Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

?

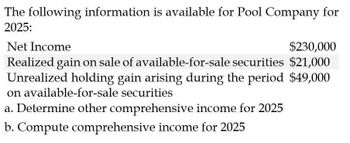

Transcribed Image Text:The following information is available for Pool Company for

2025:

Net Income

$230,000

Realized gain on sale of available-for-sale securities $21,000

Unrealized holding gain arising during the period $49,000

on available-for-sale securities

a. Determine other comprehensive income for 2025

b. Compute comprehensive income for 2025

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Cullumber Corporation reported the following information for 2021: Sales revenue Cost of goods sold Operating expenses Unrealized holding gain on available-for-sale securities Cash dividends received on the securities $1034000 For 2021, Cullumber would report comprehensive income of $241956. $237820. $200596. O $41360. 723800 113740 41360 4136arrow_forwardSandhill Co. reported the following information for 2020: Sales revenue $2520000 Cost of goods sold 1748000 Operating expenses 282000 Unrealized holding gain on available-for-sale securities 85700 Cash dividends received on the securities 9200 For 2020, Sandhill would report comprehensive income of A.$85700. B.$499200. C.$575700. D.$584900.arrow_forwardSonic Corporation recorded current assets of $345,200 and current liabilities of $318,650 for year 2020. Compute for Sonic's working capital for the year. Select one: a. $663,850 b. $26,550 O C. 92% d. 1.08arrow_forward

- Microsoft’s 2020 10-K includes the following information relevant to its available-for-sale investments in Note 17—Accumulated Other Comprehensive Income (Loss): Year Ended June 30, 2020 2019 2018 Balance, beginning of period $1,488 $(850) $1,825 Unrealized gains (losses), net of tax of $1,057, $616, and $(427) 3,987 2,331 (1,146) Reclassification adjustments for (gains) losses included in other income (expense), net 4 93 (2,309) Tax expense (benefit) included in provision for income taxes (1) (19) 738 Cumulative effect of accounting changes 0 (67) 42 Balance, end of period $5,478 $1,488 $(850) Answer the following questions by referring to the disclosure note above: Prepare a journal entry to record unrealized gains for 2020. (Hint: $3,987 is net of tax effects, so you will need to add back tax effects to show the amount of pretax unrealized gain.) Prepare a journal entry to record Microsoft’s reclassification…arrow_forwardSunland Company reported the following information for 2025: Sales revenue Cost of goods sold Operating expenses Unrealized holding gain on available-for-sale debt securities Cash dividends received on the securities O $490300. O $404600. $480700. $2420000 O $85700. 1754000 271000 85700 For 2025, Sunland would report comprehensive income (ignoring tax effects) of 9600arrow_forward1. The following information is from Direct to You Corp.’s (DYC) financial records for its year ended December 31, 2020: Select statement of financial position information: 2020 2019 Investments in financial assets (at fair value through profit or loss [FVPL]) 12,000 10,000 Inventory 575,000 498,000 Property, plant, and equipment (PPE) 1,984,000 1,396,000 Less: accumulated depreciation (650,400) (487,000) Copyright 126,000 135,000 Patents 564,000 417,000 Select statement of comprehensive income information: Depreciation of property, plant, and equipment (334,400) Amortization of patents (65,000) Interest expense (75,000) Impairment loss — copyright (9,000) Gain on sale of PPE 23,000 Additional information: PPE that originally cost $570,000 was sold during the year. 100,000 common shares were issued in 2020 to acquire $450,000 of property, plant, and equipment. DYC is subject to IFRS. What amount of net cash used…arrow_forward

- Godoarrow_forwardSome selected financial statement items belonging to MNO Company are given in the table below. According to this information, which of the following is Return on Assets (ROA) in 2021? Inventory 12,500Total Assets in 2021 110,000Current Liabilities 40,000Total Assets in 2020 90,000Net Profit 12,000Shareholders' Equity 65,000 Select one:a. 0.12b. 0.10c. 0.18d. 0.13arrow_forwardOn January 1, 2025, Artic Inc. had the following balance sheet: Cash Total Debt investments (available-for-sale) 363,000 $434,000 Assets Interest revenue ARTIC INC. BALANCE SHEET AS OF JANUARY 1, 2025 ARTIC INC. INCOME STATEMENT FOR THE YEAR ENDED DECEMBER 31, 2025 $11,000 Gain on sale of investments Net income $71,000 Common stock (a) The accumulated other comprehensive income related to unrealized holding gains on available-for-sale debt securities. The fair value of Artic Inc.'s available-for-sale debt securities at December 31, 2025, was $310,000; its cost was $277,000. No debt securities were purchased during the year. Artic Inc.'s income statement for 2025 was as follows: (Ignore income taxes.) 28,000 $39,000 (Assume all transactions during the year were for cash.) Accumulated other comprehensive income Total Equity $389,000 Debit 45,000 $434,000 Prepare the journal entry to record the sale of the available-for-sale debt securities in 2025. (Credit account titles are…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...

Finance

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:Cengage Learning

Fundamentals Of Financial Management, Concise Edi...

Finance

ISBN:9781337902571

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College