Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

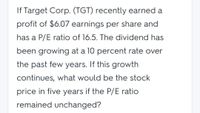

Transcribed Image Text:If Target Corp. (TGT) recently earned a

profit of $6.07 earnings per share and

has a P/E ratio of 16.5. The dividend has

been growing at a 10 percent rate over

the past few years. If this growth

continues, what would be the stock

price in five years if the P/E ratio

remained unchanged?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Southern Markets recently paid an annual dividend of $2.77 on its common stock. This dividend increases at an average rate of 4.4 percent per year. The stock is currently selling for $38.67 a share. What is the market rate of return?arrow_forwardYZ Inc. is experiencing rapid growth. Earnings and dividends are expected to grow at a rate of 17% during the next 2 years, at 15% the following year, and at a constant rate of 7% during Year 4 and thereafter. Its last dividend was $1.55, and its required rate of return is 12%. a. Calculate the value of the stock today. b. Calculate P1 and P2 (Prices for Year 1 and Year 2). c. Calculate the dividend and capital gains yields for Years 1, 2, and 3.arrow_forwardFinancial analysts forecast Safeco Corp.'s (SAF) growth rate for the future to be 10 percent. Safeco's recent dividend was $1.4 What is the value of Safeco stock when the required return is 12 percent? ( Round your answer to 2 decimal places.)arrow_forward

- A&T, Inc. paid an annual dividend of $1.47 per share last month. The company is planning on paying $1.56, $1.68, and $1.75 per share over the next three years, respectively. After that, the dividend will be constant at $1.80 per share per year. What is the market price of this stock if the market rate of return is 12 percent? $13.98 $14.65 $13.54 $14.16 O None of these answers are correctarrow_forwardThe most recent dividend paid by Altier Corporation was $3.25. That dividend is expected to grow by 8% this year, and 7% in year two. Beginning in year three, the dividend is expected to grow at a constant rate of 5%. With a 12% required return, what is a share of this company's common stock worth today?arrow_forwardMelanie Corp. is growing quickly. Dividends are expected to grow at a rate of 25 percent for the next three years, with the growth rate falling off to a constant 9.9 percent thereafter. If the required return is 14.6 percent and the company just paid a dividend of $4.71, what is the current share price? ( Do not round intermediate calculations, round your answer to two decimal points, i.e. 32.16)arrow_forward

- Suppose that a firm's recent earnings per share and dividend per share are $3.10 and $2.10, respectively. Both are expected to grow 7 percent. However, the firm's current P/E ratio of 30 seems high for this growth rate. The P/E ratio is expected to fall to 26 within five years. Compute the dividends over the next five years. (Do not round intermediate calculations. Round your answers to 3 decimal places Years First year Second year Third year Fourth year Fifth year Dividends Compute the value of this stock in five years. (Do not round intermediate calculations. Round your answer to 2 decimal places.) Stock pricearrow_forwardA bond with a $1,000 par value and a contract or coupon interest rate of 11%. A new issue would have a floatation cost of 6% of the $1,125 market value. The bonds mature in 7 years. The firm's average tax rate is 30%, and its marginal tax rate is 23%. What is the fırm's after-tax cost of the bond? 9.83% 8.55% 7.57% 6.58%arrow_forwardPerfectlySoft Corp. is experiencing rapid growth. Dividends are expected to grow at 26 percent per year during the next three years, 15 percent over the following year, and then 4 percent per year thereafter indefinitely. The required return on this stock is 8.18 percent, and the stock currently sells for $79.91 per share. What is the projected dividend (in $) for the coming year? Answer to two decimals, carry intermediate calcs. to four decimals.arrow_forward

- Mobray Corp. is experiencing rapid growth. Dividends are expected to grow at 25 percent per year during the next three years, 15 percent over the following year, and then 7 percent per year indefinitely. The required return on this stock is 12 percent, and the stock currently sells for $88 per share. What is the projected dividend for the coming year? (i.e. Div 1)arrow_forwardTaussig Technologies Corporation (TTC) has been growing at a rate of 13% per year in recent years. This same growth rate is expected to last for another 2 years, then decline to gn = 7%. a. If D₁ = $2.90 and rs = 13%, what is TTC's stock worth today? Do not round intermediate calculations. Round your answer to the nearest cent. $ What is its expected dividend yield at this time, that is, during Year 1? Do not round intermediate calculations. Round your answer to two decimal places. % What is its capital gains yields at this time, that is, during Year 1? Do not round intermediate calculations. Round your answer to two decimal places. % b. Now assume that TTC's period of supernormal growth is to last for 5 years rather than 2 years. How would this affect the price, dividend yield, and capital gains yield? I. Due to the longer period of supernormal growth, the value of the stock will be higher for each year. Although the total return will remain the same, the distribution between dividend…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education