Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

thumb_up100%

Required: (NOT IN EXCEL)

(a) Calculate the payback period, accounting

potential projects.

(b) Explain which of the three potential investment projects should be undertaken. Your

explanation should be based on the results of your calculations in part (a).|

(c) Critically discuss the approaches to investment appraisal used in part (a). As part of your

critical evaluation, identify what additional information might be used to improve the approach

to investment appraisal.

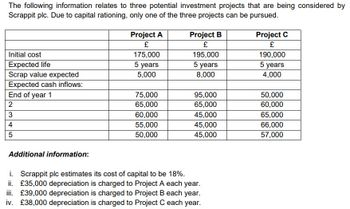

Transcribed Image Text:The following information relates to three potential investment projects that are being considered by

Scrappit plc. Due to capital rationing, only one of the three projects can be pursued.

Initial cost

Expected life

Scrap value expected

Expected cash inflows:

End of year 1

2

3

4

5

Additional information:

Project A

£

175,000

5 years

5,000

75,000

65,000

60,000

55,000

50,000

Project B

£

195,000

5 years

8,000

95,000

65,000

45,000

45,000

45,000

i. Scrappit plc estimates its cost of capital to be 18%.

ii. £35,000 depreciation is charged to Project A each year.

£39,000 depreciation is charged to Project B each year.

£38,000 depreciation is charged to Project C each year.

iii.

Project C

£

190,000

5 years

4,000

50,000

60,000

65,000

66,000

57,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Illustrate the conceptual basis upon which the practice of financial project analysis is built?arrow_forwardIf the net present value of a project is positive, the project earns a return that is Group of answer choices - equal to the required rate or return - greater than the required rate of return - equal to the accounting rate of return - greater than the accounting rate of returnarrow_forwardPlease answer with full explaination The capital budgeting decision depends in part on the A. availability of funds. B. relationships among proposed projects C. risk associated with a particular project D. all of these answers are correctarrow_forward

- Write the formula to evaluate the investment worth of projects?arrow_forwardPrepare a detailed analytical report that encompasses the following areas. Nature of investment markets, the Primary and secondary investment markets. Also brief discussion on the money market and capital market providing key differences between the two. Five stages of the investment management process providing key points that will ensure the success of the investment decision.arrow_forward1. State the criterion for accepting or rejecting independent projects under each of the following methods. - Profitability index - Discounted payback period - Accounting rate of return - Net present value - Payback period - Internal rate of returnarrow_forward

- Which of the following statements is true? O The salvage value of new equipment should not be considered when using the internal rate of return method to evaluate a project. O The internal rate of return method assumes that the cash flows generated by a project are reinvested at a rate of return that equals the company's cost of capital. O The profitability index and the internal rate of return will always result in the same preference ranking for investment projects. O In calculating the profitability index, the initial investment in the project should be reduced by any proceeds from the sale of old equipment. O None of the above statements is true.arrow_forwardDefine “the stand-alone principle” applying in evaluating projects and discuss the types of cashflows in project evolution.arrow_forwardNet Present Value Method Net present value (NPV) is one method that can be used to evaluate the financial viability of potential projects. It determines the present value of all future cash flows associated with potential projects and measures this against the cost of the project. To use net present value, a required rate of return must be defined. The required rate of return is the minimum -v acceptable rate of return that an investment must yield for it to make sense economically. Managers often choose a required rate of return above their cost of capital to ensure that the inherent uncertainties surrounding future cash flows is addressed. This can be risky, however, as it biases the process toward short-term projects. If the NPV is positive, then the project should be accepted - V ; if it is negative, then the project should be rejected V. Let's look at a net present value example using the present value of an ordinary annuity table. The company has a project with a 5-year life that…arrow_forward

- There are four main methods of investment appraisal: Accounting Rate of Return, Payback, Net Present Value and Internal Rate of Return. Critically evaluate each method and briefly discuss their advantages and disadvantagesarrow_forwardWe learn there are three primary methods used to analyze capital investment proposals. Please compare and contrast these three methods. Be sure to include strengths (benefits) and weaknesses (drawbacks) of each. Three primary methods are: Payback method Internal rate of return Net present value.arrow_forwardExplain the uses, limitations and merits of the Payback Period compared to Net Present Value in investment appraisal.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education