FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

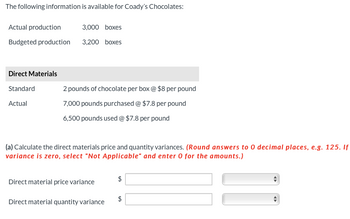

Transcribed Image Text:The following information is available for Coady's Chocolates:

Actual production

3,000 boxes

Budgeted production 3,200 boxes

Direct Materials

Standard

2 pounds of chocolate per box @ $8 per pound

Actual

7,000 pounds purchased @ $7.8 per pound

6,500 pounds used @ $7.8 per pound

(a) Calculate the direct materials price and quantity variances. (Round answers to 0 decimal places, e.g. 125. If

variance is zero, select "Not Applicable" and enter 0 for the amounts.)

Direct material price variance

$

Direct material quantity variance

◄►

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Subject: acountingarrow_forward"Required 2" looks the save as "Required 1" (pictured).arrow_forwardLucia Company has set the following standard cost per unit for direct materials and direct labor. Direct materials (16 pounds @ $4 per pound) $ 64 Direct labor (3 hours @ $15 per hour) 45 During May the company incurred the following actual costs to produce 8,000 units. Direct materials (131,100 pounds @ $3.80 per pound). Direct labor (27,300 hours @ $15.10 per hour) AR-Actual Rate SR Standard Rate AQ-Actual Quantity SQ = Standard Quantity AP Actual Price SP- Standard Price (1) Compute the direct materials price and quantity variances. (2) Compute the direct labor rate variance and the direct labor efficiency variance. Complete this question by entering your answers in the tabs below. Required 1 $ 498,180 412,230 Required 2arrow_forward

- Please do not give solution in image format thankuarrow_forwardNumber 1 fill in tablearrow_forwardPerfect Pet Collar Company makes custom leather pet collars. The company expects each collar to require 2.35 feet of leather and predicts leather will cost $4.20 per foot. Suppose Perfect Ret made 85 collars during February. For these 85 collars, the company actually averaged 2.50 feet of leather per collar and paid $3.80 per foot. Required: 1. Calculate the standard direct materials cost per unit. 2. Without performing any calculations, determine whether the direct materials price variance will be favorable or unfavorable. 3. Without performing any calculations, determine whether the direct materials quantity variance will be favorable or unfavorable. 6. Calculate the direct materials price and quantity variances. Complete this question by entering your answers in the tabs below. Req 1 Req 2 and 3 Req 6 Calculate the standard direct materials cost per unit. Note: Round your answer to 2 decimal places. Standard Direct Materials per Collar Reg 2 and 3>arrow_forward

- Required information [The following information applies to the questions displayed below.] Antuan Company set the following standard costs per unit for its product. Direct materials (3.0 pounds @ $4.00 per pound) Direct labor (1.8 hours @ $12.00 per hour) $ 12.00 21.60 33.30 Overhead (1.8 hours @ $18.50 per hour) Standard cost per unit $ 66.90 The standard overhead rate ($18.50 per direct labor hour) is based on a predicted activity level of 75% of the factory's capacity of 20,000 units per month. Following are the company's budgeted overhead costs per month at the 75% capacity level. Overhead Budget (75% Capacity) Variable overhead costs Indirect materials $ 15,000 Indirect labor 75,000 Power 15,000 Maintenance 30,000 135,000 Total variable overhead costs Fixed overhead costs Depreciation-Building 24,000 70,000 Depreciation-Machinery Taxes and insurance 16,000 Supervisory salaries 254,500 Total fixed overhead costs 364,500arrow_forwardCan I get some help with this practice quesiton this is all the information I recieved regarding the question Thank youarrow_forward5arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education