ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

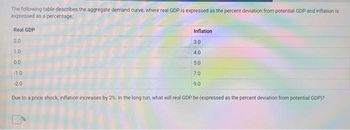

Transcribed Image Text:The following table describes the aggregate demand curve, where real GDP is expressed as the percent deviation from potential GDP and inflation is

expressed as a percentage:

Real GDP

2.0

1.0

0.0

-1.0

-2.0

Inflation

19

3.0

4.0

5.0

7.0

9.0

Due to a price shock, inflation increases by 2%. In the long run, what will real GDP be (expressed as the percent deviation from potential GDP)?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- During the transition from the short run to the long run, price level expectations will (remain the same, increases, decreases), and the (aggregate demand, short-run aggregate supply) curve will shift to the (left, right). In the long run, as a result of the investment tax credit, the price level (remain the same, increases, decreases), the quantity of output (rises above, falls below, returns to) potential output, and the unemployment rate (rises above, falls below, returns to) the natural rate of unemployment.arrow_forwardHow will an increase in aggregate demand most likely affect the economy in the long run? Because output is above full-employment level of output, unemployment is below the natural rate of unemployment. The nominal wage will be pushed upward thus increasing the cost of production and aggregate supply decreases. Real GDP returns to full employment and the price level decrease. Because output is below full-employment level of output, unemployment is above the natural rate of unemployment. The nominal wage will be pushed downwards thus reducing the cost of production and aggregate supply increases. Real GDP returns to full employment and the price level increase. Because output is above full-employment level of output, unemployment is below the natural rate of unemployment. The nominal wage will be pushed upward thus increasing the cost of production and aggregate supply decreases. Real GDP returns to full employment and the price level increases Because output is above full-employment…arrow_forwardQ2. If output falls, what is likely to happen to inflation and employment?arrow_forward

- Assume that the housing market is in equilibrium in year 1. In year 2, the mortgage rate that banks charge consumers increases, but producers are not affected. Which of the following is most likely to be the equilibrium change? a The equilibrium will be at point C before the change in expectations and point A after the change b The equilibrium will be at point A before the change in expectations and point B after the change c The equilibrium will be at point A before the change in expectations and point C after the change d The equilibrium will be at point E before the change in expectations and point C after the changearrow_forwardEconomists forecast future economic conditions by studying variables that tend to fluctuate in advance of the overall economy. The most significant of these variables are known as leading indicators, and they compose the index of leading economic indicators. Which of the following variables are measured as part of this index? Check all that apply. Supplier deliveries The ratio of elderly to nonelderly workers New orders for consumer goods Stock prices The money supply True or False: Businesses and government care only about long-run economic forecasts, because they cannot adapt policy or output to accommodate short-run fluctuations. False True Suppose the most recent data show that the average initial weekly claims for unemployment insurance have recently decreased. This change suggests ____ period in the coming months.arrow_forwardAssume that the housing market is in equilibrium in year 1. In year 2, the mortgage rate that banks charge consumers decreases, but producers are not affected. Also in year 2, the cost of lumber used to build homes decreases. Which of the following is most likely to be the equilibrium change? a The equilibrium will be at point C before the change in expectations and point B after the change b The equilibrium will be at point A before the change in expectations and point B after the change c The equilibrium will be at point A before the change in expectations and point E after the change d The equilibrium will be at point E before the change in expectations and point A after the changearrow_forward

- Suppose the government decides to decrease government expenditures as a means of cutting the existing government budget deficit. Using a graph of aggregate demand and supply, show the effects of such a decision on the economy in the short run. Describe the effects on inflation and output. What will be the effect on the real interest rate, the inflation rate, and the output level if the Bank of Canada decides to stabilize the inflation rate?arrow_forwardIllustrate graphically what would happen in the short run and in the long run to the price level and Real GDP if individuals hold rational expectations, prices and wages are flexible, and individuals overestimate the rise in aggregate demand (bias upward).arrow_forwardIn 2013, Prussia's aggregate demand curve was determined by the equation M + 0 = 4%. A change in aggregate demand means that in 2014, Prussia's aggregate demand curve was determined by the equation M + U = 7%. Using this information, draw Prussia's old and new dynamic aggregate demand curves on the graph. Inflation rate 14 13 12 11 10 9 8 7 4 3 2 1 0 -4 -3 2-1 0 1 2 3 4 5 Real GDP growth rate AD 2013 AD 2014 6 7 8 9 10 Which of the factors could have resulted in the change in aggregate demand seen between 2013 and 2014? higher consumer confidence an improvement in technology O a decrease in oil prices an increase in importsarrow_forward

- Should the government use monetary and fiscal policy in an effort to stabilize the economy? The following questions address the issue of how monetary and fiscal policies affect the economy, as well as the pros and cons of using these tools to combat economic fluctuations. The following graph plots hypothetical aggregate demand (AD), short-run aggregate supply (AS), and long-run aggregate supply (LRAS) curves for the U.S. economy in May 2026. Suppose the government chooses to intervene in order to return the economy to the natural level of output by using policy. Depending on which curve is affected by the government policy, shift either the AS curve or the AD curve to reflect the change that would successfully restore the natural level of output. PRICE LEVEL 150 50 30 130 110 8 70 80 50 20 20 22 24 LRAS 28 AS OUTPUT (Trillions of dollars) AD 28 30 AD ਵੇ ㅁ AS ? Suppose that in May 2026 the government successfully carries out the type of policy necessary to restore the natural level of…arrow_forwardquestion 3: The Covid-19 pandemic shifted the aggregate supply and aggregate demand curves to the left. Did that increase or decrease real GDP, employment, and inflation rate?arrow_forwardPlease note I only need help with Part 4 and 5. I have answers for the other parts. Thank you so much for your time and effort! Figure 2: Keynes’s AD-AS Model (Image normally goes here) Part 1:Changes in which factors could cause aggregate demand to shift from AD to AD1? What could happen to the unemployment rate? What could happen to the inflation rate? Part 2: The Keynesian AD-AS model describes what happens with price levels when aggregate demand increases. Could you find any evidence from the last ten-fifteen years that might support AD-AS model descriptions of demand-pull inflation, cost-push inflation, and recession? For example, you could find data on the GDP’s of any two countries from 2000 to 2017 to support your findings. Please note the followong for the next 3 parts of this. In macroeconomics, the immediate short run is known as a length of time when both input prices and output prices are fixed. In the short-run, input prices are fixed but output prices are variable. In…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education