FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

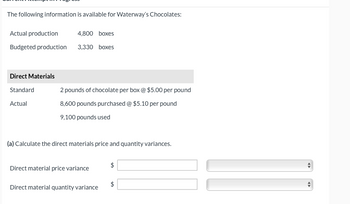

Transcribed Image Text:The following information is available for Waterway's Chocolates:

Actual production

4,800 boxes

Budgeted production 3,330 boxes

Direct Materials

Standard

Actual

2 pounds of chocolate per box @ $5.00 per pound

8,600 pounds purchased @ $5.10 per pound

9,100 pounds used

(a) Calculate the direct materials price and quantity variances.

Direct material price variance

Direct material quantity variance

$

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Standard Direct Materials Cost per Unit Crazy Delicious Inc. produces chocolate bars. The primary materials used in producing chocolate bars are cocoa, sugar, and milk. The standard costs for a batch of chocolate (2,143 bars) are as follows: Ingredient Quantity Price Cocoa 510 lbs. $0.40 per lb. Sugar 150 lbs. $0.60 per lb. Milk 120 gal. $1.30 per gal. Determine the standard direct materials cost per bar of chocolate. If required, round to the nearest cent.$per bararrow_forwardThe following information is available for Swifty's Chocolates: Actual production 2,550 boxes Budgeted production 3,600 boxes Direct Materials Standard Actual 4 pounds of chocolate per box @ $6.00 per pound 8,900 pounds purchased @ $6.10 per pound 9,400 pounds used (a) Calculate the direct materials price and quantity variances. Direct material price variance Direct material quantity variance $ $arrow_forwardStandard Amount per Case Dark Chocolate Light Chocolate Standard Price per Pound Cocoa 12 lbs. 8 lbs. $7.25 Sugar 10 lbs. 14 lbs. 1.40 Standard labor time 0.50 hr. 0.60 hr. Dark Chocolate Light Chocolate Planned production 4,700 cases 11,000 cases Standard labor rate $15.50 per hr. $15.50 per hr. I Love My Chocolate Company does not expect there to be any beginning or ending inventories of cocoa or sugar. At the end of the budget year, I Love My Chocolate Company had the following actual results: Dark Chocolate Light Chocolate Actual production (cases) 5,000 10,000 Actual Price per Pound Actual Pounds Purchased and Used Cocoa $7.33 140,300 Sugar 1.35 188,000 Actual Labor Rate Actual Labor Hours Used Dark chocolate $15.25 per hr. 2,360 Light chocolate 15.80 per hr. 6,120 this is all the information i have and i need help calulating the direct labor time variancearrow_forward

- Activity Cost Driver Chosen asAllocation Base Conversion Cost Per Unit ofAllocation Base Materials handling Number of parts $1.00 Machining Machine hours 60.00 Packaging Number of finished units 2.00 Each windsock requires three parts and spends five minutes in the machining department. The total cost of direct materials and direct labor is $3.50 per windsock. Gale produces 20,000 windsocks each year and sells them at 140% of cost. The selling price per windsock is: Question 8 options: $13.50. $18.90. $16.10. $88.20.arrow_forwardDon't give answer in image formatarrow_forwardStandard Direct Materials Cost per Unit Roanoke Company produces chocolate bars. The primary materials used in producing chocolate bars are cocoa, sugar, and milk. The standard costs for a batch of chocolate (1,730 bars) are as follows: Ingredient Quantity Price Cocoa 570 lbs. $0.30 per lb. Sugar 180 lbs. $0.60 per lb. Milk 150 gal. $1.60 per gal. Determine the standard direct materials cost per bar of chocolate. If required, round to the nearest cent.arrow_forward

- ll.2arrow_forwardStandard Direct Materials Cost per Unit Crazy Delicious Inc. produces chocolate bars. The primary materials used in producing chocolate bars are cocoa, sugar, and milk. The standard costs for a batch of chocolate (2,800 bars) are as follows: Ingredient Quantity Price Cocoa 540 lbs. $0.30 per lb. Sugar 150 lbs. $0.60 per lb. Milk 120 gal. $1.40 per gal. Determine the standard direct materials cost per bar of chocolate. If required, round to the nearest cent.$per bararrow_forwardStandard Direct Materials Cost per Unit Roanoke Company produces chocolate bars. The primary materials used in producing chocolate bars are cocoa, sugar, and milk. The standard costs for a batch of chocolate (2,600 bars) are as follows: Ingredient Quantity Price Cocoa 480 Ibs. $0.30 per Ib. Sugar 150 Ibs. $0.60 per Ib. Milk 120 gal. $1.30 per gal. Determine the standard direct materials cost per bar of chocolate. If required, round to the nearest cent. per bararrow_forward

- f2 Four grams of musk oil are required for each bottle of Mink Caress, a very popular perfume made by a small company in western Siberia. The cost of the musk oil is $1.70 per gram. Budgeted production of Mink Caress is given below by quarters for Year 2 and for the first quarter of Year 3: Units of raw materials needed per unit of finished goods Units of raw materials needed to meet production Total units of raw materials needed Units of raw materials to be purchased Unit cost of raw materials Cost of raw materials to purchased Required: Prepare a direct materials budget for musk oil, by quarter and in total, for Year 2. f3 First 92,000 Budgeted production, in bottles. The inventory of musk oil at the end of a quarter must be equal to 20% of the following quarter's production needs. Some 73,600 grams of musk oil will be on hand to start the first quarter of Year 2. f4 fs Second 122,000 First Mink Caress Direct Materials Budget - Year 2 f6 Year 2 Q Search 4- Third 182,000 Second f7…arrow_forwardStandard Direct Materials Cost per Unitarrow_forwardOrdering and Carrying Costs Ottis, Inc., uses 683,910 plastic housing units each year in its production of paper shredders. The cost of placing an order is $29. The cost of holding one unit of inventory for one year is $20. Currently, Ottis places 149 orders of 4,590 plastic housing units per year. Required: 1. Compute the annual ordering cost. $fill in the blank 1 2. Compute the annual carrying cost. $fill in the blank 2 3. Compute the cost of Ottis’s current inventory policy. $fill in the blank 3 Is this the minimum cost?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education