FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

The following information is available to reconcile Branch Company’s book balance of cash with its bank statement cash balance as of July 31.

- On July 31, the company’s Cash account has a $25,640 debit balance, but its July bank statement shows a $27,003 cash balance.

- Check Number 3031 for $1,110, Check Number 3065 for $331, and Check Number 3069 for $1,878 are outstanding checks as of July 31.

- Check Number 3056 for July rent expense was correctly written and drawn for $1,280 but was erroneously entered in the accounting records as $1,270.

- The July bank statement shows the bank collected $6,000 cash on a note for Branch. Branch had not recorded this event before receiving the statement.

- The bank statement shows an $805 NSF check. The check had been received from a customer, Evan Shaw. Branch has not yet recorded this check as NSF.

- The July statement shows a $9 bank service charge. It has not yet been recorded in miscellaneous expenses because no previous notification had been received.

- Branch’s July 31 daily cash receipts of $7,132 were placed in the bank’s night depository on that date but do not appear on the July 31 bank statement.

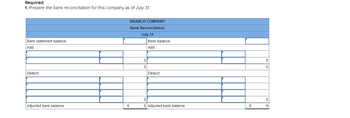

Transcribed Image Text:### Bank Reconciliation Template

#### Required:

1. Prepare the bank reconciliation for this company as of July 31.

#### BRANCH COMPANY

**Bank Reconciliation**

**July 31**

| Bank statement balance | | Book balance | |

|------------------------|-------------------------------------|-------------------------|-------------------------------------|

| | | | |

| **Add:** | | **Add:** | |

| | | | |

| 0 | | 0 | |

| 0 | | 0 | |

| **Deduct:** | | **Deduct:** | |

| | | | |

| | | | |

| 0 | | 0 | |

| 0 | | 0 | |

| **Adjusted bank balance** | $0 | **Adjusted book balance** | $0 |

#### Explanation:

This template assists in preparing the bank reconciliation for a company. Bank reconciliation is a process that explains the difference between the bank balance shown in an organization's bank statement, as supplied by the bank, and the corresponding amount shown in the organization's own accounting records at a specific point in time.

Here's how to fill out the template:

- **Bank statement balance**: Record the ending balance shown on the company’s bank statement.

- **Book balance**: Record the ending balance in the company's ledger or book as of July 31.

- **Add**: List any items that need to be added to the bank or book balance, such as deposits in transit or bank credits not yet recorded.

- **Deduct**: List any items that need to be deducted from the bank or book balance, such as outstanding checks or bank charges not yet recorded in the books.

- **Adjusted bank balance** and **Adjusted book balance**: After making the additions and subtractions, the adjusted balances should match, indicating that the bank reconciliation is complete.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- help with working for eacharrow_forwardThe Cash account of Ranger Security Systems reported a balance of $2,550 at December 31, 2025. There were outstanding checks totaling $800 and a December 31 deposit in transit of $100. The bank statement, which came from Tri Cities Bank, listed the December 31 balance of $3,910. Included in the bank balance was a collection of $670 on account from Sally Jones, a Ranger Security Systems customer who pays the bank directly. The bank statement also shows a $20 service charge and $10 of interest revenue that Ranger Security System earned on its bank balance. Prepare Ranger Security System's bank reconciliation at December 31. Ranger Security Systems Bank Reconciliation Bank: Balance, December 31, 2025 ADD: Deposit in transit December 31, 2025 LESS: Outstanding checks Adjusted bank balance, December 31, 2025 Book: Balance, December 31, 2025 ADD: LESS: Service charge Adjusted book balance, December 31, 2025arrow_forwardThe following information is available to reconcile Branch Company's book balance of cash with its bank statement cash balance as of July 31. a. On July 31, the company's Cash account has a $24,942 debit balance, but its July bank statement shows a $27,152 cash balance. b. Check Number 3031 for $1,450, Check Number 3065 for $501, and Check Number 3069 for $2,218 are outstanding checks as of July 31. c. Check Number 3056 for July rent expense was correctly written and drawn for $1,270 but was erroneously entered in the accounting records as $1,260. d. The July bank statement shows the bank collected $8,000 cash on a note for Branch. Branch had not recorded this event before receiving the statement. e. The bank statement shows an $805 NSF check. The check had been received from a customer, Evan Shaw. Branch has not yet recorded this check as NSF. f. The July statement shows a $12 bank service charge. It has not yet been recorded in miscellaneous expenses because no previous notification…arrow_forward

- Peterson Company's general ledger shows a cash balance of $7,720 on May 31. May cash receipts of $1,340, included in the general ledger balance, are placed in the night depository at the bank on May 31 and processed by the bank on June 1. The bank statement dated May 31 shows an NSF check for $190 and a service fee of $60. The bank processes all checks written by the company by May 31 and lists them on the bank statement, except for one check totaling $1,710. The bank statement shows a balance of $7,840 on May 31. Prepare a bank reconciliation to calculate the correct ending balance of cash on May 31. (Amounts to be deducted should be indicated with a minus sign.) Bank's Cash Balance Before reconciliation After reconciliation PETERSON COMPANY Bank Reconciliation May 31 SA Company's Cash Balance Before reconciliation 0 After reconciliation SA 0arrow_forwardKk196.arrow_forwardMarin Company’s general ledger indicates a cash balance of $22,340 as of September 30, 2018. Early in OctoberMarin received a bank statement indicating that during September Marin had an NSF check of $1,500 returnedto a customer and incurred service charges of $45. Marin also learned it had incorrectly recorded a checkreceived from a customer on September 15 as $500 when in fact the check was for $550. Calculate Marin’s correct September 30, 2018, cash balance.arrow_forward

