FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

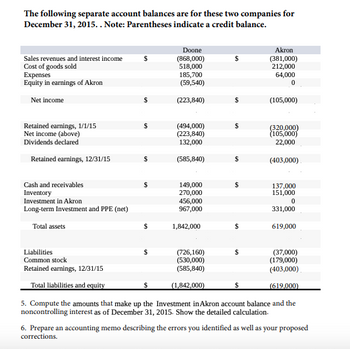

Transcribed Image Text:The following separate account balances are for these two companies for

December 31, 2015.. Note: Parentheses indicate a credit balance.

Sales revenues and interest income

Cost of goods sold

Expenses

Equity in earnings of Akron

Net income

Doone

(868,000)

518,000

Akron

(381,000)

212,000

185,700

(59,540)

64,000

0

(223,840)

(105,000)

Retained earnings, 1/1/15

(494,000)

Net income (above)

(223,840)

(320,000)

(105,000)

Dividends declared

132,000

22,000

Retained earnings, 12/31/15

(585,840)

$

(403,000)

Cash and receivables

149,000

$

137,000

Inventory

270,000

151,000

Investment in Akron

456,000

0

Long-term Investment and PPE (net)

967,000

331,000

Total assets

$

1,842,000

619,000

Liabilities

Common stock

Retained earnings, 12/31/15

Total liabilities and equity

(726,160)

$

(37,000)

(530,000)

(179,000)

(585,840)

(403,000)

(1,842,000)

$

(619,000)

5. Compute the amounts that make up the Investment in Akron account balance and the

noncontrolling interest as of December 31, 2015. Show the detailed calculation.

6. Prepare an accounting memo describing the errors you identified as well as your proposed

corrections.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The following data were provided by Mystery Incorporated for the year ended December 31: Cost of Goods Sold $ 155,000 Income Tax Expense 14,820 Merchandise Sales (gross revenue) for Cash 220,000 Merchandise Sales (gross revenue) on Credit 38,000 Office Expense 18,000 Sales Returns and Allowances 6,450 Salaries and Wages Expense 36,200 1. What was the gross profit percentage? (round your percentage to 1 decimal place)arrow_forwardThe following information was taken from the accounts receivable records of Sarasota Corporation as at December 31, 2020: OutstandingBalance Percentage Estimatedto be Uncollectible 0 – 30 days outstanding $160,000 0.5% 31 – 60 days outstanding 66,000 2.5% 61 – 90 days outstanding 40,200 4.0% 91 – 120 days outstanding 20,600 6.5% Over 120 days outstanding 5,600 10.0% (a) Prepare the year-end adjusting entry for bad debt expense, assuming allowance for doubtful accounts had a credit balance of $1,200 prior to the adjustment (b) Prepare the year-end adjusting entry for bad debt expense, assuming allowance for doubtful accounts had a debit balance of $3,880 prior to the adjustment.arrow_forwardThe following is an income statement from the financial records of Peace, Love and Joy Company for the year ended December 31, 2015: Income Statement Sales (net) $ 245,675 Cost of Goods Sold (67,500) Gross Profit $ 178,175 Operating expenses (125,000) Operating Income $ 53,175 Interest revenue 5,600 Interest expense (8,750) Income before taxes $ 50,025 Income tax expense (15,008) Net Income $ 35,017 Refer to Exhibit 5-2. Compute earnings-based interest coverage for Peace, Love, and Joy Company. 6.72 times 5.72 times 16.88 times 6.08 timesarrow_forward

- darrow_forwardThe Cullumber Supply Company reported the following information for 2017. Prepare a common-size income statement for the year ended June 30, 2017. (Round answers to 1 decimal place, e.g. 52.7%.) Cullumber Supply CompanyIncome Statement for the Fiscal Year Ended June 30, 2017($ thousands) % of Net Sales Net sales $2,111,000 enter percentages of net sales % Cost of goods sold 1,464,000 enter percentages of net sales % Selling and administrative expenses 312,200 enter percentages of net sales % Nonrecurring expenses 27,600 enter percentages of net sales % Earnings before interest, taxes, depreciation, and amortization (EBITDA) $307,200 enter percentages of net sales % Depreciation 117,000 enter percentages of net sales % Earnings before interest and taxes (EBIT) 190,200 enter percentages of net sales % Interest expense 118,600 enter percentages of net sales % Earnings before taxes (EBT)…arrow_forwardJars Plus recorded $862,430 in credit sales for the year and $489,000 in accounts receivable. The uncollectible percentage is 2.3% for the income statement method, and 3.0% for the balance sheet method. A. Record the year-end adjusting entry for 2018 bad debt using the income statement method. B. Record the year-end adjusting entry for 2018 bad debt using the balance sheet method. C. Assume there was a previous debit balance in Allowance for Doubtful Accounts of $10,220, record the year-end entry for bad debt using the income statement method, and then the entry using the balance sheet method. D. Assume there was a previous credit balance in Allowance for Doubtful Accounts of $5,470, record the year-end entry for bad debt using the income statement method, and then the entry using the balance sheet method. If an amount box does not require an entry, leave it blank. If required, round final answers to two decimal places. A. Dec. 31 Bad Debt Expense 88 88 88 38 88 88 Allowance for…arrow_forward

