings) using the CAPM approach?arrow_forwardZapata Corporation will pay dividends of USD 5.00, USD 6.00, and USD 7.00 in the next three years. Thereafter, the company expects its dividend growth rate to be a constant 10 percent. If the required rate of return is 15 percent, what is the current market price of Zapata stock?arrow_forward

- Citco Company is considering investing up to $512,000 in a sustainability-enhancing project. Its managers have narrowed their choices to three potential projects. • Project A would redesign the production process to recycle raw materials waste back into the production cycle, saving on direct materials costs and reducing the amount of waste sent to the landfill. Project B would remodel an office building, utilizing solar panels and natural materials to create a more energy-efficient and healthy work environment. Project C would build a new training facility in an underserved community, providing jobs and economic security for the local community. Required: 1. Assuming the cost of capital is 12%, complete the table below by computing the payback period, NPV, profitability index, and internal rate of return. (Future Value of $1, Present Value of $1, Future Value Annuity of $1, Present Value Annuity of $1.) 2. Based strictly on the economic analysis, in which project should they invest?…arrow_forwardDollar Tree Inc (DLTR) is expected to pay a $1.85 dividend, and it is expected to grow at 9.85% for the next 3 years. After 3 years the dividend is expected to grow at the rate of 5.15% indefinitely. If the required return is 8.15%, what is DLTR's stock value today?arrow_forwardBelotti Company just paid a dividend of $1.67 per share to its stockholders. Market analysts believe Belotti Company will grow by 19 percent next year, 13.75 percent the following year, and 13 percent the year after. Then, it is projected that Belotti Company will grow at a constant rate of 4.75 percent per year indefinitely. The current rate of interest on risk-free asset is 2.51 percent and the rate of return on market portfolio is 11.25 percent. Belotti Company’s beta is estimated to be 1.09. What is your estimate of the current market price of Belotti Company’ stock?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education