- ! Required information [The following information applies to the questions displayed below.] The following information is available to reconcile Branch Company's book balance of cash with its bank statement cash balance as of July 31. a. On July 31, the company's Cash account has a $25,318 debit balance, but its July bank statement shows a $27,304 cash balance. b. Check Number 3031 for $1,360, Check Number 3065 for $456, and Check Number 3069 for $2,128 are outstanding checks as of July 31. c. Check Number 3056 for July rent expense was correctly written and drawn for $1,270 but was erroneously entered in the accounting records as $1,260. d. The July bank statement shows the bank collected $7,500 cash on a note for Branch. Branch had not recorded this event before receiving the statement. e. The bank statement shows an $805 NSF check. The check had been received from a customer, Evan Shaw. Branch has not yet recorded this check as NSF. f. The July statement shows a $11 bank service…arrow_forwardThe following information is available to reconcile Branch Company’s book balance of cash with its bank statement cash balance as of July 31. On July 31, the company’s Cash account has a $25,507 debit balance, but its July bank statement shows a $27,043 cash balance. Check No. 3031 for $1,180, Check No. 3065 for $366, and Check No. 3069 for $1,948 are outstanding checks as of July 31. Check No. 3056 for July rent expense was correctly written and drawn for $1,280 but was erroneously entered in the accounting records as $1,270. The July bank statement shows the bank collected $7,000 cash on a note for Branch. Branch had not recorded this event before receiving the statement. The bank statement shows an $805 NSF check. The check had been received from a customer, Evan Shaw. Branch has not yet recorded this check as NSF. The July statement shows a $11 bank service charge. It has not yet been recorded in miscellaneous expenses because no previous notification had been received.…arrow_forwardThe following information is available to reconcile Branch Company's book balance of cash with its bank statement cash balance as of July 31. a. On July 31, the company's Cash account has a $25,127 debit balance, but its July bank statement shows a $27,260 cash balance. b. Check Number 3031 for $1,420, Check Number 3065 for $486, and Check Number 3069 for $2,188 are outstanding checks as of July 31. c. Check Number 3056 for July rent expense was correctly written and drawn for $1,290 but was erroneously entered in the accounting records as $1,280. d. The July bank statement shows the bank collected $9,000 cash on a note for Branch. Branch had not recorded this event before receiving the statement. e. The bank statement shows an $805 NSF check. The check had been received from a customer, Evan Shaw. Branch has not yet recorded this check as NSF. f. The July statement shows a $14 bank service charge. It has not yet been recorded in miscellaneous expenses because no previous notification…arrow_forward

- The following data were accumulated for use in reconciling the bank account of Nakajima Co. for July: Cash balance according to the company's records at July 31, $49,910. Cash balance according to the bank statement at July 31, $48,250. Checks outstanding, $4,460. Deposit in transit, not recorded by bank, $6,450. A check for $590 issued in payment of an account was erroneously recorded in the check register as $950. Bank debit memo for service charges, $30. Question Content Area a. Prepare a bank reconciliation, using the format shown in Exhibit 12. Nakajima Co.Bank ReconciliationJuly 31 Cash balance according to bank statement $fill in the blank 8740c9ff3f91023_1 - Select - - Select - Adjusted balance $fill in the blank 8740c9ff3f91023_6 Cash balance according to company's records $fill in the blank 8740c9ff3f91023_7 - Select - - Select - Adjusted balance $fill in the blank 8740c9ff3f91023_12 Question Content Area b. If the…arrow_forwardRexrode Company's bank statement at January 31 showed an ending balance of $24,712.80. The unadjusted cash account balance for Rexrode is $21,245.75. The following data were gathered by Rexrode's accountant: Outstanding checks as of January 31: $4,895.44 ● NSF check from customer: $183.62 • Debit memo related to the returned deposit: $20.00 Credit memo for interest earned: $12.00 • Deposits in transit: $1,236.77 Required: a. Prepare a bank reconciliation for Rexrode Company at January 31. b. Indicate how each of the required adjusting entries impact the financial statements. . • Complete this question by entering your answers in the tabs below. Required A Required B Indicate how each of the required adjusting entries impact the financial statements. Note: Enter any decreases to account balances and cash outflows with a minus sign. Leave cells blank if no input is needed. Round your answers to 2 decimal places. Item Outstanding checks NSF check from a customer Debit memo related to the…arrow_forwardAt August 31, Sheridan Company has a cash balance per books of $7,750 and the following additional data from the bank statement: charge for printing Sheridan Company checks $58, interest earned on checking account balance $41, and outstanding checks $820.Determine the adjusted cash balance per books at August 31. Adjusted cash balance per books $arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education