FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

![Required information

[The following information applies to the questions displayed below.]

The following transactions apply to Jova Company for Year 1, the first year of operation:

1. Issued $10,000 of common stock for cash.

2. Recognized $210,000 of service revenue earned on account.

3. Collected $162,000 from accounts receivable.

4. Paid operating expenses of $125,000.

5. Adjusted accounts to recognize uncollectible accounts expense. Jova uses the allowance method of accounting for

uncollectible accounts and estimates that uncollectible accounts expense will be 1 percent of sales on account.

The following transactions apply to Jova for Year 2:

1. Recognized $320,000 of service revenue on account.

2. Collected $335,000 from accounts receivable.

3. Determined that $2,150 of the accounts receivable were uncollectible and wrote them off.

4. Collected $800 of an account that had previously been written off.

5. Paid $205,000 cash for operating expenses.

6. Adjusted the accounts to recognize uncollectible accounts expense for Year 2. Jova estimates uncollectible accounts

expense will be 0.5 percent of sales on account.

Required

Complete the following requirements for Year 1 and Year 2. Complete all requirements for Year 1 prior to beginning the

requirements for Year 2.](https://content.bartleby.com/qna-images/question/8e85e096-6423-4a35-815c-6db40b8d92fd/94493f5f-eb7c-42bb-b9c4-d3e5f9860392/8zxtz5w_thumbnail.png)

Transcribed Image Text:Required information

[The following information applies to the questions displayed below.]

The following transactions apply to Jova Company for Year 1, the first year of operation:

1. Issued $10,000 of common stock for cash.

2. Recognized $210,000 of service revenue earned on account.

3. Collected $162,000 from accounts receivable.

4. Paid operating expenses of $125,000.

5. Adjusted accounts to recognize uncollectible accounts expense. Jova uses the allowance method of accounting for

uncollectible accounts and estimates that uncollectible accounts expense will be 1 percent of sales on account.

The following transactions apply to Jova for Year 2:

1. Recognized $320,000 of service revenue on account.

2. Collected $335,000 from accounts receivable.

3. Determined that $2,150 of the accounts receivable were uncollectible and wrote them off.

4. Collected $800 of an account that had previously been written off.

5. Paid $205,000 cash for operating expenses.

6. Adjusted the accounts to recognize uncollectible accounts expense for Year 2. Jova estimates uncollectible accounts

expense will be 0.5 percent of sales on account.

Required

Complete the following requirements for Year 1 and Year 2. Complete all requirements for Year 1 prior to beginning the

requirements for Year 2.

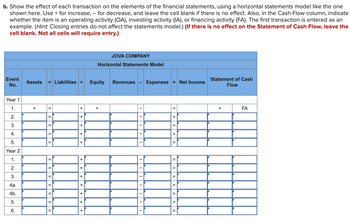

Transcribed Image Text:b. Show the effect of each transaction on the elements of the financial statements, using a horizontal statements model like the one

shown here. Use + for increase, - for decrease, and leave the cell blank if there is no effect. Also, in the Cash Flow column, indicate

whether the item is an operating activity (OA), investing activity (IA), or financing activity (FA). The first transaction is entered as an

example. (Hint. Closing entries do not affect the statements model.) (If there is no effect on the Statement of Cash Flow, leave the

cell blank. Not all cells will require entry.)

Event

No.

Year 1

1.

2.

3.

4.

5.

Year 2

1.

2.

3.

4a.

4b.

5.

6.

Assets

+

= Liabilities + Equity

=

+ + + + +

+++

JOVA COMPANY

Horizontal Statements Model

| + + + +

+

Revenues Expenses = Net Income

▪▪▪▪…….

