FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

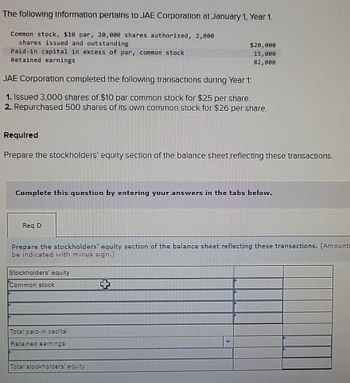

Transcribed Image Text:The following Information pertains to JAE Corporation at January 1, Year 1.

Common stock, $10 par, 20,000 shares authorized, 2,000

shares issued and outstanding

Paid-in capital in excess of par, common stock

Retained earnings

JAE Corporation completed the following transactions during Year 1:

1. Issued 3,000 shares of $10 par common stock for $25 per share.

2. Repurchased 500 shares of its own common stock for $26 per share.

Required

Prepare the stockholders' equity section of the balance sheet reflecting these transactions.

Complete this question by entering your answers in the tabs below.

Req D

$20,000

15,000

82,000

Prepare the stockholders' equity section of the balance sheet reflecting these transactions. (Amounts

be indicated with minus sign.)

Stockholders' equity

Common stock

Total paid-in capital

Retained earnings

Total stockholders' equity

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Selected transactions completed by Equinox Products Inc. during the fiscal year ended December 31, Year 1, were as follows: Record on journal page 10: Jan. 3 Issued 15,000 shares of $20 par common stock at $30, receiving cash. Feb. 15 Issued 4,000 shares of $80 par preferred 5% stock at $100, receiving cash. May 1 Issued $500,000 of 10-year, 5% bonds at 104, with interest payable semiannually. 16 Declared a quarterly dividend of $0.50 per share on common stock and $1.00 per share on preferred stock. On the date of record, 100,000 shares of common stock were outstanding, no treasury shares were held and 20,000 shares of preferred stock were outstanding. Journalize this transaction as two separate entries. 26 Paid the cash dividends declared on May 16. Jun. 1 Purchased 7,500 shares of Solstice Corp. at $40 per share plus a $150 brokerage commission. The investment is classified as an available-for-sale investment. 8 Purchased 8,000 shares of treasury common stock…arrow_forwardThe outstanding capital stock of Metlock Corporation consists of 1,900 shares of $100 par value, 9% preferred, and 5,400 shares of $50 par value common. Assuming that the company has retained earnings of $84,500, all of which is to be paid out in dividends, and that preferred dividends were not paid during the 2 years preceding the current year, state how much each class of stock should receive under each of the following conditions. a. The preferred stock is noncumulative and nonparticipating. (Round answers to O decimal places, e.g. 38,487.) $ $ Preferred b. The preferred stock is cumulative and nonparticipating. (Round answers to O decimal places, e.g. 38,487.) $ Preferred $ Preferred $ Common c. The preferred stock is cumulative and participating. (Round the rate of participation to 4 decimal places, e.g.1.4278%. Round answers to O decimal places, e.g. 38,487.) $ Common Commonarrow_forwardSierra Corporation engaged in the following share transactions in the first quarter of their fiscal year: 19 Issued 5,500 common shares for cash of $11.50 per share. 3 Sold 2,500 $1.50 Class A preferred shares for $14,000 cash to new investors. Received inventory valued at $30,000 and vehicles with market value of $22,000 for 5,200 common shares. Jul. Aug. 11 Sep. 15 Issued 3,500 $2.00 Class B preferred shares for $14.00 per share. Required 1. Journalize the transactions. Explanations are not required. 2. How much contributed capital did these transactions generate for Sierra Corporation? Requirement 1. Journalize the transactions. Explanations are not required. (Record debits first, then credits. Exclude explanations from journal entries.) July 19. Issued 5,500 common shares for cash of $11.50 per share. Journal Entry Date Jul. 19 Accounts Debit Creditarrow_forward

