FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

tutor give proper solution

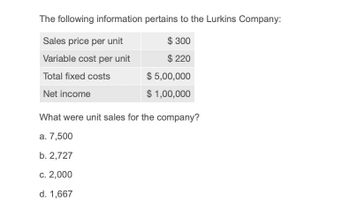

Transcribed Image Text:The following information pertains to the Lurkins Company:

Sales price per unit

$ 300

Variable cost per unit

$ 220

Total fixed costs

$ 5,00,000

$ 1,00,000

Net income

What were unit sales for the company?

a. 7,500

b. 2,727

c. 2,000

d. 1,667

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The following information is for Alex Corp: Product X: Revenue Variable Cost Product Y: Revenue Variable Cost Total fixed costs $12.00 $4.50 $25.00 $10.00 $40,500 What is the operating income, assuming actual sales total 120,000 units, and the sales mix is two units of Product X and one unit of Product Y? 1,960,000 1,240,500 1,200,000 1,159,500arrow_forward11. George Corporation has the following information for the current year: Selling price per unit Variable costs per unit 10.00 $ 6.00 $1,000.00 Fixed costs Required: Prepare a cost-volume-profit graph identifying the following items: Total fixed costs line Total variable costs line Total costs line Total revenues line Breakeven point in sales dollars Breakeven point in units Profit area Loss area А. В. С. D. E. F. G. Н. 6,000 5,000 4,000 3,000 2,000 1,000 100 200 300 400 500 Qty (# Units) 3 Dollars ($)arrow_forwardNeed helparrow_forward

- The following information pertains to the Lurkins Company Sales price per unit $ 160 Variable cost per unit $ 110 Total fixed costs $250,000 Net income $ 50,000 Unit sales for the company must have been: Select one: O a. 1,000 O b. 1,875 O c. 2,727 O d. 6,000 dirontarrow_forwardThe following income statement is provided for grante solve this questionarrow_forwardA company has assessed the profitability of its three products as shown here: Product A Product B Product C Total Sales (units) 3,000 5,000 2,000 10,000 £ £ Price 15.00 10.00 5.00 Variable costs 6.00 4.00 3.00 Divisible fixed costs 2.00 1.00 0.50 Non-divisible fixed costs 2.00 2.00 2.00 Profit/(Loss) 5.00 3.00 (0.50) As a result of this, it has been suggested that Product C should be dropped. All other things being equal what would be the financial impact of dropping Product C? A B Profit would increase by £1,000. Profit would increase by £2,000. Profit would fall by £3,000. C D Profit would fall by £4,000. £arrow_forward

- solve this account queryarrow_forwardCompute the missing amounts in the contribution income statement shown below: (Round "Per Unit" answers to 2 decimal places.) Company B 2,500 Number of units sold Sales Variable costs Contribution margin Fixed costs Income Company A Total Per unit $ 567,100 $ 107.00 360,400 $ 132,500 Total 155,000 212,500 77,500 Per unitarrow_forwardA8arrow_forward

- Complete the Table Total Total Unit Selling Total Fixed Variable Variable Price Revenue of Costs Costs Cost Output ? ? $5,000 $6,600 $2,000 ? $18,000 ? 2 $45,000 ? $94,050 ? $5 ? ? ? $75.24 $13 $10 $75 ? ? 2 ? $10,000 $60,000 Level Net Income Rate $4,000 ?$14,500 $84,600 1,800 $78,000 3,000 $18,000 ? ?-$19,500 Contribution Unit Show Transcribed Text ? ? 35% ? 38% Contribution Margin $7.50 ? $13 ? can anyone help me doing this in easiest and less confusing wayarrow_forwardThe following information is for Alex Corp: Product X: Revenue $12.00 Variable Cost $4.50 Product Y: Revenue $44.50 Variable Cost $9.50 Total fixed costs $75,000 What is the breakeven point assuming the sales mix consists of two units of Product X and one unit of Product Y?arrow_forward18. Assume the company's monthly target profit is $17,000. The dollar sales to attain that target profit is closest to:A. $387,392B. $635,069C. $671,925D. $993,313arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education