Concept explainers

The following is the operating section of the statement of

Collections from customers $ 28,000

Payments to suppliers for inventory purchases (13,000 )

Payments for operating expenses (9,000 )

Payments for income taxes (2,260 )

Cash provided by operating activities 3,740

The following information is obtained from the income statement of Battery Builders:

Net income $ 6,740

In addition, the following information is obtained from the comparative

Change in

Change in inventory 3,000

Change in accounts payable 2,000

Change in accrued payables (related to operating expense) (2,000 )

Change in income taxes payable (1,000 )

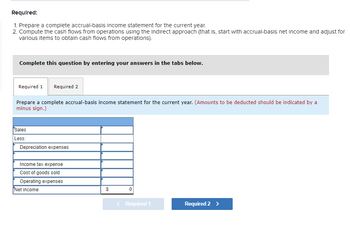

Required:

Prepare a complete accrual-basis income statement for the current year.

Compute the cash flows from operations using the indirect approach (that is, start with accrual-basis net income and adjust for various items to obtain cash flows from operations).

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

- The following information pertains to Peak Heights Company: Income Statement for Current Year Sales $ 85,300 Expenses Cost of goods $ sold 51,675 Depreciation 8,100 expense Salaries 12,000 71,775 expense Net income $ 13,525 Partial Balance Prior Sheet Current year year Accounts $ $ 9,900 receivable 14,400 Inventory 13,700 8,300 Salaries payable 1,550 850 Required: Present the operating activities section of the statement of cash flows for Peak Heights Company using the indirect method. Note: List cash outflows as negative amounts. PEAK HEIGHTS COMPANY Statement of Cash Flows (Partial) Cash flows from operating activities: Accounts receivable increasearrow_forwardRavenna Company is a merchandiser using the indirect method to prepare the operating activities section of its statement of cash flows. Its balance sheet for this year is as follows: Ending Balance Beginning Balance Cash and cash equivalents $ 89,000 $ 106,750 Accounts receivable 71,500 77,000 Inventory 96,000 87,500 Total current assets 256,500 271,250 Property, plant, and equipment 255,000 245,000 Less accumulated depreciation 85,000 61,250 Net property, plant, and equipment 170,000 183,750 Total assets $ 426,500 $ 455,000 Accounts payable $ 56,000 $ 99,500 Income taxes payable 43,500 57,000 Bonds payable 105,000 87,500 Common stock 122,500 105,000 Retained earnings 99,500 106,000 Total liabilities and stockholders’ equity $ 426,500 $ 455,000 During the year, Ravenna paid a $10,500 cash dividend and sold a piece of equipment for $5,250 that originally cost $12,000 and had accumulated depreciation of $8,000. The company did not retire any bonds or…arrow_forwardThe following are excerpts from Hamburg Company’s statement of cash flows and other financial records. From Statement of Cash Flows: Cash flows from operating activities $433,104 Cash flows from investing activities -13,381 Cash flows from financing activities -221,035 From other records: Capital expenditure costs 18,547 Cash dividend payments 12,864 Sales revenue 465,762 Total assets 446,698 Compute free cash flow.arrow_forward

- Shown below are totals of the three sections from the SCF for the Sivad Motel for the year just ended. Analyze this information and prepare a report indicating your opinion regarding its sources and uses of cash and their impact on the future of the company. Your conclusions and recommendations should be supported with proper explanations and assumptions. Statement of Cash Flows Net cash provided by operating activities $10,000 Net cash used by investing activities (15,000) Net cash used by financing activities (5,000) Decrease in cash for the year (10,000) Cash at beginning of year 15,000 Cash at end of…arrow_forwardRequired information Skip to question [The following information applies to the questions displayed below.] Ravenna Company is a merchandiser that uses the indirect method to prepare the operating activities section of its statement of cash flows. Its balance sheet for this year is as follows: Ending Balance Beginning Balance Cash and cash equivalents $ 102,000 $ 122,400 Accounts receivable 81,700 88,000 Inventory 109,700 100,000 Total current assets 293,400 310,400 Property, plant, and equipment 291,000 280,000 Less accumulated depreciation 97,000 70,000 Net property, plant, and equipment 194,000 210,000 Total assets $ 487,400 $ 520,400 Accounts payable $ 64,000 $ 113,700 Income taxes payable 49,700 65,700 Bonds payable 120,000 100,000 Common stock 140,000 120,000 Retained earnings 113,700 121,000 Total liabilities and stockholders’ equity $ 487,400 $ 520,400…arrow_forwardBelow is the data for Michael Ski Company . Prepare the cash flows from operating activities in the statement of cash flows using the direct method. (Do not prepare a reconciliation schedule.) David Ski Company had the following statements prepared as of December 31, 2020: Michael Ski Company Comparative Balance Sheet As of December 31 2020 2019 Cash 2,500 4,000 Account receivable 103,000 97,000 Short-term investment (Available-for-sale) 96,000 121,000 Inventories 91,000 54,000 Prepaid insurance 4,000 6,000 Ski equipment 89,000 43,000 Accumulated depr.-equipment (23,500) (18,000) Trademarks 79,000 83,000 Total asets 441,000 390,000 Account payable 92,200 75,000 income taxes payable 21,800 15,700 Wages payable 4,000 9,000 Short-term loans payable to bank 23,500 0 Long-term loans payable 75,000 125,000 Common stock, $1 par 100,000 100,000 Additional paid-in capital 20,000 20,000 Retained earnings 104,500 45,300 Total…arrow_forward

- Prepare the operating activities section of the statement of cash flows using the indirect method. Note: Amounts to be deducted should be indicated with a minus sign. The following income statement and additional year-end information is provided. SONAD COMPANY Income Statement For Year Ended December 31 Sales $ 2,189,000 Cost of goods sold 1,072,610 Gross profit 1,116,390 Operating expenses Salaries expense $ 299,893 Depreciation expense 52,536 Rent expense 59,103 Amortization expenses—Patents 6,567 Utilities expense 24,079 442,178 674,212 Gain on sale of equipment 8,756 Net income $ 682,968 Accounts receivable $ 46,450 increase Accounts payable $ 12,900 decrease Inventory 13,500 increase Salaries payable 5,150 decreasearrow_forwardThe following income statement was drawn from the annual report of Newtown Company: Cash revenue $ 69,800 Depreciation expense (24,900) Accrued interest expense (10,400) Cash operating expenses (29,700) Operating income 4800 Gain on sale of equipment 2600 Net income $ 7400 What is the net cash flow from operating activities? Group of answer choices $40,100 $42,700 $35,300 $32,700 Trainingarrow_forwardRavenna Company is a merchandiser using the indirect method to prepare the operating activities section of its statement of cash flows. Its balance sheet for this year is as follows: Ending Balance Beginning Balance Cash and cash equivalents $ 89,000 $ 106,750 Accounts receivable 71,500 77,000 Inventory 96,000 87,500 Total current assets 256,500 271,250 Property, plant, and equipment 255,000 245,000 Less accumulated depreciation 85,000 61,250 Net property, plant, and equipment 170,000 183,750 Total assets $ 426,500 $ 455,000 Accounts payable $ 56,000 $ 99,500 Income taxes payable 43,500 57,000 Bonds payable 105,000 87,500 Common stock 122,500 105,000 Retained earnings 99,500 106,000 Total liabilities and stockholders’ equity $ 426,500 $ 455,000 During the year, Ravenna paid a $10,500 cash dividend and sold a piece of equipment for $5,250 that originally cost $12,000 and had accumulated depreciation of $8,000. The company did not retire any bonds or…arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education