Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

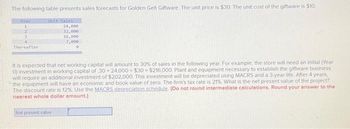

Transcribed Image Text:The following table presents sales forecasts for Golden Gelt Giftware. The unit price is $30. The unit cost of the giftware is $10.

Unit Sales

Year

1

3

Thereafter

24,000

32,000

16,000

7,000

0

It is expected that net working capital will amount to 30% of sales in the following year For example, the store will need an initial (Year)

0) investment in working capital of 30 24,000 $30-$216,000. Plant and equipment necessary to establish the giftware business

will require an additional investment of $202,000. This investment will be depreciated using MACRS and a 3-year life. After 4 years,

the equipment will have an economic and book value of zero. The firm's tax rate is 21% What is the net present value of the project?

The discount rate is 12%. Use the MACRS depreciation schedule. (Do not round intermediate calculations. Round your answer to the

nearest whole dollar amount.)

Net present value

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- Please make in excel and take screenshots. A Pumpkin Pie Manufacturing Company pays on the tenth day after purchase. The average collection period is 35 days, and the average inventory age is based on inventory turnover of 9 times per year. The company spends about $16 million on operating cycle investments, and is considering a plan that would lengthen its average payable period by 20 days. If the company pays 12% per year on its investment of resources, what annual savings-if any-can it realize with this plan? Assume there is no discount for early payment of accounts payable and a year has 360 days. exercise in the image, it is in Spanish, but it is the original one. exercise in the image, it is in Spanish, but it is the original one I already translated it for you, the other image is the format... I can't translate the format, but it's easy to deduce.arrow_forwardThe following table presents sales forecasts for Golden Gelt Giftware. The unit price is $40. The unit cost of the giftware is $25. Year 1 2 3 4 Thereafter Unit Sales 22,000 30,000 14,000 5,000 8 It is expected that net working capital will amount to 20% of sales in the following year. For example, the store will need an initial (Year 0) Investment in working capital of 0.20 x 22,000 × $40 = $176,000. Plant and equipment necessary to establish the giftware business will require an additional Investment of $200,000. This Investment will be depreciated straight-line over 3 years. The firm's tax rate is 30%. The discount rate is 20%. a. What is the net present value of the project? Note: Do not round Intermediate calculations. Round your answer to the nearest whole dollar amount. b. By how much does NPV Increase if the firm takes Immediate 100% bonus depreciation? a. Net present value b. Increase in NPVarrow_forwardYou are considering a project which will cost $140,000. It is expected to bring in incomes of $45,000 per year for the next 5 years. You company's discount rate is 12%. What is the NPV of this project?arrow_forward

- Aylmer-in-You (AIY) Inc. projects unit sales for a new opera tenor emulation implant as follows: Year Unit Sales 1 101,000 2 115,000 3 125,000 4 145,000 5 90,000 Production of the implants will require $753,000 in net working capital to start and additional net working capital investments each year equal to 15% of the projected sales increase for the following year. (Because sales are expected to fall in Year 5, there is no NWC cash flow occurring for Year 4.) Total fixed costs are $177,000 per year, variable production costs are $309 per unit, and the units are priced at $360 each. The equipment needed to begin production has an installed cost of $10.0 million. Because the implants are intended for professional singers, this equipment is considered industrial machinery and thus falls into Class 8 for tax purposes (20%). In five years, this equipment can be sold for about 20% of its acquisition cost. AIY is in the 40% marginal tax bracket and has a required…arrow_forward(4) Evaluate the ROI.arrow_forwardA firm is considering a new inventory system that will cost $120,000. The system is expected to generate positive cash flows over the next four years in the amounts of $35,000 in year 1, $55,000 in year 2, $65,000 in year 3, and $40,000 in year 4. The firm’s required rate of return is 9%. What is the payback period of this project? 1.95 years 2.46 years 2.99 years 3.10 years Based on the information from Question 47. What is the net present value (NPV) of the project? $28,830.29 $30,929.26 $36,931.43 $39,905.28 Based on the information from Question 47, what is the internal rate of return (IRR) of this project? 14.03% 17.56% 19.26% 21.78% Based on the information from Question 47, what is the profitability index (PI) of this project? 0.87 1.11 1.31 1.83.arrow_forward

- ou are preparing to produce some goods for sale. You will sell them in one year and you will incur costs of $ 76,000 immediately. If your cost of capital is 7%. What is the minimum dollar amount you need to sell the goods for in order for this to be a non-negative NPV? Question content area bottom Part 1 The minimum dollar amount is $XXX enter your response here .arrow_forwardBhupatbhaiarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education