FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Dont use ai okk just solve full accurate answers with excel work okk

No extra explanation needs no guideline answer..

Just solve accurate ok

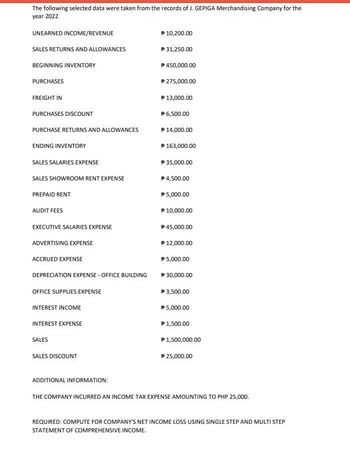

Transcribed Image Text:The following selected data were taken from the records of J. GEPIGA Merchandising Company for the

year 2022

UNEARNED INCOME/REVENUE

SALES RETURNS AND ALLOWANCES

BEGINNING INVENTORY

PURCHASES

FREIGHT IN

PURCHASES DISCOUNT

PURCHASE RETURNS AND ALLOWANCES

ENDING INVENTORY

SALES SALARIES EXPENSE

SALES SHOWROOM RENT EXPENSE

PREPAID RENT

AUDIT FEES

EXECUTIVE SALARIES EXPENSE

ADVERTISING EXPENSE

ACCRUED EXPENSE

DEPRECIATION EXPENSE - OFFICE BUILDING

OFFICE SUPPLIES EXPENSE

INTEREST INCOME

INTEREST EXPENSE

SALES

SALES DISCOUNT

ADDITIONAL INFORMATION:

P 10,200.00

P 31,250.00

450,000.00

P 275,000.00

P 13,000.00

$ 6,500.00

P 14,000.00

P 163,000.00

P 35,000.00

P 4,500.00

Đ 5,000.00

P 10,000.00

℗ 45,000.00

℗ 12,000.00

$5,000.00

℗ 30,000.00

P 3,500.00

P 5,000.00

1,500.00

P 1,500,000.00

℗ 25,000.00

THE COMPANY INCURRED AN INCOME TAX EXPENSE AMOUNTING TO PHP 25,000.

REQUIRED: COMPUTE FOR COMPANY'S NET INCOME LOSS USING SINGLE STEP AND MULTI STEP

STATEMENT OF COMPREHENSIVE INCOME.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 4 images

Knowledge Booster

Similar questions

- hi im looking at the solution above and have a quuestion-im a littlepuzzled on exactly how i should be plugging in the numbersfor example, the chart liists Time (ln2/(ln(1+r)) but how exactly should i type this in my calculatorto get =l3/J3? maybe im overthinking itarrow_forwardPlease do not rely too much on chatgpt, because its answer may be wrong. Please consider it carefully and give your own answer. You can borrow ideas from gpt, but please do not believe its answer.Very very grateful!Please do not rely too much on chatgpt, because its answer may be wrong. Please consider it carefully and give your own answer. You can borrow ideas from gpt, but please do not believe its answer.Very very grateful!arrow_forwardPlease do not rely too much on chatgpt, because its answer may be wrong. Please consider it carefully and give your own answer. You can borrow ideas from gpt, but please do not believe its answer.Very very grateful!Please do not rely too much on chatgpt, because its answer may be wrong. Please consider it carefully and give your own answer. You can borrow ideas from gpt, but please do not believe its answer.Very very grateful!arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education