- Skysong Corporation had the following 2025 Income statement. Revenues $103,000 Expenses Net income In 2025, Skysong had the following activity in selected accounts. Accounts Receivable 21,000 Revenues 103,000 Write-offs Collections 1/1/25 66,000 $37,000 12/31/25 29.100 Allowance for Doubtful Accounts 1/1/25 Write-offs 900 Bad debt expense 12/31/25 (a) 900 94,000 1,300 1,700 2,100 Prepare Skysong's cash flows from operating activities section of the statement of cash flows using the din SKYSONG CORPORATION Statement of Cash Flows-Direct Method (Partial)arrow_forwardSelected income statement data follow for Harper, Inc., for the year ended December 31 (in thousands). What is the company's times interest earned ratio? Operating income before interest Interest expense Operating income after interest Income tax Income after tax 35.6 30.6 11.2 24.4 6,617 189 6.428 1,607 4,821arrow_forwardMillennial Manufacturing has net credit sales for 2018 in the amount of $1,453,630, beginning accounts receivable balance of $587,900, and an ending accounts receivable balance of $623,450. A. Compute the accounts receivable turnover ratio and the number of days' sales in receivables ratio for 2018. Round answers to two decimal places. Accounts receivable turnover ratio fill in the blank 1 times Sales in receivables ratio fill in the blank 2 days B. What do the outcomes tell a potential investor about Millennial Manufacturing if industry average is 2.6 times and number of day’s sales ratio is 180 days? a. Millennial Manufacturing collects its accounts more quickly than its competitors. b. A lender may favour Millennial Manufacturing over its competitors because of its faster collection period. c. Without prior years’ data it is hard to tell if Millennial Manufacturing is really more efficient than its competitors. d. All of the above statements may be correct.arrow_forward

- The comparative financial statements prepared at December 31, 2017, for Pinnacle Plus showed the following summarized data: Required: 1. Complete the two final columns shown beside each item in Pinnacle's comparative financial statements. (Round your percentage answers to 1 decimal place. Any decrease in the amount should be indicated with minus sign.) Increase (Decrease) 2017 over 2016 4 2017 2016 Amount Income statement Sales revenue Cost of goods sold $ 106,400 $96.000 50,200 46.500 Gross profit 56.200 49.500 Operating expenses 35,400 32.400 Interest expense 3,700 3,700 income before income tax expense 17.100 13.400 Income tax expense (30%) 5.130 4,020 Net income $ 11.970 $ 9.380 Balance sheet: Cash $ 55,370 $16,770 Accounts receivable, net Inventory 35,800 30,500 23,800 44,500 Property and Equipment, net Total assets Accounts payable 92,600 102.000 $ 207,570 $ 193.770 S 41,100 $33.500 Income tax payable 1,000 470 Note payable, long-term Total liabilities Contributed capital (9,000…arrow_forwardNeed a,b,carrow_forwardAt January 1, 2024, Kennel Inc. reported the following information on its statement of financial position: Accounts receivable Allowance for expected credit losses During 2024, the company had the following summary transactions for receivables: 1. 2. 3. 4. 5. 6. Show Transcribed Text Sales on account, $1.670,000; cost of goods sold, $935.200; return rate of 7% Selling price of goods returned, $83.000: cost of goods returned to inventory, $46,480 Collections of accounts receivable, $1,600,000 Write-offs of accounts receivable deemed uncollectible, $47,000 Collection of accounts previously written off as uncollectible, $13,000 After considering all of the above transactions, total estimated uncollectible accounts, $29,000 (1) Bal v (4) $500,000 46,000 Your answer is partially correct. (1) Prepare T accounts for Accounts Receivable and Allowance for Expected Credit Losses, (2) enter the opening balances, (3) post the above summary entries, and (4) determine the ending balances. (Post…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education