FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

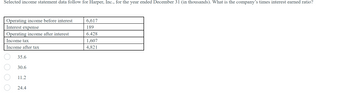

Transcribed Image Text:Selected income statement data follow for Harper, Inc., for the year ended December 31 (in thousands). What is the company's times interest earned ratio?

Operating income before interest

Interest expense

Operating income after interest

Income tax

Income after tax

35.6

30.6

11.2

24.4

6,617

189

6.428

1,607

4,821

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Times Interest Earned Sprout Company reported the following on the company's income statement in two recent years: Current Year Prior Year Interest expense $467,000 $560,400 Income before income tax expense 6,911,600 7,733,520 a. Determine the times interest earned ratio for the current year and the prior year. Round to one decimal place. cutent Year Prior Year b. Is the times interest earned ratio improving or declining?arrow_forwardBhaarrow_forwardAssume the following sales data for a company:Current year$832,402 Preceding year608,082What is the percentage increase in sales from the preceding year to the current year? a.136.89% b.36.89% c.73.05% d.26.95% The relationship of $242,729 to $104,267, expressed as a ratio, is a.0.8 b.2.3 c.0.4 d.0.7arrow_forward

- Refer to the following selected financial information from a company. Compute the company’s debt-to-equity ratio for Year 2. Year 2 Year 1 Net sales $ 484,500 $ 427,450 Cost of goods sold 277,500 251,320 Interest expense 10,900 11,900 Net income before tax 68,450 53,880 Net income after tax 47,250 41,100 Total assets 319,500 295,200 Total liabilities 175,400 168,500 Total equity 144,100 126,700 Answer: A. 1.22. B. 1.82. C. 3.36. D. 0.82. E. 2.22.arrow_forwardRefer to the following selected financial information from a company. Compute the company’s return on total assets for Year 2. Year 2 Year 1 Net sales $ 483,000 $ 427,150 Cost of goods sold 277,200 251,020 Interest expense 10,600 11,600 Net income before tax 68,150 53,580 Net income after tax 46,950 40,800 Total assets 318,900 293,400 Total liabilities 176,900 168,200 Total equity 142,000 125,200 Answer: A. 22.3% B. 14.7% C. 9.7% D. 2.7% E. 15.3%arrow_forwardCalculate the net income after corporate income tax is paid for Quarter 1 from the following income statement. Use a corporate income tax rate of 21%. Q1 (x1000) Q2(x1000) Net Sales 115 125 COGS (30) (31) Gross Profit 85 94 Overhead (32) (41) Pre-tax Income 53 53 Net Income = $[?] Multiply your result by 1000 before entering. For example: 1.23 (x1000) = $1,230. %3D Enter Copyright 2003 - 2021 Acellus Corporation. All Rights Reserved,arrow_forward

- Following information are taken from financial statements of a company. What is the interest coverage ratio? Sales Revenue $1,000,000 Tax Rate 20% Net Income $200,000 Operating Income $280,000arrow_forwardAssume the following sales data for a company: Current year $778,795 Preceding year 600,257 What is the percentage increase in sales from the preceding year to the current year?arrow_forwardSelected information from the annual financial statements of Delicata Industries is shown below. ($ in thousands) Revenue Operating income Net other income(expense) Net income 240,000 5,600 196,480 Average operating assets 4,200,000 Average operating liabilities 1,800,000 Current Financials $1,500,000 Delicata has an income tax rate of 20%. a. What is Delicata's net operating profit after taxes (NOPAT) for the year? $0 b. Calculate Delicata's net operating profit margin (NOPM) for the year. Result Numerator + Denominator = 0 + $ 0 = NOPM $ c. Calculate Delicata's return on net operating assets (RNOA) for the year. Numerator + Denominator = Result 0 + $ 0 = RNOA $ 96arrow_forward

- Compute the component percentages for Trixy Magic’s income statement below. (Enter your answers as a percentage rounded to 2 decimal place (i.e. 0.1234 should be entered as 12.34). Enter all answers as positive values.)arrow_forwardPharoah Corporation recently filed the following financial statements with the SEC. Pharoah CorporationIncome Statement for the FiscalYear Ended July 31, 2017 Net sales $77,630 Cost of products sold 55,218 Gross profit $22,412 Selling, general, and administrative expenses 9,893 Depreciation 1,124 Operating income (loss) $11,395 Interest expense 688 Earnings (loss) before income taxes $10,707 Income taxes 3,748 Net earnings (loss) $6,959 What are the company’s current ratio and quick ratio? (Round answers to 2 decimal places, e.g. 52.75.) Current ratio Quick ratioarrow_forwardPrepare common size income statements Which company earns more net income? Which companies net income has a higher percentage of its net sales revenue?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education