- The outstanding capital stock of Oriole Corporation consists of 1,900 shares of $100 par value, 8% preferred, and 4,700 shares of $50 par value common. Assuming that the company has retained earnings of $89,500, all of which is to be paid out in dividends, and that preferred dividends were not paid during the 2 years preceding the current year, state how much each class of stock should receive under each of the following conditions. a. The preferred stock is noncumulative and nonparticipating. (Round answers to O decimal places, e.g. 38,487.) Preferred b. The preferred stock is cumulative and nonparticipating. (Round answers to O decimal places, e.g. 38,487.) EA Preferred Common c. The preferred stock is cumulative and participating. (Round the rate of participation to 4 decimal places, e.g.1.4278%. Round answers to O decimal places, e.g. 38,487.) Preferred LA Common Commonarrow_forwardThe stockholders’ equity accounts of Rayburn Corporation as of January 1 appear below: Common stock, $7 par value, 400,000 shares authorized; 180,000 shares issued and outstanding $1,260,000 Paid-in capital in excess of par value 920,000 Retained earnings 513,000 During the year, the following transactions occurred: June 7 Declared a 10 percent stock dividend; market value of the common stock was $13 per share. June 28 Issued the stock dividend declared on June 7. Dec. 5 Declared a cash dividend of $1.45 per share. Dec. 26 Paid the cash dividend declared on December 5. Required a. Prepare journal entries to record the foregoing transactions. General Journal Date Description Debit Credit Jun.07 Answer Answer Answer Stock Dividends Distributable Answer Answer Answer Answer Answer Declared stock dividend. Jun.28 Answer Answer Answer Common Stock Answer Answer Issued common shares as stock dividend. Dec.05 Answer…arrow_forwardAt the start of the current year, Mundo Company’s stockholders’ equity account appeared as follows: Common stock, P15 par value; authorized 200,000 shares; issued and outstanding, 150,000 shares 2,250,000 Paid-in capital in excess of par 300,000 Retained earnings 5,000,000 Total 7,550,000 During the year, Mundo entered into the following transactions: May 1 Acquired 30,000 shares of its stock for P1,600,000. June 1 Reissued 15,000 treasury shares at P19 per share. July 1 Declared a cash dividend of P1.50 for holders on record on July 30 to be distributed on January of next year October 1 Reissued 10,000 treasury shares at P16 per share. December 1 Retired the remaining treasury shares. The total stockholders’ equity reported in the current year statement of financial position is Group of answer choices 6,395,000 6,215,000 6,192,500 6,170,000arrow_forward

- When Crossett Corporation was organized in January Year 1, it immediately issued 4,700 shares of $48 par, 8 percent, cumulative preferred stock and 12,000 shares of $8 par common stock. Its earnings history is as follows: Year 1, net loss of $12,700; Year 2, net income of $58,700; Year 3, net income of $119,700. The corporation did not pay a dividend in Year 1. b. Assume that the board of directors declares a $55,596 cash dividend at the end of Year 2 (remember that the Year 1 and Year 2 preferred dividends are due). How will the dividend be divided between the preferred and common stockholders? (Amounts to be deducted should be indicated with minus sign.)arrow_forwardThe following accounts and their balances appear in the ledger of Young Properties Inc. on November 30 of the current year: Common Stock, $15 par $168,000 Paid-In Capital in Excess of Par 13,440 Paid-In Capital from Sale of Treasury Stock 7,300 Retained Earnings 277,000 Treasury Stock 10, 450 Prepare the Stockholders' Equity section of the balance sheet as of November 30. Fifty thousand shares of common stock are authorized, and 550 shares have been reacquired.arrow_forwardShown below is information relating to the stockholders' equity of Grant Corporation at December 31, Year 1: 6.5% cumulative preferred stock, $100 par value; authorized, 18,000 shares; issued and outstanding, 9,000 shares Common stock, $4 par value; authorized, 340,000 shares; issued and outstanding, 204,000 shares Additional paid-in capital: preferred stock Additional paid-in capital: common stock Retained earnings Dividends have been declared and paid for Year 1. The average issue price per share of Grant's preferred stock was: Multiple Choice O $52.50. $100.00. $105.00. $ 900,000 $ 816,000 $ 45,000 $ 1,500,000 $ 920,000arrow_forward

- The annual report for Sneer Corporation disclosed that the company declared and paid preferred dividends in the amount of $140.000 in the current year. It also declared and paid dividends on common stock in the amount of $2.40 per share. During the current year, Sneer had 1 milion common shares authorized; 340,000 shares had been issued; and 136,000 shares were in treasury stock. The opening balance in Retained Earnings was $840,000 and Net Income for the current year was $340,000 Required: 1. Prepare journal entries to record the declaration, and payment, of dividends on (a) preferred and (b) common stock. 2. Using the information given above, prepare a statement of retained earnings for the year ended December 31 3. Prepare a journal entry to close the dividends account.arrow_forwardSweet Company’s outstanding stock consists of 1,900 shares of cumulative 5% preferred stock with a $100 par value and 10,900 shares of common stock with a $10 par value. During the first three years of operation, the corporation declared and paid the following total cash dividends. Dividends Declared & Paid Year 1 $ 2,900 Year 2 $ 6,900 Year 3 $ 36,500 The amount of dividends paid to preferred and common shareholders in year 3 is:Multiple Choice $28,500 preferred; $8,000 common. $9,500 preferred; $27,000 common. $0 preferred; $36,500 common. $18,700 preferred; $17,800 common. $36,500 preferred; $0 common.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education