FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

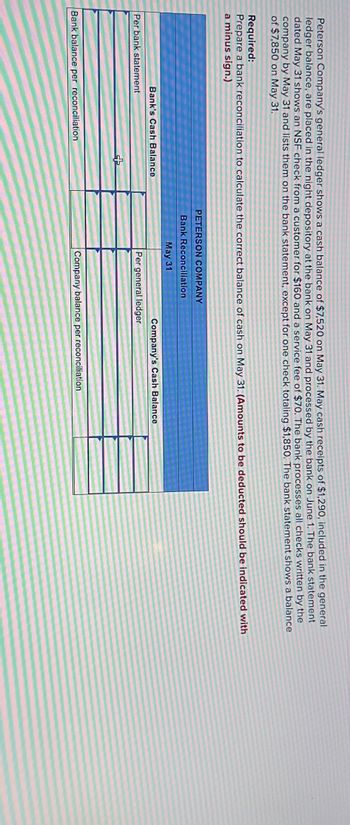

Transcribed Image Text:Peterson Company's general ledger shows a cash balance of $7,520 on May 31. May cash receipts of $1,290, included in the general

ledger balance, are placed in the night depository at the bank on May 31 and processed by the bank on June 1. The bank statement

dated May 31 shows an NSF check from a customer for $160 and a service fee of $70. The bank processes all checks written by the

company by May 31 and lists them on the bank statement, except for one check totaling $1,850. The bank statement shows a balance

of $7,850 on May 31.

Required:

Prepare a bank reconciliation to calculate the correct balance of cash on May 31. (Amounts to be deducted should be indicated with

a minus sign.)

Bank's Cash Balance

Per bank statement

Bank balance per reconciliation

PETERSON COMPANY

Bank Reconciliation

May 31

Company's Cash Balance

Per general ledger

Company balance per reconciliation

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The following data were accumulated for use in reconciling the bank account for Mathers Co. For July: 1. Cash balance according to the company's record at July 31, $25,470. 2. Cash balance according to the bank statement at July 31, $26,890. 3. Checks outstanding, $5,170. 4. Deposit in transit, not record it by bank, $4,150. 5.a check for a $270 and payment of an account was erroneously recorded in the check register at $720. 6. Bank debit memo for service charges, $50. Journalize the entries that should be made up by the company, part (a )error and part ( b) service charge A. July 31 _______ _______ B. July 31 ______ _____arrow_forwardWright Company's cash account shows a $30,100 deblt balance and its bank statement shows $28,400 on deposit at the close of business on May 31. a. The May 31 bank statement lists $230 in bank service charges; the company has not yet recorded the cost of these services. b. Outstanding checks as of May 31 total $6,900. c. May 31 cash receipts of $7,500 were placed in the bank's night depository after banking hours and were not recorded on the May 31 bank statement. d. In reviewing the bank statement, a $530 check written by Smith Company was mistakenly drawn against Wright's account. e. The bank statement shows a $340 NSF check from a customer; the company has not yet recorded this NSF check. Prepare its bank reconciliation using the above information. WRIGHT COMPANY Bank Reconciliation May 31 Bank statement balance Book balance Add: Add: Deduct: Deduct: Adjusted bank balance Adjusted book balance < Prev 5 of 5 Next ...arrow_forwardSal's Surf Shop deposits all receipts in the bank and makes all payments by check. On July 31 the cash account had a balance of $6,105.42. The bank statement on July 31 reported a balance of $4,146.46. Upon comparing the bank statement to the books, the following items were found.arrow_forward

- On March 31, Sigment Company had a $44,547.60 checkbook balance. The bank statement showed a balance on that date of $46,574.10, and the following information on the bank statement had not been entered in the checkbook: $24.75 Service charge $68.85 NSF charge A review of the company’s bank statement and checkbook showed a deposit in transit of $3,919.44 and outstanding checks as follows: Number 234 for $281.34 Number 236 for $445.12 Number 237 for $2,901.60 Number 238 for $2,411.48 Prepare a bank reconciliation in proper format. List and total the outstanding checks at the bottom of the bank reconciliation.arrow_forwardOn April 30, the bank reconciliation of Metlock, Inc. shows three outstanding checks: no. 254, $630; no. 255, $870; and no. 257, $500. The May bank statement and the May cash payments are shown as follows. Date 5/4 5/2 5/17 5/12 5/20 5/29 5/30 Date 5/2 Bank Statement 5/5 5/10 5/15 5/22 5/24 5/29 Checks Paid Check No. 254 257 258 259 261 263 262 Cash Payments Checks Issued 258 259 260 261 262 263 264 Amount Check No. Amount $630 Check No. " 500 289. 215 590 460 770 $289 215 980 590 770 460 Using Step 2 in the reconciliation procedure, list the outstanding checks at May 31. 540 Total $ Amountarrow_forwardRefer to the Information given below: a. The August 31 balance shown on the bank statement is $9,050. b. There is a deposit in transit of $1,300 at August 31. c. Outstanding checks at August 31 totaled $1,620. d. Interest credited to the account during August but not recorded on the company's books amounted to $68. e. A bank charge of $44 for checks was made to the account during August. Although the company was expecting a charge, the amount was not known until the bank statement arrived. f. In the process of reviewing the canceled checks, it was determined that a check issued to a supplier in payment of accounts payable of $142 had been recorded as a disbursement of $412 g. The August 31 balance in the general ledger Cash account, before reconciliation, is $8,436. Required: Prepare a bank reconciliation as of August 31 from the above Information. Balance per bank Add: Deduct: Reconciled balance Bank Reconciliation August 31 Balance per books Add: Deduct: Reconciled balancearrow_forward

