FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Please help me

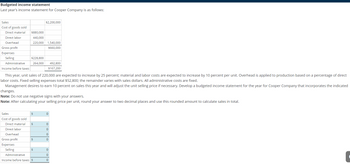

Transcribed Image Text:Budgeted income statement

Last year's income statement for Cooper Company is as follows:

Sales

Cost of goods sold

Direct material

Direct labor

Overhead

Gross profit

Expenses

Selling

Administrative

Income before taxes

Sales

Cost of goods sold

Direct material

Direct labor

$880,000

440,000

220,000 1,540,000

$660,000

$228,800

264,000

Overhead

Gross profit

Expenses

Selling

This year, unit sales of 220,000 are expected to increase by 25 percent; material and labor costs are expected to increase by 10 percent per unit. Overhead is applied to production based on a percentage of direct

labor costs. Fixed selling expenses total $52,800; the remainder varies with sales dollars. All administrative costs are fixed.

Management desires to earn 10 percent on sales this year and will adjust the unit selling price if necessary. Develop a budgeted income statement for the year for Cooper Company that incorporates the indicated

changes.

Note: Do not use negative signs with your answers.

Note: After calculating your selling price per unit, round your answer to two decimal places and use this rounded amount to calculate sales in total.

$

$

$2,200,000

$

$

492,800

$167,200

Administrative

Income before taxes $

0

0

0

0

0

0

0

0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Title 1. Complete a search of online resources for grieving individuals. Which ones might you find helpful Description 1. Complete a search of online resources for grieving individuals. Which ones might you find helpful in your work with clients? Which ones might be helpful for your clients? 2. What do you think should be the minimum level of education, training, and experience for individuals who assist bereaved individuals?arrow_forwardCan anyone explain how to do these problems step by step?arrow_forwardplease solve those problemsarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education