FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

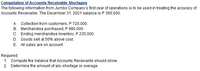

Transcribed Image Text:Computation of Accounts Receivable Shortages

The following information from Jumbo Company's first year of operations is to be used in treating the accuracy of

Accounts Receivable. The December 31, 2021 balance is P 360,000.

A. Collection from customers, P 720,000.

B. Merchandise purchased, P 980,000

C. Ending merchandise inventory, P 235,000.

D. Goods sell at 50% above cost.

E. All sales are on account.

Required:

1. Compute the balance that Accounts Receivable should show.

2. Determine the amount of any shortage or overage.

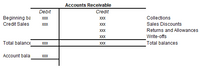

Transcribed Image Text:Accounts Receivable

Debit

Credit

Beginning ba

Credit Sales

XXX

XXX

Collections

XXX

XXX

Sales Discounts

XXX

Returns and Allowances

Write-offs

Total balances

XXX

Total balance

XXX

XXX

Account bala

XXX

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The Phillips Company gathered the following information pertaining to its year ended December 31, 2020 prior to any adjustments: Net Sales for the Year $780,000 Accounts Receivable, 12/31 165,000 Allowance for Uncollectible Accounts, 12/31 2,200 Debit Assume that Phillips uses the percentage of outstanding accounts receivable method for uncollectible amounts. An aging of accounts receivable indicates that $9,550 will be uncollectible. Phillips will report the following amounts in its 2020 financial statements: Select one: a. Bad debts expense $11,750; Net accounts receivable $155,450 b. Bad debts expense $9,550; Net accounts receivable $155,450 c. Bad debts expense $9,550; Net accounts receivable $157,650 d. Bad debts expense $1,750; Net accounts receivable $157,650 e. Bad debts expense $7,350; Net accounts receivable $157,650arrow_forwardThe following selected transactions were taken from the records of Rustic Tables Company for the year ending December 31: June 8. Wrote off account of Kathy Quantel, $8,150. Aug. 14. Received $5,790 as partial payment on the $14,590 account of Rosalie Oakes. Wrote off the remaining balance as uncollectible. Oct. 16. Received the $8,150 from Kathy Quantel, whose account had been written off on June 8. Reinstated the account and recorded the cash receipt. Dec. 31. Wrote off the following accounts as uncollectible (record as one journal entry): Wade Dolan $2,360 Greg Gagne 1,470 Amber Kisko 5,620 Shannon Poole 3,260 Niki Spence 900 Dec. 31. If necessary, record the year-end adjusting entry for uncollectible accounts. If no entry is required, select "No entry" and leave the amount boxes blank. If an amount box does not require an entry, leave it blank. a. Journalize the transactions under the direct write-off method. June 8 Bad Debt Expense Accounts Receivable-Kathy Quantel Aug. 14 Cash…arrow_forwardBlossom Company has a balance in its Accounts Receivable control account of $11,300 on January 1, 2022. The subsidiary ledger contains three accounts: Bixler Company, balance $4,200: Cuddyer Company, balance $2,200, and Freeze Company. During January the following receivable-related transactions occurred. Bixler Company Cuddyer Company Freeze Company (a) Credit Sales Collections $9,000 $7,900 2.600 8.800 7.100 8.500 Returns $0 3.000 Balance in the Freeze Company subsidiary account S 0 What is the January 1 balance in the Freeze Company subsidiary account?arrow_forward