- Franklin Company deposts all cash receipts on the day they are received and makes all cash payments by check. At the dove of business on August 31. as Cash account shows a debit balance of $13362 Franke's August tiank statement shows a $14.237 balance in the bank Determine the adjusted cash balance using the following information Deposit in transit Outstanding checks Bank service fees, not yet recorded by company The bank collected on a note receivable, not yet recorded by the company The adjusted cash balance should be O O O C $1873 $10.333 SHUBEY saja Help Seve&ait $4,500 $3,000 $50 $1,725arrow_forwardThe following data were accumulated for use in reconciling the bank account of Mathers Co. for July: Cash balance according to the company's records at July 31 $19,850. Cash balance according to the bank statement at July 31, $20,970. Checks outstanding, $4,030. Deposit in transit, not recorded by bank, $3,240. A check for $590 in payment of an account was erroneously recorded in the check register as $950. Bank debit memo for service charges, $30. a. Prepare a bank reconciliation, using the format shown in Exhibit 14. Mathers Co. Bank Reconciliation July 31 Cash balance according to bank statement $ Adjusted balance $ Cash balance according to company's records $ Adjusted balance $ b. If the balance sheet is prepared for Mathers Co. on July 31, what amount should be reported for cash?$ c. Must a bank reconciliation always balance (reconcile)?arrow_forwardThe following data were accumulated for use in reconciling the bank account of Mathers Co. for July: Cash balance according to the company's records at July 31 $14,720. Cash balance according to the bank statement at July 31, $15,730. Checks outstanding, $2,990. Deposit in transit, not recorded by bank, $2,400. A check for $270 in payment of an account was erroneously recorded in the check register as $720. Bank debit memo for service charges, $30. a. Prepare a bank reconciliation, using the format shown inarrow_forward

- Peterson Company's general ledger shows a cash balance of $7,720 on May 31. May cash receipts of $1,340, included in the general ledger balance, are placed in the night depository at the bank on May 31 and processed by the bank on June 1. The bank statement dated May 31 shows an NSF check for $190 and a service fee of $60. The bank processes all checks written by the company by May 31 and lists them on the bank statement, except for one check totaling $1,710. The bank statement shows a balance of $7,840 on May 31. Prepare a bank reconciliation to calculate the correct ending balance of cash on May 31. (Amounts to be deducted should be indicated with a minus sign.) Bank's Cash Balance Before reconciliation After reconciliation PETERSON COMPANY Bank Reconciliation May 31 SA Company's Cash Balance Before reconciliation 0 After reconciliation SA 0arrow_forwardHathaway Company’s general ledger shows a cash account balance of $23,290 on July 31, 2024. Cash sales of $1,839 for the last three days of the month have not yet been deposited. The bank statement dated July 31 shows bank service fees of $51 and an NSF check from a customer of $310. The bank processes all checks written by the company by July 31 and lists them on the bank statement, except for one check totaling $1,470. The bank statement shows a balance of $22,560 on July 31. Required: 1. Prepare a bank reconciliation to calculate the correct balance of cash on July 31, 2024. 2. Record the necessary entry(ies) to adjust the balance for cash.arrow_forwardOscar Myer receives the March bank statement for Jam Enterprises on April 11, 2018. The March 31 bank statement shows an ending cash balance of $67,566. A comparison of the bank statement with the general ledger Cash account, No. 101, reveals the following. O. Myer notices that the bank erroneously cleared a $500 check against his account in March that he did not issue. The check documentation included with the bank statement shows that this check was actually issued by a company named Jam Systems. On March 25, the bank lists a $50 charge for the safety deposit box expense that Jam Enterprises agreed to rent from the bank beginning March 25. On March 26, the bank lists a $102 charge for printed checks that Jam Enterprises ordered from the bank. On March 31, the bank lists $33 interest earned on Jam Enterprises' checking account for the month of March. O. Myer notices that the check he issued for $128 on March 31, 2018, has not yet cleared the bank. O. Myer verifies that all deposits…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education