FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

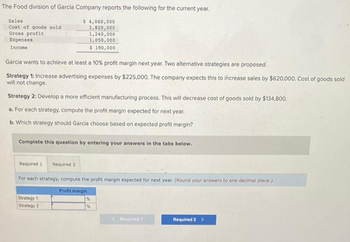

Transcribed Image Text:The Food division of Garcia Company reports the following for the current year.

$ 4,060,000

2,820,000

1,240,000

1,050,000

$ 190,000

Sales

Cost of goods sold

Gross profit

Expenses

Income

Garcia wants to achieve at least a 10% profit margin next year. Two alternative strategies are proposed.

Strategy 1: Increase advertising expenses by $225,000. The company expects this to increase sales by $620,000. Cost of goods sold

will not change.

Strategy 2: Develop a more efficient manufacturing process. This will decrease cost of goods sold by $134,800.

a. For each strategy, compute the profit margin expected for next year.

b. Which strategy should Garcia choose based on expected profit margin?

Complete this question by entering your answers in the tabs below.

Required 1 Required 2

For each strategy, compute the profit margin expected for next year. (Round your answers to one decimal place.)

Profit margin

Strategy 1

Strategy 2

%

%

Required 1

Required 2 >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- A furniture's store is considering tow marketing strategies: a loyalty program that would cost $3,000 and increase revenue by $15,000, or a seasonal sale that would cost $5,000 and increase revenue by $25,000. The store's contribution margin is 30%. Which strategy should they pursue if the goal is to maximize ROMI? What about if the goal is to maximize revenue growth?arrow_forwardWildhorse's managers have determined that variable costs per unit will increase by 16% beginning next month. To offset this increase in costs, they are considering a 10% increase in the sales price. Market research indicates that the price increase will result in a 2% decrease in the number of learning systems Wildhorse sells. What will be Wildhorse's expected operating income if the price increase is implemented? (Round per unit calculations to 2 decimal places e.g. 52.75 and final answer to O decimal places, eg. 5,275.) Operating income %24arrow_forwardOre Company produces bookcases. Sales were good in 2019. However, with the slowdown in the economy, the Chief Financial Officer is concerned about the sales for 2020. The income statement for 2020 is as follows: Sales revenue $600,000 Less: Variable costs $360,000 Contribution margin $240,000 Less: Fixed costs $140,000 Net profit $100,000 The company expects to sell 60,000 units in 2020. Compare different types of cost behaviours to do the following: (a) Use cost-volume-profit analysis to determine the breakeven point in units and in dollars. (b) Use cost-volume-profit analysis to determine the margin of safety in units and in dollars. (c) Assuming that cost behaviour pattern remains unchanged, compute the decrease in net income if sales revenue dropped by $200,000 in 2020.arrow_forward

- What is the margin, turnover and ROI if the existing company performs the same next year AND it adds the proposed investment? Paul company has the following data for its most recent year end: Sales $1,400,000 Variable Expenses $756,000 Contribution Margin $644,000 Fixed Expenses $410,000 NOI $234,000 AIso Paul is considering an investment in new equipment that willcost $250,000. The new equipment is projected to produce saIes of$420,000 and have variabIe costs of 60% of sales and fixed costs of$114,000.arrow_forwardi need the answer quicklyarrow_forwardWhat is the level of sales needed to obtain a 15% ROI of $8,250,000 for a restaurant and cover all the costs? (Condition: the restaurant has two main products, food and beverage) Food generates 75% of total sales and $3,000,000 in food sales with a 34% food cost. Beverage with a CMR of .80. Tax rate is 18% and fixed costs are $500,000 annually.arrow_forward

- Using this information below, answer the following question: What is the Net Income required? Total sales amount to $2,000,000 Food generates 75% of total sales Food cost is $500,000 Beverages generated sales of $300,000 with a CMR of 0.85 The gift store generated the remaining sales at a cost of 30% Tax rate is 27% Annual fixed costs total $1,500,000 Group of answer choices $1,080,000 $1,010,000 $1,000,000 $1,090,000arrow_forwardBhaarrow_forwardA new restaurant is ready to open for business. It is estimated that the food cost (variable cost) will be 64.46% of sales, while fixed cost will be $450,000. The first year’s sales estimates are $1,285,245. Calculate the firm’s operating breakeven level of sales.arrow_forward

- 3) A shoe retailer plans, for the period, net sales of $3,000,000 with a 20% profit and 25% operating expenses. The anticipated markdowns are 15%, along with sales discounts at 2% and shortages of 3%. Cash discounts to be earned are estimated at 5%, and alterations are 1% of net sales. What initial markup % is needed for this retailer's merchandise to achieve the desired profit goal?arrow_forwardBear Paints is a national paint manufacturer and retailer. (Click the icon to view additional information.) Assume that management has specified a 20% target rate of return. Read the requirements. Requirement 1. Calculate each division's ROI. First enter the formula, then calculate the ROI for each division. (Enter the ROI as a percent rounded to the nearest hundredth of a percentage, X.XX%.) Paint Stores Paint Stores Consumer Requirement 2. Calculate each division's sales margin. Interpret your results. Enter the formula, then calculate the sales margin for each division. (Enter the sales margin as a percent rounded to the nearest hundredth of a percentage, X.XX%.) Sales margin Consumer Interpret your results. The Paint Stores Consumer + The Paint Stores + Consumer + Division is more profitable on each dollar of sales. Requirement 3. Calculate each division's capital turnover. Interpret your results. First enter the formula, then calculate the capital turnover for each division.…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education