FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:The following information is based on an actual annual report. Different names and years are being used.

Bond and some of its subsidiaries provide certain postretirement medical, dental, and vision care and life insurance

for retirees and their dependents and for the surviving dependents of eligible employees and retirees. Generally,

the employees become eligible for postretirement benefits if they retire no earlier than age 55 with 10 years of

service. The liability for postretirement benefits is funded through trust funds based on actuarially determined

contributions that consider the amount deductible for income tax purposes. The health care plans are contributory,

funded jointly by the companies and the participating retirees. The December 31, 20X2 and 20X1, postretirement

benefit liabilities and related data were determined using the January 1, 20X2, actuarial valuations.

Information related to the accumulated postretirement benefit obligation plan for the years 20X2 and 20X1 follows:

Years Ended December 31,

($ in thousands)

Change in benefit obligation

Benefit obligation at beginning of period

20X2

20X1

$1,236,000

41,000

82,000

4,000

(188,000)

(51,000)

$1,139,000

38,000

78,000

3,000

25,000

(47,000)

Service cost

Interest cost

Plan participants' contributions

Actuarial loss (gain)

Benefits paid

Special termination benefits

Benefit obligation at end of period

Change in plan assets

Fair value of plan assets at beginning of period

Actual return on plan assets

Employer contributions

Plan participants' contributions

Benefits paid

Fair value of plan assets at period-end

27,000

1,151,000

1,236,000

767,000

122,000

20,000

3,000

(47,000)

865,000

(371,000)

865,000

105,000

24,000

4,000

(51,000)

947,000

(204,000)

Plan assets less than benefit obligations

AOCI-net actuarial (gain) loss

AOCI-prior service cost

(555,000)

41,000

(352,000)

48,000

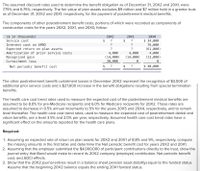

Transcribed Image Text:The assumed discount rates used to determine the benefit obligation as of December 31, 20X2 and 20X1, were

7.75% and 6.75%, respectively. The fair value of plan assets excludes $9 million and $7 million held in a grantor trust

as of December 31, 20X2 and 20X1, respectively, for the payment of postretirement medical benefits.

The components of other postretirement benefit costs, portions of which were recorded as components of

construction costs for the years 20X2, 20X1, and 20XO, follow:

($ in thousands)

20X2

20X1

20X0

$ 34,000

76,000

(61,000)

4,000

(13,000)

Service cost

?

$

?

Interest cost on APBO

?

Expected return on plan assets

Amortization of prior service costs

Recognized gain

?

?

4,000

(14,000)

30,000

4,000

(14,000)

Curtailment loss

Net periodic benefit cost

$

?

$

?

$ 40,000

The other postretirement benefit curtailment losses in December 20X2 represent the recognition of $3,000 of

additional prior service costs and a $27,000 increase in the benefit obligations resulting from special termination

benefits.

The health care cost trend rates used to measure the expected cost of the postretirement medical benefits are

assumed to be 8.0% for pre-Medicare recipients and 6.0% for Medicare recipients for 20X2. Those rates are

assumed to decrease in 0.5% annual increments to 5% for the years 20X5 and 20X4, respectively, and to remain

level thereafter. The health care cost trend rates, used to measure the expected cost of postretirement dental and

vision benefits, are a level 3.5% and 2.0% per year, respectively. Assumed health care cost trend rates have a

significant effect on the amounts reported for the health care plans.

Required:

1. Assuming an expected rate of return on plan assets for 20X2 and 20X1 of 8.8% and 9%, respectively, compute

the missing amounts in the first table and determine the Net periodic benefit cost for years 20X2 and 20X1.

2. Assuming that the employer submitted the $4,000,000 of participant contributions directly to the trust, show the

journal entry that Bond would make to record its 20X2 company (employer) contribution, Net periodic benefit

cost, and AOCI effects.

3. Show that the 20X2 journal entries result in a balance sheet pension asset (liability) equal to the funded status.

Assume that the beginning 20X2 balance equals the ending 20X1 funded status.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please help mearrow_forwardWhen James retired as managing partner of “James and Jerry, CPAs,” he was entitled to a retirement annuity of $75,000 per year until he died. Is this arrangement allowed by the California Accountancy Act? Why or why not?arrow_forwardThe factors affecting pension expense are not always obvious.As the accountant for Sunlight City, you determine the following with respect to the city's pensions in a particular year.Service cost $356,000Interest on total pension liability 400,000Actual earnings on pension plan investments 500,000Projected earnings on pension plan investments 450,000Employer contribution to the plan 180,000Benefits paid to retirees 211,000 Based on the information provided, what should the city report as its pension expense for the year? Suppose that the benefits paid to retirees were actually $251,000 rather than $211,000. How would that affect the pension expense? Explain. Suppose also that the city failed to contribute anything to the pension plan. How would that affect the pension expense to be reported on the government‐wide statements? Explain. How would it affect the pension expenditure to be reported on the statements of the general fund?arrow_forward

