FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

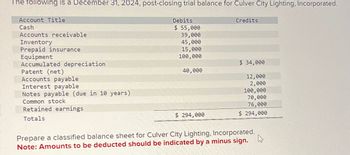

Transcribed Image Text:The following is a December 31, 2024, post-closing trial balance for Culver City Lighting, Incorporated.

Account Title

Cash

Accounts receivable

Inventory

Prepaid insurance

Equipment

Accumulated depreciation

Patent (net)

Accounts payable

Interest payable

Notes payable (due in 10 years)

Common stock

Retained earnings

Totals

Debits

$ 55,000

39,000

45,000

15,000

100,000

40,000

$ 294,000

Credits

$ 34,000

12,000

2,000

100,000

70,000

76,000

$ 294,000

Prepare a classified balance sheet for Culver City Lighting, Incorporated.

Note: Amounts to be deducted should be indicated by a minus sign.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The following is the trial balance of Swifty Corporation at December 31, 2020. SWIFTY CORPORATIONTRIAL BALANCEDECEMBER 31, 2020 Debits Credits Purchase Discounts $33,000 Cash $626,010 Accounts Receivable 346,500 Rent Revenue 59,400 Retained Earnings 528,000 Salaries and Wages Payable 59,400 Sales Revenue 3,630,000 Notes Receivable 363,000 Accounts Payable 161,700 Accumulated Depreciation—Equipment 92,400 Sales Discounts 47,850 Sales Returns and Allowances 57,750 Notes Payable 231,000 Selling Expenses 765,600 Administrative Expenses 326,700 Common Stock 990,000 Income Tax Expense 177,870 Cash Dividends 148,500 Allowance for Doubtful Accounts 16,500 Supplies 46,200 Freight-in 66,000…arrow_forwardBenwick Company borrowed $56,000 cash on October 1, 2022, and signed a nine-month, 9% interest-bearing note payable with interest payable at maturity. Assuming that adjusting entries have not been made during the year, the amount of accrued interest payable to be reported on the December 31, 2022 balance sheet is which of the following? Group of answer choices $630. $756. $1,260. $1,890.arrow_forwardBryant Corporation was incorporated on December 1, 2018, and began operations one week later. Before closing the books for the fiscal year ended November 30, 2019, Bryant’s controller prepared the following financial statements: BRYANT CORPORATION Balance Sheet November 30, 2019 1 Assets 2 Current Assets: 3 Cash $180,000.00 4 Accounts receivable 480,000.00 5 Less: Allowance for doubtful accounts (59,000.00) 6 Inventories 430,000.00 7 Prepaid insurance 15,000.00 8 Total current assets $1,046,000.00 9 Property, plant, and equipment 426,000.00 10 Less: Accumulated depreciation (40,000.00) 11 R&D costs 120,000.00 12 Total Assets $1,552,000.00 13 Liabilities and Shareholders’ Equity 14 Current Liabilities: 15 Accounts payable and accrued expenses $592,000.00 16 Income taxes payable 168,000.00 17 Total current liabilities…arrow_forward

- Selected accounts from Han Corporation’s trial balance are as follows. Prepare a partial balance sheet listing only the Fixed Assets section. Han Corporation Abbreviated Trial Balance December 31, 2020 Account Name (Acct. #) Debit Balances Credit Balances Cash 150,000 Short-term Marketable Securities 145,000 Accounts Receivable 26,000 Inventories 90,000 Other Current Assets 10,000 Land 350,000 Buildings 300,000 Accumulated Depreciation: Buildings 40,000 Equipment 145,000 Accumulated Depreciation: Equipment 150,000 Goodwill 40,000 Other Intangible Assets 20,000arrow_forwardThe hypothetical company XYZ Inc started its operations in 2020. On December 31 2020, it had the following adjusted trial balance: Account Balance ($) Notes Payable 20,000 Wages Payable 8,000 Additional Paid In Capital 300,000 Common Stock at par value 60,000 A/P 60,000 PP&E (at cost) 110,000 Inventory 62,000 Cash 419,000 Unearned Revenues 10,000 Accumulated Depreciation 10,000 Account Receivables ? Retained Earnings 230,000 During 2021 the following transactions occurred: A dividend of $20,000 was declared during 2021. These dividends will be paid in 2022. During the year the company performed and delivered services and billed its clients for $900,000. Collections from customers were $800,000. In addition to the transactions described in items 3 above, products were shipped to the customers who paid $10,000 in advance (see December 31, 2020 balances). The selling price was $80,000…arrow_forwardBayley Company has the following trial balance below at December 31, 2020. All accounts have normal balances. Account Balance Cash $460,000 Accounts receivable (net of the Allowance for Doubtful Accounts) 352,000 Inventory at the lower of FIFO cost and net realizable value 451,000 Trading Investments 230,000 Buildings (net of accumulated depreciation) 740,000 Equipment (net of accumulated depreciation) 240,000 Land held for Future Use 305,000 Goodwill 89,000 Notes Receivable (due 2025) 91,000 Prepaid Insurance 16,000 Accounts Payable 345,000 Guaranteed Investment Certificates 50,000 Notes Payable (due in 2021) 235,000 Bonds Payable at net carrying value (due February 1, 2021) 83,000 Rent Payable 55,000 Bonds Payable at net carrying value (due December 31, 2028) 746,000 Common shares, unlimited number of shares authorized 400,000 Contributed surplus 190,000 Retained…arrow_forward

- Wright Corporation had the following permanent accounts and ending balances on December 31, 2019 (before adjusting entries): Dr. ($) Cr. ($) Cash 400,000 Equipment 1,600,000 Bonds payable 950,000 Retained earnings 300,000 Allowance for Doubtful Accounts 9,000 FV-OCI investments 600,000 Inventory 720,000 Accumulated Depreciation-Equipment 120,000 Accounts payable 560,000 Accounts receivable 320,000 Common shares 1,700,000 Accumulated OCI 30,000 Prepaid insurance 20,000 FV-NI investments 180,000 There were no transactions recorded in Allowance for Doubtful Accounts during the year. The company should recognize bad debt expenses for $7,000 at the end of 2019. The company prepaid $20,000 for one-year insurance becoming effective on April 1, 2019. The company purchased the equipment on July 1, 2017, and estimated that the…arrow_forward38 es Maps On January 1, 2021, the general ledger of ACME Fireworks includes the following account balances: Accounts Cash Accounts Receivable Allowance for Uncollectible Accounts Inventory Land Equipment Accumulated Depreciation Accounts Payable Notes Payable (6%, due April 1, 2022) Common Stock Retained Earnings Totals Saved Helparrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education