7. The following transactions of Best Pizza, owned by Reyes, Ortiz and Flores, took place from March 1 to May 31, 2019: (see attached images)

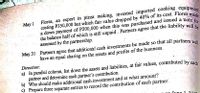

March 1

Reyes, who owns an ice cream parlor, invested cash of P80,000 and merchandise costing P120,000 but with a fair value of P70,000. Customers’ accounts of P50,000 were also taken over by the

Ortiz invested cash of P40,000 and pieces of furniture costing P150,000 which the partners agree to be 50%

May 1

Flores, an expert in pizza making, invested imported cooking equipment costing P350,000 but which fair value dropped by 40% of its cost. Flores made a down payment of P200,000 when this was purchased and issued a note for the balance half of which is still unpaid. Partners agree that the liability will be assumed, by the partnership.

May 31

Partners agree that additional cash investments be made so that all partners will have an equal sharing on the assets and profits of the business.

Direction:

a) In parallel column, list down the assets and liabilities, at fair values, contributed by each partner and determine each partner's contribution.

b) Who should make additional cash investment and at what amount?

c) Prepare three separate entries to record the contribution of each partner.

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 8 images

- On July 1, 2020, Wency and William agreed to form a partnership from their respective proprietorship businesses and to share profits equally. Wency and William’s balance sheet before the formation were: Wency William Cash P 6,000 P 15,000 Accounts receivable 36,000 21,000 Merchandise inventory 99,000 126,000 Prepaid rent 12,000 Store equipment 120,000 90,000 Accum. Depreciation ( 45,000) ( 54,000) Building 375,000 Accum. Depreciation (75,000) Land 180,000 - Totals P 696,000 P 210,000 Accounts payable P 22,500 P 9,000 Mortgage payable 180,000 - Capital 493,500 201,000 Totals P 696,000 P 210,000 The fair values of Wency’s and William’s assets were: Wency William Merchandise inventory P 81,000 P 135,000 Prepaid rent - 0 Store equipment 45,000 19,500 Building 750,000 -…arrow_forwardHosea, Riziki and Zarika are trading as Horizon enterprises. They share profits and losses in the ratio of 2:2:1 respectively. The following is the statement of comprehensive income for the partnership for the year ended 31 December 2018: Shs. Shs. Sales Opening stock Purchases Closing stock Gross profit Less: Salaries Repairs and maintenance Interest Goodwill Depreciation Mortgage repayment Insurance Auditee Legal fee Equipment purchase Rent and rates Net profit 300,000 4,000,000 (600,000) 900,000 100,000 480,000 198,000 142,000 200,000 384,220 315,780 100,000 200,000 18,0000 8,000,000 (3700,000) 4,300,000 (3,200,000) 1,100,000 Additional information 1. Opening inventory and closing inventory were overvalued by 30%. 2. Included in interest expense is interest on capital to partners of Sh. 80,000. This amount was to be shared in the profit sharing ratio. The balance of interest relates to an…arrow_forwardPartners A and B formed a partnership on January 1, 2020 where Partner A invested P500,000 while Partner B invested P300,000. Profit and loss as agreed upon by partners is to be shared in the ratio of the original capital. The drawing accounts of Partners A and B have debit balances of P24,000 and P12,000 respectively. Net income for the period ending December 31, 2020 amounted to P180,200. What is capital balance of Partner B for the year ending December 31, 2020?arrow_forward

- Lawler and Riello formed a partnership on March 15, 2024. The partners agreed to contribute equal amounts of capital. Lawler contributed her sole proprietorship's assets and liabilities (credit balances in parentheses) as follows: X Data table Lawler's Business Current Market Value its. Select the explanation on the last line of the journal entry table.) Accounts Receivable 10,600 Merchandise Inventory 29,000 Prepaid Expenses 2,800 Credit 26,000 Store Equipment, Net Accounts Payable (25,000) Done More info On March 15, Riello contributed cash in an amount equal to the current market value of Lawler's partnership capital. The partners decided that Lawler will earn 60% of partnership profits because she will manage the business. Riello agreed to accept 40% of the profits. During the period ended December 31, the partnership earned net income of $70,000. Lawler's withdrawals were $36,000, and Riello's withdrawings totaled $26,000. Print Done Requirement 1. Journalize the partners' initial…arrow_forwardAhmed and Salim form a partnership on June 1. Ahmed contributes OMR 15,000 cash, inventory with a market value of OMR 40,000 , and Accounts Payable of OMR 80,000. Ahmed also contributed computer equipment with a cost of OMR 80,000 and accumulated depreciation of OMR 20,000 . Current market value is OMR 85,000 Ahmed's Capital will be Select one: O a. Credit, 30,000 O b. Credit, 60,000 O c. Debit, 30,000 O d. Debit, 60,000arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education