- Below are amounts (in millions) from three companies' annual reports. WalCo TarMart CostGet Required: Beginning Accounts Receivable $1,805 6,116 619 Ending Accounts Receivable $2,752 6,644 655 Net Sales $321,427 66,878 67,963 1. Calculate the receivables turnover ratio and the average collection period for WalCo, TarMart and CostGet. 2. Which company appears most efficient in collecting cash from sales?arrow_forwardBelow are amounts (in millions) from three companies' annual reports. Beginning Accounts Ending Accounts Receivable $2,722 6,494 625 WalCo TarMart CostGet Receivable $1,775 5,966 589 Net Sales $318,427 63,878 64,963 Required: 1. Calculate the receivables turnover ratio and the average collection period for WalCo, TarMart and CostGet. 2. Which company appears most efficient in collecting cash from sales?arrow_forwardDuring the year ended December 31, 2021, Kelly's Camera Shop had sales revenue of $120,000, of which $60,000 was on credit. At the start of 2021, Accounts Receivable showed a $12,000 debit balance and the Allowance for Doubtful Accounts showed a $500 credit balance. Collections of accounts receivable during 2021 amounted to $58,000. Data during 2021 follow: a. On December 10, a customer balance of $1,000 from a prior year was determined to be uncollectible, so it was written off. b. On December 31, a decision was made to continue the accounting policy of basing estimated bad debt losses on 2 percent of credit sales for the year. Required: 1. Give the required journal entries for the two events in December. 2-a. Show how the amounts related to Bad Debt Expense would be reported on the income statement. 2-b. Show how the amounts related to Accounts Receivable would be reported on the balance sheet. 3. On the basis of the data available, does the 2 percent rate appear to be reasonable?arrow_forward

- Haresharrow_forwardThe following information is available for Market, Incorporated and Supply, Incorporated at December 31. Accounts Market, Incorporated Supply, Incorporated Accounts receivable $59,800 $77,800 Allowance for doubtful accounts 2,548 2,956 Sales revenue 616,960 907,100 Required What is the accounts receivable turnover for each of the companies? What is the average days to collect the receivables? Assuming both companies use the percent of receivables allowance method, what is the estimated percentage of uncollectible accounts for each company? What is the accounts receivable turnover for each of the companies? (Round your answers to 1 decimal place.) Company Accounts Receivable Turnover Market times Supply times What is the average days to collect the receivables? (Use 365 days in a year. Do not round intermediate calculations. Round your answers to the nearest whole number.)…arrow_forwardPresented below is information for Vaughn Company. 1. Beginning-of-the-year Accounts Receivable balance was $24,900. 2. Net sales (all on account) for the year were $105,300. Vaughn does not offer cash discounts. 3. Collections on accounts receivable during the year were $84,300. All Boo (a) Prepare (summary) journal entries to record the items noted above. (If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually.) No. Account Titles and Explanation 1. Debit Credit 2. 3.arrow_forward

- The following data were selected from the records of Sykes Company for the year ended December 31, current year. Balances January 1, current year Accounts receivable (various customers) Allowance for doubtful accounts $121,000 5,000 In the following order, except for cash sales, the company sold merchandise and made collections on credit terms 5/10, n/30 (assume a unit sales price of $600 in all transactions). Transactions during current year: a. Sold merchandise for cash, $260,000. b. Sold merchandise to R. Smith; invoice price, $8,500. c. Sold merchandise to K. Miller; invoice price, $40,000. d. Two days after purchase date, R. Smith returned one of the units purchased in (b) and received account credit. e. Sold merchandise to B. Sears; invoice price, $22,000. f. R. Smith paid his account in full within the discount period. g. Collected $90,000 cash from customer sales on credit in prior year, all within the discount periods. h. K. Miller paid the invoice in (c) within the discount…arrow_forwardAt January 1, 2024, Kennel Inc. reported the following information on its statement of financial position: Accounts receivable Allowance for expected credit losses During 2024, the company had the following summary transactions for receivables: 1. 2. 3. 4. 5. 6. Show Transcribed Text Sales on account, $1.670,000; cost of goods sold, $935.200; return rate of 7% Selling price of goods returned, $83.000: cost of goods returned to inventory, $46,480 Collections of accounts receivable, $1,600,000 Write-offs of accounts receivable deemed uncollectible, $47,000 Collection of accounts previously written off as uncollectible, $13,000 After considering all of the above transactions, total estimated uncollectible accounts, $29,000 (1) Bal v (4) $500,000 46,000 Your answer is partially correct. (1) Prepare T accounts for Accounts Receivable and Allowance for Expected Credit Losses, (2) enter the opening balances, (3) post the above summary entries, and (4) determine the ending balances. (Post…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education