FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

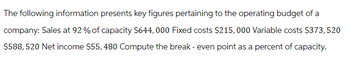

Transcribed Image Text:The following information presents key figures pertaining to the operating budget of a

company: Sales at 92 % of capacity $644,000 Fixed costs $215,000 Variable costs $373,520

$588, 520 Net income $55, 480 Compute the break-even point as a percent of capacity.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 7 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Nonearrow_forwardThe following information was drawn from the accounting records of Ashton Company. Budgeted Actual Sales $ 10,000 $ 13,000 Cost of Goods Sold (5,000 ) (6,600 ) Gross Margin 5,000 6,400 Variable Cost (2,000 ) (2,700 ) Fixed Cost (2,500 ) (1,900 ) Net Income $ 500 $ 1,800 Based on this information Ashton Company has a Multiple Choice $1,300 favorable sales variance $1,300 unfavorable sales variance $3,000 favorable sales variance $3,000 unfavorable sales variancearrow_forwardA company manufactures and sells a single product. The following data have been extracted from the current year’s budget. Sales and production (units) 5,000 Variable cost per unit $50 Fixed cost per unit $70 C/S (contribution/sales) ratio 75% The selling price per unit for next year is budgeted to increase by 8%, whereas both the variable cost per unit and the total fixed costs are expected to increase by 12%. Calculate the number of units that should be produced and sold next year in order to achieve the same profit as in the current year.arrow_forward

- Please do not give solution in image format thankuarrow_forwardThe contribution format income statement for Huerra Company for last year is given below: Total Unit Sales $ 1,008,000 $ 50.40 Variable expenses 604,800 30.24 Contribution margin 403,200 20.16 Fixed expenses 323,200 16.16 Net operating income 80,000 4.00 Income taxes @ 40% 32,000 1.60 Net income $ 48,000 $ 2.40 The company had average operating assets of $499,000 during the year. Required: 5. As a result of a more intense effort by sales people, sales are increased by 10%; operating assets remain unchanged. 6. At the beginning of the year, obsolete inventory carried on the books at a cost of $18,000 is scrapped and written off as a loss, thereby lowering net operating income. 7. At the beginning of the year, the company uses $178,000 of cash (received on accounts receivable) to repurchase some of its common stock.arrow_forwardBased on a predicted level of production and sales of 24,000 units, a company anticipates total contribution margin of $79,200, fixed costs of $24,000, and operating income of $55,200. Based on this information, the budgeted operating income for 21,000 units would be: Multiple Choice $55,200. $103,200. $45,300. $44,571. $79,200.arrow_forward

- 7. Boone Corporation's income statement for the most recent month is given below. Company Store G Store H Sales 150,000 60,000 90,000 Variable expenses 60,000 30,000 30,000 Contribution margin 90,000 30,000 60,000 Traceable fixed expenses 60,000 15,000 45,000 Division segment margin 30,000 15,000 15,000 Common fixed expenses 10,000 Net operating income $20,000 Store H sales will increase by $15,000 with no change in fixed costs. What is the new division segment margin for Store H? Group of answer choices $35,000 $25,000 $40,000 $50,000arrow_forward6. Prepare a budgeted income statement using the information shown. Sales units 84,000 22 Sales price per unit Uncollectible expense Direct material per unit Direct labor hours per unit Direct labor rate per hour Manufacturing overhead Variable sales and administration expenses per unit sold Fixed sales and administration expenses 1% $4 $ 1.50 0.8 19 $14,000 $ 2.10 $23,000 Тахes 15%* *of income before taxes %24arrow_forwardPlease do not give solution in image format thankuarrow_forward

- Required Information [The following information applies to the questions displayed below.] The fixed budget for 21,500 units of production shows sales of $559,000; variable costs of $64,500; and fixed costs of $142,000. If the company actually produces and sells 26,500 units, calculate the flexible budget Income. Sales Variable costs Contribution margin Fixed costs Income ------Flexible Budget-..... Variable Amount Total Fixed per Unit Cost $ 689,000 689,000 ------Flexible Budget at 21,500 units $ $ 0 0 26,500 units $ $ 0 0arrow_forwardA company’s static budget estimate of total shipping cost was $100,000 based on theassumption that 10,000 units would be produced and sold. The company estimatesthat 30% of this amount is variable and the remainder is fixed. What would be thetotal shipping cost if 12,000 units were produced and sold?a. $96,000b. $100,000c. $106,000d. $116,000arrow_forward← The operating budget for a certain company shows a net income of $353,920. To achieve this, the company is targeting sales of $644,000, variable costs of $283.360, and fixed costs of $6,720. Compute the break-even point in sales dollars. The break-even point in sales dollars is $ (Round to the nearest cent as needed Round att intermediate values to six decimal places as needed.)arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education