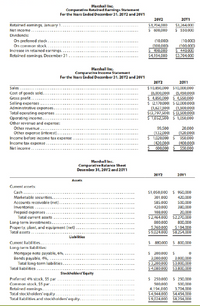

The comparative Financial statements of Marshall Inc. are as follows. The market price of Marshall common stock was $82.60 on December 31, 20Y2.

Instructions

Determine the following measures for 20Y2. Round to one decimal place, including percentages, except for per-share amounts, which should be rounded to the nearest cent.

1. Working capital

2.

4.

5. Number of days' sales in receivables

6. Inventory turnover

7. Number of days' sales in inventory

8. Ratio of fixed assets to long-term liabilities 9- Ratio of liabilities to stockholders' equity

10. Times interest earned

11. Asset turnover

12. Return on total assets

13. Return on stockholders' equity

14. Return on common stockholders' equity

15. Earnings per share on common stock

16. Price-earnings ratio

17. Dividends per share of common stock

18. Dividend yield

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

- Measures of liquidity, Solvency, and Profitability The comparative financial statements of Marshall Inc. are as follows. The market price of Marshall common stock was $ 65 on December 31, 20Y2. Marshall Inc. Comparative Retained Earnings Statement For the Years Ended December 31, 20Y2 and 20Y1 20Y2 20Y1 Retained earnings, January 1 $1,173,375 $995,425 Net income 259,200 203,900 Total $1,432,575 $1,199,325 Dividends: On preferred stock $8,400 $8,400 On common stock 17,550 17,550 Total dividends $25,950 $25,950 Retained earnings, December 31 $1,406,625 $1,173,375 Marshall Inc. Comparative Income Statement For the Years Ended December 31, 20Y2 and 20Y1 20Y2 20Y1 Sales $1,622,790 $1,495,130 Cost of goods sold 611,010 562,130 Gross profit $1,011,780 $933,000 Selling expenses $341,930 $416,290 Administrative expenses 291,280 244,490 Total operating…arrow_forwardFind Out : (a)Earnings per share(b)Return on common stockholders' equity in %(c)Return on assets in %(d)Current ratio in :1(e)Accounts receivable turnover in times(f)Average collection period in days(g)Inventory turnover in times (h)Days in inventory in days (i)Times interest earned in times (j)Asset turnover in times (k)Debt to assets ratio in % (l)Free cash flowarrow_forwardProfitability Ratios The following selected data were taken from the financial statements of Vidahill Inc. for December 31, 20Y7, 20Y6, and 20Y5: December 31 20Y7 20Y6 20Y5 Total assets $309,000 $278,000 $247,000 Notes payable (8% interest) 100,000 100,000 100,000 Common stock 40,000 40,000 40,000 Preferred 3% stock, $100 par 20,000 20,000 20,000 (no change during year) Retained earnings 114,945 75,650 60,000 The 20Y7 net income was $39,895, and the 20Y6 net income was $16,250. No dividends on common stock were declared between 20Y5 and 20Y7. Preferred dividends were declared and paid in full in 20Y6 and 20Y7. a. Determine the return on total assets, the return on stockholders' equity, and the return on common stockholders’ equity for the years 20Y6 and 20Y7. Round percentages to one decimal place. 20Y7 20Y6 Return on total assets fill in the blank 1 % fill in the blank 2 % Return on stockholders’ equity fill…arrow_forward

- A company reports earnings per share on common stock of $2.00 when the market price of per share of common stock is $50.000. What is the company’s price-earnings ratio?arrow_forwardProfitability Ratios The following selected data were taken from the financial statements of Vidahill Inc. for December 31, 20Y7, 20Y6, and 20Y5: December 31 20Y7 20Y6 20Y5 Total assets $250,000 $225,000 $200,000 Notes payable (8% interest) 80,000 80,000 80,000 Common stock 32,000 32,000 32,000 Preferred 7% stock, $100 par 16,000 16,000 16,000 (no change during year) Retained earnings 88,510 64,380 48,000 The 20Y7 net income was $25,250, and the 20Y6 net income was $17,500. No dividends on common stock were declared between 20Y5 and 20Y7. Preferred dividends were declared and paid in full in 20Y6 and 20Y7. a. Determine the return on total assets, the return on stockholders' equity, and the return on common stockholders’ equity for the years 20Y6 and 20Y7. When required, round to one decimal place. 20Y7 20Y6 Return on total assets fill in the blank 1 % fill in the blank 2 % Return on stockholders’ equity fill…arrow_forwardplease answer parts 7, 8, and 9.arrow_forward

