Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

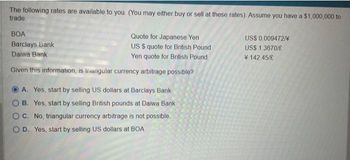

Transcribed Image Text:The following rates are available to you. (You may either buy or sell at these rates). Assume you have a $1,000,000 to

trade.

Quote for Japanese Yen

US $ quote for British Pound

Yen quote for British Pound

Given this information, is triangular currency arbitrage possible?

BOA

Barclays Bank

Daiwa Bank

A. Yes, start by selling US dollars at Barclays Bank

OB.

Yes, start by selling British pounds at Daiwa Bank

No, triangular currency arbitrage is not possible.

O D. Yes, start by selling US dollars at BOA

O C.

US$ 0.009472/

US$ 1.3670/£

142.45/£

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Suppose that Cloudastries Bank is a U.S.-based financial intermediary that serves the foreign exchange market. Assume that this bank is willing to both purchase and sell currency for the same rate. In other words, assume there is no bid/ask spread. Suppose Cloudastries has made the following direct quotations: Currency Dollar Spot Rate $0.55 $1.65 Mexican Peso Euro Additionally, Cloudastries has quoted a cross exchange rate of 1 euro = 3.01 pesos. After exchanging euros for pesos, the last step in triangular arbitrage is to exchange those pesos for dollars. If you exchange your 36,484.84 for dollars from Cloudastries, you would receive This represents a profit ofarrow_forwardMatch each term in Column A with its related definition in Column B.Column A1. Spot rate2. Currency appreciation3. Translation risk4. Transaction risk5. Exchange rateColumn Ba. The rate at which one currency can be traded for another currency.b. The possibility that future cash transactions will be affected by changing exchange rates.c. A month ago, $1 U.S. was worth 8.5 Mexican pesos. Today, $1 is worth 9.0 Mexicanpesos. The U.S. dollar has undergone what?d. The degree to which a firm’s financial statements are exposed to exchange ratefluctuation.e. The exchange rate of one currency for another for immediate delivery (today).arrow_forwardA bank in Mississauga has a buying rate of ¥1 = C$0.01275. If the exchange rate is ¥1 = C$0.01315, calculate the rate of commission that the bank charges to buy currencies. Round to two decimal placesarrow_forward

- Question 1 All else held constant, which of the following would make the put option on the common stock more valuable? A lower exercise price Stock price drops Stock price volatility reducesarrow_forwardSuppose the Japanese yen exchange rate is ¥116/$ and the British pond exchange rate is $1.27/£. a) What is the yen to pound cross-rate? b) Suppose that a bank gives you a quote of ¥156/£. Is there an arbitrage opportunity here? If so, explain how to take advantage of the mispricing.arrow_forwardThe following exchange rates are available to you. • Bank Quotation Fuji Bank, Tokyo Y120/$ • Credit Suisse First Boston, New York SF 1.60/$ Swiss First Bank, Zurich 83/ SF • Assume that you have an initial USD 10,000,000. What is the profit in USD from Triangular Arbitrage Show all working a. $66,666.67 b. $1,066,666 $533333 C. d. $75000arrow_forward

- A bank in London, Ontario charges 1.75% commission to buy and sell currencies. Assume that the current exchange rate is US$1 = C$1.3973. a. How many Canadian dollars will you receive from the bank if you sell US$1,310? Round to the nearest cent b. How much commission will you pay the bank for this transaction?arrow_forwardK (Foreign exchange arbitrage) You own $7,000. The dollar rate in Tokyo is ¥215.9372/$. The yen rate in New York is given in the following table: Selling Quotes for Foreign Currencies in New York Country-Currency Japan-yen Contract Spot 30-day 90-day (Click on the icon in order to copy its contents into a spreadsheet.) Are arbitrage profits possible? Set up an arbitrage scheme with your capital. What is the gain in dollars? The net View an example $/Foreign Currency "Assuming no transaction costs, the rates in Tokyo and New York are out of line. Therefore, arbitrage profits are possible." The statement above is true (Select from the drop-down menu.) 0.004698 0.004741 0.004782 Get more help - ... from arbitrage would be $ (Round to the nearest cent.) Clear all Check answerarrow_forwardD3)arrow_forward

- Assume the bid rate of an Yen dollar is $ 1.8 while the ask rate is $ 3.5 at Arab Bank.Assume the bid rate of an Yen dollar is $3.4 while the ask rate is $5.7 at Palestine Bank. Given this information, what would be your gain if you use $8876.7 and execute locational arbitrage? =8876.713.5^ * 3.4b =8876.7/5.7^ * 3.5c =8876.7/3.4^ * 1.8d = 8876.7 /3.5^ * 5.7arrow_forwardConsider the following table. There are two countries and two goods. Assume both countries have the same price table: Time t t+1 P1 $8 $10 P2 $4 $5 a. Assume commodity price parity. What is the foreign currency price of the two goods at the two points in time? What is the domestic inflation rate? What is the foreign inflation rate. b. Suppose PPP is known to hold as is covered interest parity between two countries. What determines any differences between the expected real returns on risk free interest bearing assets in the two countries?arrow_forwardA bank in London, Ontario has a buying rate of CHF 1 = C$1.3547. If the exchange rate is CHF 1 = C$1.3841, calculate the rate of commission that the bank charges.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education