ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

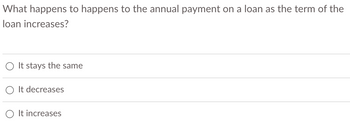

Transcribed Image Text:What happens to happens to the annual payment on a loan as the term of the

loan increases?

O It stays the same

It decreases

It increases

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- A 6 Okay 2048 tv 8 Hello ... E88 STUDY NOTES FOR SELF THO What is the value of the IRA when you turn 65? (Round to the nearest dollar as needed.) How much of the future value is interest? 9 Starting at age 25, you deposit $2000 a year into an IRA account for retirement. Treat the yearly deposits into the account as a continuous income stream. If money in the account eams 6%, compounded continuously, how much will be in the account 40 years later, when you retire at age 65? How much of the final amount is interest? U ( I December 5, 2022 at 8:28 AM (Round to the nearest dollar as needed.) A l Aa 8= 5 A E » Q 38 reviou --K--arrow_forwardShow complete solution and do not use excel.arrow_forwardFind the present value of a future value of $420 at 5.5% annual simple interest for 2 years? O a. $398.10 O b. $377.35 O c. $375.73 d. $378.38 Previous page Next page 耳 P Type here to searcharrow_forward

- 6. You may borrow or lend at a 5% interest rate, which you expect to remain stable forever. Make a choice and explain your answer in each scenario below. a. You may receive a gift of $500 today or a gift of $540 next year. b. You may receive gift of $100 today or a four-year loan of $500 without interest. c. You may receive a $350 rebate on an $8000 car or one year of no-interest financing on the full price of the car. d. You have just won $1 million in the lottery. You may receive $500,000 now or the full million, paid out in 20 annual payments of $50,000. e. Alternatively, you may take $500,000 now or receive $25,000 per year for eternity (a contract that your heirs will inherit).arrow_forwarddo fastarrow_forward5 Question Let Ya,n be the present value of an n-year term continuous annuity of $1 per year for an insured aged x. Let Y be the present value of a whole life continuous annuity of $1 per year for an insured aged x. Given a constant force of interest, 8, show that: 1 бп Cov (Yz,n, Yz) = (A — e¯ðª‚„Ez (1 − Āz+n) — ±‚ñ¦Ã‚) 82 n. - -arrow_forward

- 2.One of life's great lessons is to start early and save all the money you can! If you save $10 today and $10 each and every day thereafter until you are 60 years old(suppose you're 20 years old now, save $3,650 per year), how nuch money will you accumulate if the annual interest rate is 5%?arrow_forwardCalculate the maturity value of a 300-day, $6,000 simple interest term deposit earning 5.15%. O a. $7,021.99 O b. $6,309.00 O c. $6,111.78 O d. $6,253.97 e. $5,756.34arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education