FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Transcribed Image Text:Ayayai Corporation builds in-home theater systems. Ayayai's business is growing quickly. Therefore, the CEO, Paul Ayayai, decides to

purchase three new trucks on September 20, 2017. The terms of acquisition for each truck are described below.

The first truck's list price is $15,540. Ayayai exchanges home theater equipment from its inventory for the truck. The home

theater equipment cost Molitor $9,620. Ayayai normally sells the equipment for $14,615. Ayayai uses a perpetual inventory

1.

system.

The second truck has a list price of $16,280. Ayayai makes a down payment of $3,700 cash on this truck and signs a zero-

interest-bearing note with a face amount of $12,580. Payment of the note is due September 20, 2018. Ayayai would normally

have to pay interest at a rate of 8% for such a borrowing.

The list price of the third truck is $14,208. This truck is acquired in exchange for 888 shares of common stock in Ayayai

Corporation. The stock has a par value per share of $10 and a market price of $14 per share.

3.

Prepare the appropriate journal entries for the above transactions for Ayayai Corporation. (Round present value factors to 5 decimal

places, e.g. 0.52587 and final answers to 2 decimal places, e.g. 5,275.50. Credit account titles are automatically indented when amount is

entered. Do not indent manually.)

2.

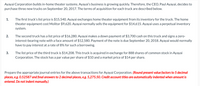

Transcribed Image Text:No. Account Titles and Explanation

Debit

Credit

1.

2.

3.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Locate the financial statements for a publicly traded company that provides segmented financial information. Prepare an overview of what is revealed about the company through its segmented data. Discuss the benefits of reporting financial information this way. Provide a link to the financial statements with your initial post and include the company name in the subject line. Do not choose a company that one of your peers has already posted on. Participate in follow-up discussion by critiquing the posts provided by your peers or defending their challenges to your post. (Hint: Utilize Appendix 5A in the textbook to help you learn about segment reporting and how to analyze the information).arrow_forwardWrite down about the Accounting Principles Board in detail.arrow_forwardWhich of the following is usually included in a business plan? a) Detailed description of the product or service b) Marketing and promotional plans c) Management and staffing d) All of the abovearrow_forward

- Please analyze, assess, and synthesize the Annual Report or Form 10-K or Form 20 - F (whatever they call it in that jurisdiction) of the company you choose. You can usually find it on the Company's website in Investor R. Introduction 2. Industry situation and company plans A. Management Letter B. B. Review Company's Products and Services 3. Financial Statements A. Income Statement B. Cash Flow Statement C. Balance Sheet D. Accounting Policies 4. Financial Analysis & Ratio A. Financial Analysis B. Ratio C. Market Indicator Financial Ratios 5. References 6. Complete Calcuation of Part 4 in excelLimiarrow_forwardAn entity shall clearly identify each financial statement and display all ofthe following, except A. Name of the reporting entityB. Names of the shareholdersC. The presentation currencyD. Whether the financial statements cover the individual entity or group of entitiesarrow_forwardDescribe the basic financial statements , their purpose and their importance to various internal and external users. Clearly discuss which users are most interested in which financial statement and why.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education