Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

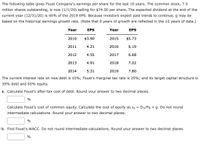

Transcribed Image Text:The following table gives Foust Company's earnings per share for the last 10 years. The common stock, 7.5

million shares outstanding, is now (1/1/20) selling for $74.00 per share. The expected dividend at the end of the

current year (12/31/20) is 45% of the 2019 EPS. Because investors expect past trends to continue, g may be

based on the historical earnings growth rate. (Note that 9 years of growth are reflected in the 10 years of data.)

Year

EPS

Year

EPS

2010

$3.90

2015

$5.73

2011

4.21

2016

6.19

2012

4.55

2017

6.68

2013

4.91

2018

7.22

2014

5.31

2019

7.80

The current interest rate on new debt is 10%; Foust's marginal tax rate is 25%; and its target capital structure is

35% debt and 65% equity.

a. Calculate Foust's after-tax cost of debt. Round your answer to two decimal places.

%

Calculate Foust's cost of common equity. Calculate the cost of equity as rs = D1/Po + g. Do not round

intermediate calculations. Round your answer to two decimal places.

%

b. Find Foust's WACC. Do not round intermediate calculations. Round your answer to two decimal places.

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Waller Company paid a $0.150 dividend per share in 2000, which grew to $0.324 in 2012. This growth is expected to continue. What is the value of this stock at the beginning of 2013 when the required return is 15.0 percent?arrow_forwardThe Bouchard Company's EPS was $6.80 in 2021, up from $3.34 in 2016. The company pays out 50% of its earnings as dividends, and its common stock sells for $35.00. a. Calculate the past growth rate in earnings. (Hint: This is a 5-year growth period.) Round your answer to two decimal places. % b. The last dividend was Do = 0.50($6.80) = $3.40. Calculate the next expected dividend, D₁, assuming that the past growth rate continues. Do not round intermediate calculations. Round your answer to the nearest cent. $ c. What is Bouchard's cost of retained earnings, rs? Do not round intermediate calculations. Round your answer to two decimal places. %arrow_forwardFinancial analysts forecast Safeco Corp.’s (SAF) growth rate for the future to be 8 percent. Safeco’s recent dividend was $1.25.What is the value of Safeco stock when the required return is 10 percent? (Round your answer to 2 decimal places.)arrow_forward

- Digital Industries paid a dividend of $2.00 per share of stock recently and expects to grow the dividend by 3% next year and beyond. Assuming a discount rate of 7%, how much value in the current stock price is attributable to the growth rate? Answer should be rounded to the nearest cent, e.g., $1.23"arrow_forwardA company's common stock currently sells for $27.27 per share. The dividend is projected to increase at a constant rate of 7.75% per year. The required rate of return on the common stock is 11.5%. What is the stock's expected price per share 5 years from today?arrow_forwardShell is experiencing rapid growth. Earnings and dividends are expected to grow at a rate of 15% during the next 2 years, at 13% the following year, and at a constant rate of 6% during Year 4 and thereafter. Its last dividend was $1.15, and its required rate of return is 12%. d) Calculate the value of the stock one year from today.arrow_forward

- Tin-Tin Waste Management, Inc., is growing rapidly. Dividends are expected to grow at rates of 30 percent, 35 percent, 25 percent, and 18 percent over the next four years. Thereafter, management expects dividends to grow at a constant rate of 7 percent. The stock is currently selling at $46.48, and the required rate of return is 18.0 percent. Compute the dividend for the current year (D0). (Round intermediate calculations and final answer to 2 decimal places Riker Departmental Stores management has forecasted a growth rate of 40 percent for the next two years, followed by growth rates of 25 percent and 20 percent for the following two years. It then expects growth to stabilize at a constant rate of 7.5 percent forever. The firm paid a dividend of $3.46 recently. If the required rate of return is 18 percent, what is the current value of Riker's stock? (Round intermediate calculations and final answer to 2 decimal place You own a company that competes with Old World DVD Company.…arrow_forwardUse the Constant Dividend Growth Model to determine the expected annual growth rate of the dividend for ELO stock. The firm is expected to pay an annual divided of $8.9 per share in one year. ELO shares are currently trading for $144.48 on the NYSE, and the expected annual rate of return for ELO shares is 12.86%. Answer as a % to 2 decimal places (e.g., 12.34% as 12.34).arrow_forwardSouthern Markets recently paid an annual dividend of $2.77 on its common stock. This dividend increases at an average rate of 4.4 percent per year. The stock is currently selling for $38.67 a share. What is the market rate of return?arrow_forward

- YZ Inc. is experiencing rapid growth. Earnings and dividends are expected to grow at a rate of 17% during the next 2 years, at 15% the following year, and at a constant rate of 7% during Year 4 and thereafter. Its last dividend was $1.55, and its required rate of return is 12%. a. Calculate the value of the stock today. b. Calculate P1 and P2 (Prices for Year 1 and Year 2). c. Calculate the dividend and capital gains yields for Years 1, 2, and 3.arrow_forwardLawrence Industries' most recent annual dividend was $1.98 per share (D Subscript 0=$1.98), and the firm's required return is 13%. Find the market value of Lawrence's shares when dividends are expected to grow at 15% annually for 3 years, followed by a 4% constant annual growth rate in years 4 to infinity.arrow_forwardThe following table gives Foust Company's earnings per share for the last 10 years. The common stock, 7.8 million shares outstanding, is now (1/1/22) selling for $77.00 per share. The expected dividend at the end of the current year (12/31/22) is 45% of the 2021 EPS. Because investors expect past trends to continue, g may be based on the historical earnings growth rate. (Note that 9 years of growth are reflected in the 10 years of data.) Year EPS Year EPS 2012 $3.90 2017 $5.73 2013 4.21 2018 6.19 2014 4.55 2019 6.68 2015 4.91 2020 7.22 2016 5.31 2021 7.80 The current interest rate on new debt is 8%; Foust's marginal tax rate is 25%; and its target capital structure is 30% debt and 70% equity. a. Calculate Foust's after-tax cost of debt. Round your answer to two decimal places. 6.00 Calculate Foust's cost of common equity. Calculate the cost of equity as rs = D1/Po + g. Do not round intermediate calculations. Round your answer to two decimal places. -5.44 % b. Find Foust's WACC. Do not…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education