- What is an accurate description of vested rights concerning a pension plan? Question 5 options: a) Rights to receive accrued interest over the life of the plan b) Rights of survivorship to receive at least the interest accrued if the deceased at time of death c) Rights to at least 50% of the initial lump sum payment d) Rights to pension benefits based on employee's/firm's contributionsarrow_forwardThe trustee for the Bronson Corporation defined benefit pension plan sent a report to the CEO with the following information for the fiscal year: Beginning balance of plan assets at fair value $ 1,560,000 Actual return on plan assets $ 210,000 Employer’s contribution $ 150,000 Distributions to retirees $ 75,000 Service cost $ 125,000 Interest cost $ 156,000 Loss from changes in benefits or assumptions $ 35,000 Beginning balance of the PBO $ 1,580,000 The ending balance of plan assets is: Multiple Choice $1,770,000. $1,845,000. $1,920,000. $1,955,000.arrow_forwardThe following selected transactions occurred for a nongovernmental, not-for-profit organization. 1. Received a contribution of stock to establish an endowment fund. The income from the endowment is unrestricted. The donor had acquired the stock for $23 about 20 years earlier. Its estimated fair value when donated was $250. 2. Pledges receivable at year end were $100, all from pledges received during the year. The pledges are unrestricted and 5% of the pledges are estimated to be uncollectible. The pledges expect to be collected early next year. For questions 3-5, assume that the organization has adopted a policy that restrictions on donations made for capital purposes are met when the capital item is purchased. A cash gift of $200 was received restricted for the purchase of equipment. Equipment of $80 was purchased from the gift restricted for this purpose. Depreciation expense for the year on the equipment purchased is $10. Required: Prepare the journal entries for the above…arrow_forward

- The City of Sweetwater maintains in trust the Employees’ Retirement Fund, a single-employer defined benefit plan that provides annuity and disability benefits. The fund is financed by actuarially determined contributions from the city’s General Fund and by contributions from employees. Administration of the retirement fund is handled by General Fund employees, and the retirement fund does not bear any administrative expenses. The Statement of Fiduciary Net Position for the Employees’ Retirement Fund as of July 1, 2023, is shown here: CITY OF SWEETWATER Employees’ Retirement Fund Statement of Fiduciary Net Position As of July 1, 2023 Assets Cash $145,000 Accrued Interest Receivable 59,200 Investments, at Fair Value: Bonds 4,507,000 Common Stocks 1,313,000 Total Assets 6,024,200 Liabilities Accounts Payable and Accrued Expenses 384,000 Fiduciary Net Position Restricted for Pensions $5,640,200 During the year ended June 30, 2024, the following…arrow_forwardSunland Corporation is a privately-owned company that uses ASPE. On January 1, 2023, Sunland's financial records indicated the following information related to the company's defined benefit pension plan: Defined Benefit Obligation Pension Plan Assets $1,310,000 1,470,000 Sunland Corporation's actuary provided the following information on December 31, 2023: Current year service cost $82,000 Prior service cost, granted Jan 1, 2023 198,000 Employer contributions for the year 88,000 Benefits paid to retirees 28,000 Expected return on assets 5% Actual return on assets Discount rate 6% 5% (a) Prepare a pension worksheet for Sunland Corporation for 2023. Balance, January 1, 2023 Current Service Cost Prior Service Cost Net Interest/Finance Cost Asset Remeasurement Gain/Loss Employer Contributions to Pension Fund Benefits Paid to Retirees from Pension Fund Defined Benefit Expense Entry - 2023 Net Funding Entry Balance, December 31, 2023 Annual Defined Benefit Expense > > > > > General Journal…arrow_forwardGive me correct answer with explanationarrow_forward

- You have the following information related to Chalmers Corporation's pension plan: Use the PV of 1, PVAD of 1, and PVOA of 1 tables where appropriate. (Use the appropriate factor(s) from the tables provided.) a. Defined benefit, noncontributory pension plan. b. Plan initiation, January 1, 20X3 (no credit given for prior service). c. Retirement benefits paid at year-end with the first payment one year after retirement. d. Assumed discount rate of 7%. e. Assumed expected rate of return on plan assets of 9%. f. Annual retirement benefit equals years of credited service × 0.02 x highest salary. g. Chalmers made $1,200 contributions to the pension fund at the end of each year. h. The actual returns were $0 and $48 in 20X3 and 20X4, respectively. i. Information for Frank Bullitt, the firm's only employee, follows: January 1, 20X0 December 31, 20Y7 (15 years from plan inception) Start date Expected retirement date Expected number of payments during retirement 20 Selected actual and expected…arrow_forwardRequired information [The following information applies to the questions displayed below.] Matthew (48 at year-end) develops cutting-edge technology for SV Inc., located in Silicon Valley. In 2021, Matthew participates in SV's money purchase pension plan (a defined contribution plan) and in his company's 401(k) plan. Under the money purchase pension plan, SV contributes 15 percent of an employee's salary to a retirement account for the employee up to the amount limited by the tax code. Because it provides the money purchase pension plan, SV does not contribute to the employee's 401(k) plan. Matthew would like to maximize his contribution to his 401(k) account after SV's contribution to the money purchase plan. (Leave no answers blank. Enter zero if applicable.) Assuming Matthew's annual salary is $71,000, c-1. What amount will SV contribute to Matthew's money purchase plan? c-2. What amount can Matthew contribute to his 401(k) account in 2021? Complete this question by entering your…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education