FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

thumb_up100%

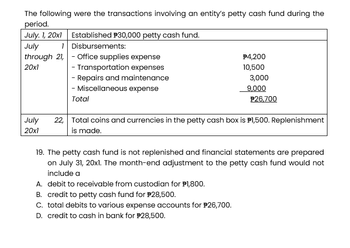

Transcribed Image Text:The following were the transactions involving an entity's petty cash fund during the

period.

July 1, 20x1 Established $30,000 petty cash fund.

July

1

Disbursements:

through 21,

20x1

- Office supplies expense

- Transportation expenses

- Repairs and maintenance

- Miscellaneous expense

Total

$4,200

10,500

3,000

9,000

A. debit to receivable from custodian for $1,800.

B. credit to petty cash fund for $28,500.

C. total debits to various expense accounts for $26,700.

D. credit to cash in bank for $28,500.

P26,700

July 22, Total coins and currencies in the petty cash box is $1,500. Replenishment

20x1

is made.

19. The petty cash fund is not replenished and financial statements are prepared

on July 31, 20x1. The month-end adjustment to the petty cash fund would not

include a

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- L Recording Petty Cash Account Transactions During March, Drapeau Company engaged in the following transactions involving its petty cash fund: a. On March 1, Drapeau Company established the petty cash fund by issuing a cheque for $1,500 to the fund custodian. b. On March 4, the custodian paid $103 out of petty cash for freight charges on new equipment. This amount is properly classified as equipment. c. On March 12, the custodian paid $140 out of petty cash for supplies. Drapeau expenses supplies purchases as supplies expense. d. On March 22, the custodian paid $28 out of petty cash for express mail services for reports sent to Environment Canada. This is considered a miscellaneous expense. e. On March 25, the custodian filed a claim for reimbursement of petty cash expenditures during the month totalling $271. f. On March 31, Drapeau Issued a cheque for $271 to the custodian, replenishing the fund for expenditures during the month. Required: Prepare the journal entries required to…arrow_forwardPetty Cash Fund Entries Journalize the entries to record the following: a. Check No. 12-375 is issued to establish a petty cash fund of $800. b. The amount of cash in the petty cash fund is now $288. Check No. 12-476 is issued to replenish the fund, based on the following summary of petty cash receipts: office supplies, $4297; miscellaneous selling expense, $123; miscellaneous administrative expense, $77. (Because the amount of the check to replenish the fund plus the balance in the fund do not equal $500, record the discrepancy in the cash short and over account.) a. Journalize the entry to establish the petty cash fund. If an amount box does not require an entry, leave it blank. 88 b. Journalize the entry to replenish the petty cash fund. For a compound transaction, if an amount box does not require an entry, leave it blank.arrow_forwardKk.435.arrow_forward

- Manarrow_forwardThe following information were taken from Bach Co.: Bach established a petty cash fund on May 2, 2021, amounting to P5,000. Expenditures from the fund by the custodian as of May 31, 2021, were evidenced by approved petty cash vouchers for the following: Page 6 of 11 Office supplies P1,960 Meals and snacks 600 Shipping charges 1,149 Miscellaneous 763 On May 31, 2021, the petty cash fund was replenished. Currency and coins in the fund at that time totaled P378. The bank statement from Sulfur Bank is shown below: Disbursements Receipts Balance Balance, May 1, 2021 Deposits Note payment direct from customer (interest of P600) Checks cleared during May Bank service charges Balance, May 31, 2021 P175,380 P560,000 18,600 P623,000 540 P130,440 The cash balance as found in Bach's records shows the following information: P177,000 Balance, May 1, 2021 May deposits Checks written in May 615,080 636,700 Deposits in transit are determined to be P60,000, and checks outstanding on May 31 totaled…arrow_forward3. Athena Co. held the following items on Dec. 31, 20x1: Petty cash fund (currencies and coins, P6,000) 10,000 65,000 Cash on hand (per cash count sheet on Dec. 31, 20x1) Cash in bank (per ledger) 2,890,000 190,000 Customer's check #109 - dated Dec. 29, 20x1. Customer's check # 392 - dated Jan. 8,20x2 20,000 Athena Co.'s check # 567 - dated Dec. 29, 20x1 54,000 NSF check (received from the bank on Dec. 30, 20x1) 40,000 All the checks were recorded when they were collected (drawn) by a debit (credit) to the Cash in bank account. The NSF* check was recorded when it was received from the customer. However, the return of the NSF check from the bank was not yet recorded. In its Dec. 31, 20x1 financial statements, what amount of cash should Athena Co. report? a. 2,695,000 b. 2,735,000 c. 2,955,000 d. 3,085,000 *NSF (No Sufficient Funds) means that the check has "bounced" or has been rejected by the bank because the drawer's account (i.e., the customer) has an insufficient balance to pay for…arrow_forward

- 2. The petty cash fund was established on April 10, 2020, in the amount of $300. These are the following expenditure made by petty cash custodian: Postage expense Mailing labels and other supplies 1.O.U from employees Shipping charges (to customer) Newspaper advertising Miscellaneous expense $27 $75.25 $25 $47.50 $33 $47.25 On April 30, 2020 the petty cash fund was reimbursed when the cash in the fund is at $25. Prepare the journal entries for the establishment of the fund and the reimbursement.arrow_forwardPetty cash book transactions in Prime books entries?arrow_forward000 Debit Cash $250; credit Accounts Payable $250. Havermill Co. establishes a $250 petty cash fund on September 1. On September 30, the fund is replenished. The accumulated receipts on that date represent $73 for Office Supplies, $137 for merchandise inventory, and $22 for miscellaneous expenses. The fund has a balance of $18. On October 1, the accountant determines that the fund should be increased by $50. The journal entry to record the establishment of the fund on September 1 is: Debit Petty Cash $250; credit Cash $250. Debit Petty Cash $250; credit Accounts Payable $250. Debit Cash $250; credit Petty Cash $250. Debit Miscellaneous Expense $250; credit Cash $250.arrow_forward

- 7. Journalize the entries to record the following: established a petty cash fund of $350 The amount of cash in the petty cash fund is now $130. The fund is replenished based on the following receipts: office supplies, 116; Sep 1 Sep 30 postage $100. Record any discrepancy in the cash short and over account. D Focusarrow_forward6arrow_forward25arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education