FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:15)

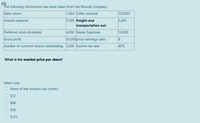

The following information has been taken from the Muscat Company:

Sales return

1,450 Other revenue

130,000

Interest expense

5,000

5,000 freight and

transportation out

Preferred stock dividends

4,000 Repair Expenses

10,000

Gross profit

number of common shares outstanding 2,000 income tax rate

50,000price-earnings ratio

40%

What is the market price per share?

Select one:

O None of the answers are correct

O $72

O $68

O $56

O $125

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The following information was drawn from the accounting records of Jones Company. Net sales $276,923 Net income 90,000 720,000 Average total assets Average total liabilities Average total stockholders' equity 500,000 300,000 Based on this information, the company's net margin (also known as return on sales) is Multiple Choice 12.5%. 18.0% 32.5%. MacBook Air 80 888 DI DD F2 F3 F4 F5 F6 F7 F8 F9 #3 $ % & * 2 3 4 6. 7 8 9 W E Yarrow_forwardThe following information was drawn from the accounting records of Jones Company. Net sales Net income Average total assets Average total liabilities Average total stockholders' equity $ 368,000 58,000 516,000 308,000 208,000 Based on this information, the company's net margin (also known as return on sales) is: Multiple Choice 11.2%. 18.8% 15.8%. None of the choices is correct.arrow_forwardProvide Answer for this Both questionarrow_forward

- The Market Cap of a company with 1,700,000 shares outstanding and a market price per share of $25 is indeterminable $42.5 MM 7 MM divided by 25 or 68,000 $52.5 MMarrow_forwardI already have the first 4 down working capital value: $2,790,000 current ratio value: 4.1 quick ratio: 2.5 accounts receivable turnover: 16 if someone can please please pleassseee help me with 5-18 please. I have been so stressed with this question and i just need answer and explanation pleasearrow_forwardConsider the financial statements for the REIT given below. Assume that the net revenue includes a loss of $4,000,000 on an asset sale. This REIT has issued 1,000,000 shares. Similar REITs are trading at FFO multiples of 10x. What valuation (share price) does this information imply for the REIT? Net Revenue Less: Less: Interest expense Net income O 49.2 O 129.2 O 95.2 89.2 Operating expenses Depreciation and amortization Income from operations $20,000,000 9,800,000 4,400,000 5,800,000 $ 1,280,000 $ 4,520,000arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education