ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

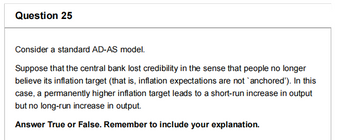

Transcribed Image Text:Question 25

Consider a standard AD-AS model.

Suppose that the central bank lost credibility in the sense that people no longer

believe its inflation target (that is, inflation expectations are not `anchored'). In this

case, a permanently higher inflation target leads to a short-run increase in output

but no long-run increase in output.

Answer True or False. Remember to include your explanation.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Explain the role of expectations in the macroeconomy.arrow_forwardAssume our complete 4-panel model of the economy in equilibrium at Y-full employment. If the Fed buys up government securities from the public, macroeconomists predict which one of the following? Group of answer choices a)In the long run there will be some inflation and aggregate output will eventually return to its full employment level. b)The short run aggregate demand curve shifts to the left and the short run aggregate supply curve shifts to the right. c)In the long run there will be some inflation and aggregate output will be permanently pushed above Y-full employment. d)The short run aggregate demand curve shifts to the right and the short run aggregate supply curve shifts to the right.arrow_forwardIllustrate graphically what would happen in the short run and in the long run to the price level and Real GDP if individuals hold rational expectations, prices and wages are flexible, and individuals overestimate the rise in aggregate demand (bias upward).arrow_forward

- Suppose to get re-elected, an incumbent government wants to continuously expand the economy so that people will associate high economic growth with the current government. Explain what will happen to the economy in the long run using the AD-AS model and the Phillips curve model, with properly labelled diagrams. Thanks.arrow_forwardAssume an economy that starts with Y = Y₂. Illustrate graphically and explain the impact of a fall in energy prices in the IS-LM-PC model with anchored expectations. Illustrate graphically, explain, and discuss the impact of the fall in energy prices depending on whether the central bank, firms, or workers have the power to adjust the economy to keep inflation at its target rate after the fall in energy prices. ་པཕབ་པ་arrow_forwardComplete the following table to compare the results of an unanticipated expansionary policy to those of an anticipated expansionary policy in the short run and long run. Determine whether, in the short run, the level of output increases, decreases, or remains unchanged relative to the potential output level when the expansionary policy is anticipated versus unanticipated. Additionally, determine whether, in the long run, the actual price level is above, below, or the same as initial expectations under both scenarios, and, again, determine whether the level of output increases, decreases, or remains unchanged. Anticipated Expansionary Policy Unanticipated Expansionary Policy Short-Run Change in Output Decrease/Increase* Decrease/Increase/No Change* Long-Run Change in Price Level Same as Initial expectation/Higher then initial expectations/ lower then initial expectations* (same options as box on the left) ** Long-Run Change in Output Decrease/Increase/No change*…arrow_forward

- In a certain economy, the Dynamic Aggregate Supply (DAS) line is represented by the function = - π₁ = Ę ₁ = ₁ π + α ( Y₁ − Ÿ) + D and the inflation expectations formation mechanism is adaptive, that is, E₁+1 Absent a supply shock (v₁ = 0), in a figure representing period t inflation rate, π, on the vertical axis, and period t output, Y₁, on the horizontal axis, the period t DAS line will pass through the pair of points, : OA. (-1) B. (α, Y) ○ C. (Y) D. (πt, Yt)arrow_forwardHow would the AD/AS model be different if it assumed rational expectations rather than adaptive expectations? Define and give an example of each.arrow_forwardInflationary expectations are an important driver of the Phillips curve relationship. What are three different ways inflationary expectations might be modelled? Depict each graphically.arrow_forward

- Which of the following is true the dynamic AS-AD model? The dynamic aggregate demand curve is downward sloping because the central bank follows the Taylor principle. An increase in the natural level of output increases the long-run inflation rate. To control inflation, the central bank should increase the nominal interest rate by less than one for one in response to an increase in the inflation rate. The monetary policy rule determines the slope of the dynamic aggregate supply curve.arrow_forwardCompared to the Adaptive Expectations Theory, the Rational Expectations Theory A) asserts the same conclusions about policy activism.B) implies that policy activism is less effectiveC) implies that policy activism is more effective.D) asserts that people cannot anticipate the effects of policies in advance.E) the inflation arising from an expansionary policy will be less.arrow_forwardYou work at the Central Bank and you are in charge of forecasting the effects of possible future shocks using the ASAD Redux model. Today, your task is to predict what will happen if the economy is subject to two consecutive shocks, namely, At time t = 1, there is a persistent positive shock on aggregate demand due to increased desired expenditures (e.g., a higher propensity to consume). At time t = 2, the Central Bank implements a permanent reduction in money supply. %3D The Central Bank wants you to forecast what will be the effects of a range of monetary contractions of different magnitude. Hence, you run six numerical simulations of the model assuming different sizes of the reduction in money supply. However, the software is faulty and some simulation results are wrong. Your computer produces six scenarios for employment (N) and price level (P), but some scenarios are clearly incorrect and inconsistent with the general predictions of the theoretical model: you need to eliminate the…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education