FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

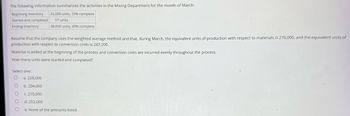

Transcribed Image Text:The following information summarizes the activities in the Mixing Department for the month of March:

Beginning inventory 24,000 units, 70% complete

Started and completed

Ending inventory

??? units

48,000 units, 40% complete

Assume that the company uses the weighted average method and that, during March, the equivalent units of production with respect to materials is 276,000, and the equivalent units of

production with respect to conversion costs is 247,200.

Material is added at the beginning of the process and conversion costs are incurred evenly throughout the process.

How many units were started and completed?

Select one:

O a. 228,000

O

b. 204,000

c. 210,000

d. 252,000

e. None of the amounts listed.

O

O

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- [The following information applies to the questions displayed below.]The first production department of Stone Incorporated reports the following for April. Units Direct Materials Conversion Percent Complete Percent Complete Beginning work in process inventory 82,000 70% 30% Units started this period 432,000 Completed and transferred out 410,000 Ending work in process inventory 104,000 85% 35% Compute the number of equivalent units of production for both direct materials and conversion for April using the weighted average method. Equivalent units of production: Weighted average method Units Direct Materials Conversion Percent Complete EUP Percent Complete EUP Beginning work in process inventory Ending work in process Totalarrow_forwardSagararrow_forwardDepartment M had 2,000 units 60% completed in process at the beginning of June, 12,000 units completed during June, and 800 units 33% completed at the end of June. What was the number of equivalent units of production for conversion costs for June if the first-in, first-out method is used to cost inventories?arrow_forward

- Hardevarrow_forwardDuring December, Krause Chemical Company had the following selected data concerning the manufacture of Xyzine, an industrial cleaner: Physical Units Production Flow Completed and transferred to the next department 100 Add: Ending work-in-process inventory Total units to account for Less: Beginning work-in-process inventory Units started during December All materials are added at the beginning of processing in this department, and conversion costs are added uniformly during the process. The beginning work-in-process inventory had $120 of raw material and $180 of conversion costs incurred. Materials added during December was $540 and conversion costs of $1,484 were incurred. Krause uses the weighted-average process-costing method. The total conversion costs assigned to units transferred to the next department in December were: Select one: 10 (40% complete as to conversion) 110 20 (60% complete as to conversion) 90 a. $1,664 b. $1,600 c. $1,513 d. $1,484arrow_forwardBistrol Corporation uses the weighted-average method in its process costing system. This month, the beginning inventory in the first processing department consisted of 800 units. The costs and percentage completion of these units in beginning inventory were: Cost Percent Complete Materials costs $ 15,700 75% Conversion costs $ 7,700 20% A total of 8,400 units were started and 7,500 units were transferred to the second processing department during the month. The following costs were incurred in the first processing department during the month: Cost Materials costs $ 186,300 Conversion costs $ 329,800 The ending inventory was 70% complete with respect to materials and 60% complete with respect to conversion costs. The cost of ending work in process inventory in the first processing department according to the company’s cost system is closest to: (Round "Cost per equivalent unit" to 3 decimal places.)arrow_forward

- Eastern Corporation uses the weighted-average method in its process costing system. This month, the beginning inventory in the first processing department consisted of 600 units. The costs and percentage completion of these units in beginning inventory were: cost Percent complete Materials costs $3,900 65% Conversion costs $10,200 35% A total of 5,700 units were started and 4,700 units were transferred to the second processing department during the month. The following costs were incurred in the first processing department during the month: Materials costs $44,800 Conversion costs $206,900 The ending inventory was 75% complete with respect to materials and 20% complete with respect to conversion costs. What are the equivalent units for conversion costs for the month in the first processing department? 5,020 6,300 4,700 320arrow_forwardThe Rolling Department of Oak Ridge Steel Company had 2,900 tons in beginning work in process inventory (70% complete) on July 1. During July, 48,700 tons were completed. The ending work in process inventory on July 31 was 2,400 tons (60% complete). What are the total equivalent units for direct materials for July if materials are added at the beginning of the process?arrow_forwardCompany A uses the weighted average method in it is process costing system. The data below pertains to operations in the first processing department for the month of February: - Beginning Inventory consisted of 400 units that were 75% complete from a material standpoint and 50% complete from a conversion standpoint. - The value of the beginning inventory consisted of $1,800 of material and $3,300 of conversion cost. - 15,000 units were started in February - Ending Inventory consisted of 1,000 units that were 80% complete from a material standpoint and 40% complete from a conversion standpoint. - The costs added in February consisted of $97,000 of material and $215,000 of conversion costs. Based upon the data provided determine the following: The EU of Material ____________________ The EU of Conversion _________________ The cost per of EU of Material __________ The cost per EU of Conversion ___________ The value of ending inventory __________arrow_forward

- Equivalent Units of Production Data for the two departments of Kimble & Pierce Company for June of the current fiscal year are as follows: Work in process, June 1 Completed and transferred to next processing department during June Work in process, June 30 Inventory in process, June 1 Started and completed in June Transferred to Winding Department in June Inventory in process, June 30 Total Drawing Department 6,600 units, 50% completed 5,000 units, 50% completed 2,600 units, 10% Broduction begins in the Drawing Department and finishes h the Winding Department. 90,400 units a. If all direct materials are placed in process at the beginning of production, determine the direct materials and conversion equivalent units of production for June for the Drawing Department. If an amount is zero, enter in "0". Drawing Department Direct Materials and onversion Equivalent Units of Production For June Inventory in process, June 1 Started and completed in June Transferred to finished goods in June…arrow_forwardMaterials are added at the beginning of the production process at Campo Company. The following information on the physical flow of units is available for the month of November. Beginning work in process (50% complete) Started in November Completed in November and transferred out Ending work in process (65% complete) Cost data for November show the following. Beginning WIP inventory Direct materials costs Conversion costs Current period costs Direct materials costs Conversion costs $ $ 27,300 49,700 360,950 1,109,550 59,000 520,000 475,000 104,000 Required: a. Compute the cost equivalent units for the conversion cost calculation assuming Campo uses the weighted-average method. b. Compute the cost per equivalent unit for materials and conversion costs for November.arrow_forwardThe Rolling Department of Jabari Steel Company had 2,300 tons in beginning work in process inventory (90% complete) on October 1. During October, 38,000 tons were completed. The ending work in process inventory on October 31 was 1,900 tons (80% complete). What are the total equivalent units for direct materials for October if materials are added at the beginning of the process? unitsarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education