Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

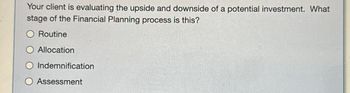

Transcribed Image Text:Your client is evaluating the upside and downside of a potential investment. What

stage of the Financial Planning process is this?

O Routine

Allocation

O Indemnification

O Assessment

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- on the topic financial plan what does UNUSUAL RESOURCES mean ? explain and give examplesarrow_forwardAnalyze prospective investment possibilities to make sure that company requirements and financial management plan are taken into account when choices are made.arrow_forwardChoose the correct option A major activity in the planning component of financial planning is: a. selecting insurance coverage b. evaluating investment alternatives.c. gaining occupational training and experience. d. allocating current resources for spending e. establishing line of creditarrow_forward

- There are four main methods of investment appraisal: Accounting Rate of Return, Payback, Net Present Value and Internal Rate of Return. Critically evaluate each method and briefly discuss their advantages and disadvantagesarrow_forwardDemonstrate and compare how return on investment and residual income are used to assess the success of investment centers.arrow_forwardDiscuss the significance of non-financial data in assessing the success of investment centers.arrow_forward

- Why is it important to identify what costs will be eliminated in the conduct of financial turnaround programarrow_forwarddescribe the stages in the financial process and discuss the advantages of a process driving approach to investment decision making. a- discuss the theory of efficient markets with specific reference to its applicability in investment decision-making. b- Discuss the issues surrounding the PE-based value of investment valuation.arrow_forwardSafety of investments comes under objective of financial management: a. Basic objectives b. Operational Objectives c. Research Objectives d. Social Objectivesarrow_forward

- Show and compare how return on investment and residual income are used to evaluate the performance of investment centers.arrow_forwardDefine the financial planning process. List the elements of a good financial plan.arrow_forwardA financial manager needs to make decisions regarding the investments that acompany needs to make and when. List five types of key investment decisions afinancial manager needs to make.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education