=

=

=

=

II

Statement of Cash

Flow

+

FA

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 44. Subject :- Accountingarrow_forwardSelected financial data for Wilmington Corporation is presented below. WILMINGTON CORPORATION Balance Sheet As of December 31 Year 7 Year 6 Current Assets Cash and cash equivalents $ 634,527 $ 335,597 Marketable securities 166,106 187,064 Accounts receivable (net) 284,226 318,010 Inventories 466,942 430,249 Prepaid expenses 60,906 28,060 Other current assets 83,053 85,029 Total Current Assets 1,695,760 1,384,009 Property, plant and equipment 1,384,217 625,421 Long-term investment 568,003 425,000 Total Assets $3,647,980 $2,434,430 Current Liabilities Short-term borrowings $ 306,376 $ 170,419 Current portion of long-term debt 155,000 168,000 Accounts payable 279,522 314,883 Accrued liabilities 301,024 183,681 Income taxes payable 107,509 196,802 Total Current Liabilities 1,149,431…arrow_forwardRequired information Skip to question [The following information applies to the questions displayed below.] At December 31, Hawke Company reports the following results for its calendar year. Cash sales $ 640,000 Credit sales $ 1,600,000 In addition, its unadjusted trial balance includes the following items. Accounts receivable $ 480,000 debit Allowance for doubtful accounts $ 5,800 debit 2. Bad debts are estimated to be 2% of credit sales. Show how Accounts Receivable and the Allowance for Doubtful Accounts appear on its December 31 balance sheet.arrow_forward

- Selected financial data for Wilmington Corporation is presented below. WILMINGTON CORPORATION Balance Sheet As of December 31 Year 7 Year 6 Current Assets Cash and cash equivalents $ 634,527 $ 335,597 Marketable securities 166,106 187,064 Accounts receivable (net) 284,226 318,010 Inventories 466,942 430,249 Prepaid expenses 60,906 28,060 Other current assets 83,053 85,029 Total Current Assets 1,695,760 1,384,009 Property, plant and equipment 1,384,217 625,421 Long-term investment 568,003 425,000 Total Assets $3,647,980 $2,434,430 Current Liabilities Short-term borrowings $ 306,376 $ 170,419 Current portion of long-term debt 155,000 168,000 Accounts payable 279,522 314,883 Accrued liabilities 301,024 183,681 Income taxes payable 107,509 196,802 Total Current Liabilities 1,149,431…arrow_forwardThe following are the current assets of Barnes Co. as of December 31: Accounts Receivable $38,000 Allowance for Doubtful Accounts 5,000 Cash 45,000 Interest Receivable 5,500 Inventory 88,000 Notes Receivable 100,000 Prepare the current asset section of the balance sheet. Barnes Co. Balance Sheet December 31 Assets Current Assets: Total Current Assets %24arrow_forwardOn the basis of the following data related to assets due within one year for Simons Co. prepare partial balance sheet in good form at December 31. Show total current assets. Cash $96,000 Notes Receivable 50,000 Accounts Receivable 275,000 Allowance for Doubtful Accounts 40,000 Interest Receivable 1,000arrow_forward

- Nonearrow_forwardJk.335.arrow_forwardRequired information [The following information applies to the questions displayed below] At December 31, Hawke Company reports the following results for its calendar year. Cash sales Credit sales $ 340,000 $ 850,000 In addition, its unadjusted trial balance includes the following items. Accounts receivable. Allowance for doubtful accounts Current assets: $765,000 debit $ 6,100 debit 3. An aging analysis estimates that 4% of year-end accounts receivable are uncollectible. Show how Accounts Receivable and the Allowance for Doubtful Accounts appear on its December 31 balance sheet. $ 0arrow_forward

- At the end of its first year of operations, a company establishes an allowance for future uncollectible accounts for $5,600. At what amount would bad debt expense be reported in the current year's income statement? Multiple Choice O $6,400. $5,600. $4,800. $800.arrow_forward1c. Journalize the entries to record the 203 transactions. Refer to the Chart of Accounts for exact wording of account titles. Round all amounts to the nearest dollar.arrow_forwardDO not give answer in imagearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education