Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

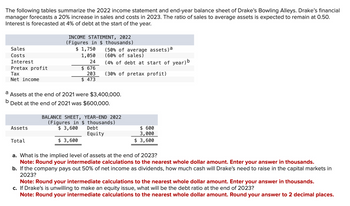

Transcribed Image Text:The following tables summarize the 2022 income statement and end-year balance sheet of Drake's Bowling Alleys. Drake's financial

manager forecasts a 20% increase in sales and costs in 2023. The ratio of sales to average assets is expected to remain at 0.50.

Interest is forecasted at 4% of debt at the start of the year.

Sales

Costs

Interest

Pretax profit

Tax

Net income

INCOME STATEMENT, 2022

(Figures in $ thousands)

$ 1,750

1,050

(50% of average assets) a

(60% of sales)

(4% of debt at start of year) b

24

$ 676

203

$ 473

(30% of pretax profit)

a

b

Assets at the end of 2021 were $3,400,000.

Debt at the end of 2021 was $600,000.

Assets

Total

BALANCE SHEET, YEAR-END 2022

(Figures in $ thousands)

$ 3,600

$ 3,600

Debt

Equity

$ 600

3,000

$ 3,600

a. What the implied level of assets at the end of 2023?

Note: Round your intermediate calculations to the nearest whole dollar amount. Enter your answer in thousands.

b. If the company pays out 50% of net income as dividends, how much cash will Drake's need to raise in the capital markets in

2023?

Note: Round your intermediate calculations to the nearest whole dollar amount. Enter your answer in thousands.

c. If Drake's is unwilling to make an equity issue, what will be the debt ratio at the end of 2023?

Note: Round your intermediate calculations to the nearest whole dollar amount. Round your answer to 2 decimal places.

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- What is the gross profit declined due to increase in cost in the amount? The management of Bataan Corporation ask you to submit an analysis of the increase in their gross profit in2021 based on their past two-year comparative income statements which show: 2021 2020 Sales 1,237,500 1,000,000 950,000 287,000 Cost of sales 800,000 Gross profit 200,000 The only known factor given is the sales price increased 12.5% beginning January 2021.arrow_forwardPlease explain without excelarrow_forwardGive me correct answerarrow_forward

- The table given below summarizes the 2019 income statement and end-year balance sheet of Drake’s Bowling Alleys. Drake’s financial manager forecasts a 10% increase in sales and costs in 2020. The ratio of sales to average assets is expected to remain at 0.40. Interest is forecasted at 5% of debt at the start of the year. Income Statement $ in thousands Sales $ 2,600 (40% of average assets)a Costs 1,950 (75% of sales) Interest 105 (5% of debt at start of year)b Pretax profit 545 Tax 218 (40% of pretax profit) Net income $ 327 aAssets at the end of 2018 were $6,240,000. bDebt at the end of 2018 was $2,100,000. Balance Sheet $ in thousands Net assets $ 6,760 Debt $ 2,100 Equity 4,660 Total $ 6,760 Total $ 6,760 a. What is the implied level of assets at the end of 2020? (Enter your answer in dollars not in thousands.) b. If the company pays out 50% of net income as dividends, how much cash will Drake need…arrow_forwardAbbreviated financial statements for Archimedes Levers are shown in the table below. Assume sales and expenses increase by 14% in 2022 and all assets and liabilities increase correspondingly. Income Statement Sales Costs, including interest Net income Net assets Total $ 4,800 3,900 $ 900 Balance Sheet, Year-End 2021 2020 $ 3,936 $3,500 $ 3,936 $3,500 Debt Equity Total 2021 $ 1,536 2,400 $ 3,936 2020 $1,433 2,067 $3,500 a. If the payout ratio is set at 50% and no external debt or equity is to be issued, what is the maximum possible growth rate for Archimedes? b. If the payout ratio is set at 50% and the firm aintains a fixed debt ratio but issues no equity, what is the maximum possible growth rate for Archimedes? Note: For all requirements, do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places.arrow_forwardArmin, Inc. had the following economic data for 2019 (refer to the attached picture): What is Armin’s breakeven point in 2019? net sales 400,000 contribution margin 160,000 margin of safety 40,000arrow_forward

- Vijayarrow_forwardSome parts of the balance sheet and income statement of PaintsWorld Enterprises is given below. You know that the effective tax rate is 23.0% and the interest rate the company pays on its long-term debt is 11.0%. You also know that the outstanding debt has been constant over the past few years. 1.Find the leverage ratio in 2022: 2. Find the asset turnover for 2022:arrow_forwardquestion: how much is the forcasted fixed expenses amount for 2015 is expected to be?arrow_forward

- for 2021arrow_forwardThe following tables summarizes the 2019 income statement and end-year balance sheet of Drake’s Bowling Alleys. Drake’s financial manager forecasts a 10% increase in sales and costs in 2020. The ratio of sales to average assets is expected to remain at 0.40. Interest is forecasted at 5% of debt at the start of the year. INCOME STATEMENT, 2019 (Figures in $ thousands) Sales $ 1,120 (40% of average assets)a Costs 840 (75% of sales) Interest 26 (5% of debt at start of year)b Pretax profit $ 254 Tax 101 (40% of pretax profit) Net income $ 152 a Assets at the end of 2018 were $2,700,000. b Debt at the end of 2018 was $530,000. BALANCE SHEET, YEAR-END (Figures in $ thousands) Assets $ 2,900 Debt $ 530 Equity 2,370 Total $ 2,900 $ 2,900 a. What is the implied level of assets at the end of 2020? (Do not round your intermediate calculations. Enter your answer in thousands.) b. If the…arrow_forwardUse the income and expense account information for Pepsico for 2017 listed below. What is the cash coverage ratio? Tax rate: 30% Interest expense: $6,590,000 Revenue: $910,500,000 Depreciation: $50,000,000 Selling, general, and administrative expense: $85,000,000 Cost of goods sold: $730,000,000 Group of answer choices 15.40 14.50 13.70 12.30 It is not possible to answer this questionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education