ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

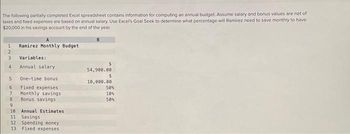

Transcribed Image Text:The following partially completed Excel spreadsheet contains information for computing an annual budget. Assume salary and bonus values are net of

taxes and fixed expenses are based on annual salary. Use Excel's Goal Seek to determine what percentage will Ramirez need to save monthly to have

$20,000 in his savings account by the end of the year.

B

1

Ramirez Monthly Budget

2

3

Variables:

4

Annual salary

54,900.00

$

5 One-time bonus

10,000.00

6

Fixed expenses

50%

7

Monthly savings

10%

8

Bonus savings

50%

9

10 Annual Estimates

11 Savings

12 Spending money

13 Fixed expenses

Transcribed Image Text:ped

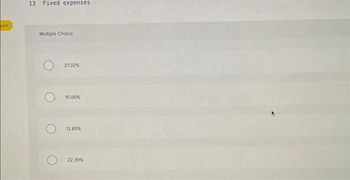

13

Fixed expenses

Multiple Choice

27.32%

10.00%

13.85%

22.39%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Student Emergency Financial Services, Inc.,which makes small loans to college students, offersto lend $550. The borrower is required to pay $42 atthe end of each week for 16 weeks. Find the interestrate per week. What is the nominal interest rate peryear? What is the effective interest rate per year?arrow_forwardGive typing answer with explanation and conclusion Gustav Co. is planning to issue new 30-year bonds. The current plan is to make the bonds non-callable, but this may be changed. If the bonds are made callable after 5 years at a 5% call premium, how would this affect their required rate of return? Question 6 options: There is no reason to expect a change in the required rate of return. The required rate of return would increase because the bond would then be?arrow_forwardPLS HELP ASAP ON BOTHarrow_forward

- What happens to happens to the annual payment on a loan as the term of the loan increases? O It stays the same It decreases It increasesarrow_forward9. The price of money Suppose that Rajiv borrows $50,000 at 5% per year to purchase equipment for his business. Complete the following table by calculating the amounts that Rajiv will have to repay in full if he borrows for three different periods (months), assuming compound interest. Period (Months) 30 40 45 Amount (Dollars)arrow_forward23. James borrowed $600 from the bank at some rate per annum and that amount becomes double in 2 years. Calculate the rate at which James borrowed the money. Amount of Rs 12800 was invested by Mr Rohan dividing it into two differentarrow_forward

- Question A Full explain this question and text typing work only We should answer our question within 2 hours takes more time then we will reduce Rating Dont ignore this line..arrow_forwardDuring a year of operation, a firm collects $50,000 in sales revenue and spends $10,000 on salaries of workers, $1,520 on electricity and utilities, $6,000 on raw materials. The firm owner had to leave his job which was paying $30,000 of annual salary. The firm owner also used $5,000 of his personal savings, which was earning a guaranteed 5 percent annual rate of return. calculate The firm earns accounting profit, The firm's economic profit.arrow_forwardTyped plzzz and Asap Thanksarrow_forward

- Question 1 Due to health reasons, Dave is considering early retirement. He currently has $700,000 in a self- managed retirement fund. He thinks he will need S40,000 per year during retirement. He intends to invest his retirement in a low-risk mutual fund which return 1.5% per year. How many years can he live off this retirement fund without the need to look for a job?arrow_forward5arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education