- Measures of liquidity, Solvency, and Profitability The comparative financial statements of Marshall Inc. are as follows. The market price of Marshall common stock was $ 65 on December 31, 20Y2. Marshall Inc. Comparative Retained Earnings Statement For the Years Ended December 31, 20Y2 and 20Y1 20Y2 20Y1 Retained earnings, January 1 $1,173,375 $995,425 Net income 259,200 203,900 Total $1,432,575 $1,199,325 Dividends: On preferred stock $8,400 $8,400 On common stock 17,550 17,550 Total dividends $25,950 $25,950 Retained earnings, December 31 $1,406,625 $1,173,375 Marshall Inc. Comparative Income Statement For the Years Ended December 31, 20Y2 and 20Y1 20Y2 20Y1 Sales $1,622,790 $1,495,130 Cost of goods sold 611,010 562,130 Gross profit $1,011,780 $933,000 Selling expenses $341,930 $416,290 Administrative expenses 291,280 244,490 Total operating…arrow_forwardDetermine the following measures for 20Y2 (round to one decimal place, including percentages, except for per-share amounts): Return on common stockholders' equity Earnings per share on common stock Price-earnings ratio Dividends per share of common stock Dividend yieldarrow_forwardThe market price for Microsoft Corporation closed at $101.57 and $85.95 on December 31, current year, and previous year, respectively. The dividends per share were $1.68 for current year and $1.56 for previous year. a. Determine the dividend yield for Microsoft on December 31, current year, and previous year. Round percentages to two decimal places. Current year fill in the blank 1% Previous year fill in the blank 2%arrow_forward

- Measures of liquidity, Solvency, and Profitability The comparative financial statements of Marshall Inc. are as follows. The market price of Marshall common stock was $ 55 on December 31, 20Y2. Marshall Inc. Comparative Retained Earnings Statement For the Years Ended December 31, 20Y2 and 20Y1 20Y2 20Y1 Retained earnings, January 1 $ 1,806,225 $ 1,533,375 Net income 408,800 314,100 Total $2,215,025 $ 1,847,475 Dividends: On preferred stock $ 13,300 $ 13,300 On common stock 27,950 27,950 Total dividends $ 41,250 $ 41,250 Retained earnings, December 31 $ 2,173,775 $ 1,806,225 Marshall Inc. Comparative Income Statement For the Years Ended December 31, 20Y2 and 20Y1 20Y2 20Y1 Sales $ 2,330,160 $ 2,146,930 Cost of goods sold 797,160 733,390 Gross profit $ 1,533,000 $ 1,413,540 Selling expenses $ 515,660 $ 632,210 Administrative expenses 439,270 371,300…arrow_forwardBelow is the financial data for Arla Inc. for the year ended December 31, 2020: Market price per share... Net Income...... $150.00 $1,750,000 Preferred Dividends declared... $75,000 Average # of common shares....... Dividends per share...... Average common shareholders' equity..... Total assets..... Total Liabilities... Accumulated Other Comprehensive Income..... 100,000 $2.50 10,000,000 $22,500,000 $11,675,000 $185,000 Instructions Calculate the Return on shareholders' equity (use up to 2 decimal places and do not include a % sign)arrow_forwardCalculate: a). The average stock return from 20x1-20x3. b). the standard deviation over the same period. c). the coefficient of variation over the same period. Comparative Balance Sheets As of December 31 Assets: 20X3 20X2 20X1 Cash $ 210,000 $ 780,000 $ 1,530,000 Accounts Receivable 315,000 265,000 240,000 Inventory 436,000 405,000 330,000 Prepaid Insurance 15,000 18,000 21,000 Total Current Assets $ 976,000 $ 1,468,000 $ 2,121,000 Land 1,650,000 1,630,000 1,400,000 Buildings 2,300,000 1,760,000 1,400,000 Less: Accumulated Depreciation (560,000) (490,000) (440,000) Net Buildings 1,740,000 1,270,000 960,000 Total Long-Term Assets 3,390,000 2,900,000 2,360,000 Total Assets 4,366,000 4,368,000 4,481,000 Liabilities & Stockholder's Equity Accounts Payable 215,000 134,000 185,000 Salaries and Wages Payable 63,000…arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education