ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

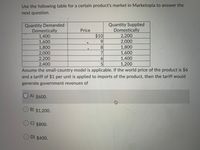

Transcribed Image Text:Use the following table for a certain product's market in Marketopia to answer the

next question.

Quantity Demanded

Domestically

1,400

1,600

1,800

2,000

2,200

2,400

Quantity Supplied

Domestically

2,200

2,000

1,800

1,600

1,400

1,200

Price

$10

9.

8

6.

5

Assume the small-country model is applicable. If the world price of the product is $6

and a tariff of $1 per unit is applied to imports of the product, then the tariff would

generate government revenues of

O A) $600.

OB) $1,200.

O C) $800.

O D) $400.

身

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- 3. Welfare effects of a tariff in a small country Suppose Ronduras is open to free trade in the world market for soybeans. Because of Honduras's small size, the demand for and supply of soybeans in Honduras do not affect the world price. The following graph shows the domestic soybeans market in Honduras. The world price of soybeans is Pw = $400 per ton. On the following graph, use the green triangle (triangle symbols) to shade the area representing consumer surplus (CS) when the economy is at the free-trade equilibrium. Then, use the purple triangle (diamond symbols) to shade the area representing producer surplus (PS). 1200 Domestic Demand Domestic Supply 1100 CS 1000 900 PS 800 700 600 500 400 300 200 100 120 140 160 180 200 20 40 60 80 QUANTITY (Tons of soybeans) PRICE (Dollars pe: ton)arrow_forwardPrice of Wagons gain by $240 lose by $240 gain by $120 lose by $75 $18.5 8 5 1 0 40 70 90 Domestic Supply World Price Domestic Demand Quantity of Wagons Refer to the figure above. If this country allows free trade in wagons, how much will consumers gain or lose?arrow_forward. Identify people and organizations that benefit from and suffer because of the tariff (2 points). Include how the tariff will impact your companarrow_forward

- A country decides to impose higher tariffs on imported goods to encourage domestic production. This policy change impacts the circular flow of income and expenditure by altering the dynamics of international trade. In this scenario, the imposition of tariffs on imports primarily:A) Acts as a leakage in the circular flowB) Functions as an injection into the circular flowC) Has no significant impact on the circular flowD) Reduces government expenditure in the circular flow Note:- Please avoid using ChatGPT and refrain from providing handwritten solutions; otherwise, I will definitely give a downvote. Also, be mindful of plagiarism.Answer completely and accurate answer.Rest assured, you will receive an upvote if the answer is accurate.arrow_forwardWhich of the following arguments might be legitimate reasons for limiting imports? a) Imports destroy jobs in the import-copeting industry so we should protect this industry to save jobs. b) We need to impose tariffs fo stop our industries moving their operations and jobs to lob wage countries c) if the cost of shifting resources from import-competing industries are high enough so that together with the other transaction costs they exceed the gains from trade, we should slow down the imports. d) Low income countries' ability to buy our goods is so much less that our ability to buy theirs, that in order to have balanced trade, we should impose some restrictions of imports from such low income countries. e) Some countries f) Some foreign producers sell below their costs in order to monopolize the market so they can raise prices to monopoly levels and fleece our cosumers, so we should impose restrictions specific to such…arrow_forward1. Explain in detail a) What is the welfare impact of quotas compared to tariffs? b) Which one of the two (quotas or tarrifs) is a more flexible tool to use?arrow_forward

- Consider the market for coffee in the small, isolated country of Krakozhia. Within Krakozhia, the domestic demand for coffee is: Q = 500-2p and the domestic supply of coffee is: Q* = -150+ 3parrow_forwardConsider a smopec in the market for bread. The domestic equilibrium price without trade would be above the world market price. If the country imposes a tariff on imports, this would lead to O No changes, because the world price would go above the domestic equilibrium price O Consumer gaining surplus O Producers gaining surplus O An increase in total welfarearrow_forward[India is the world’s largest consumer of sugar. Assume the world price for sugar is $750 per ton.] [Assume India currently has a tariff of $50 per ton on sugar and imports 7 million tons of sugar. Show this situation in a graph. Label the quantity demanded and the quantity supplied domestically and imports clearly on a graph. Explain your graph in 3-4 sentences. How to draw the graph?arrow_forward

- !arrow_forwardWhich Americans benefit from the tariff? Why? Describe why the imposition of a tariff creates a deadweight loss.arrow_forwardThe US decides to impose a tariff on Avocados of $0.75 each Under Free Trade you have the following information: $1 per Unit World and US Price: Domestic Consumption 25 Billion Units 1 Billion Units Domestic Production: Under a Tariff you have the following information: New US Price: $1.75 per Unit Domestic Consumption: Domestic Production: 21 Billion Units 5 Billion Units (a) How much does the government gain in tariff revenue? (b) How much do domestic producers gain? (c) How much do consumers lose? (d) What is net national or "dead weight" loss?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education