FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

[The following information applies to the questions displayed below.]

Tunstall, Inc., a small service company, keeps its records without the help of an accountant. After much effort, an outside accountant prepared the following unadjusted

| Tunstall, Inc. Unadjusted Trial Balance for the Year Ended December 31 |

|||||||

| Debit | Credit | ||||||

| Cash | 46,800 | ||||||

| 11,700 | |||||||

| Supplies | 550 | ||||||

| Prepaid insurance | 630 | ||||||

| Service trucks | 16,300 | ||||||

| 8,400 | |||||||

| Other assets | 9,860 | ||||||

| Accounts payable | 2,220 | ||||||

| Wages payable | |||||||

| Income taxes payable | |||||||

| Notes payable, long-term | 15,000 | ||||||

| Common stock (4,100 shares outstanding) | 1,936 | ||||||

| Additional paid-in capital | 17,424 | ||||||

| 4,600 | |||||||

| Service revenue | 85,680 | ||||||

| Wages expense | 16,200 | ||||||

| Remaining expenses (not detailed; excludes income tax) |

33,220 | ||||||

| Income tax expense | |||||||

| Totals | 135,260 | 135,260 | |||||

Data not yet recorded at December 31 included:

- The supplies count on December 31 reflected $190 in remaining supplies on hand to be used in the next year.

- Insurance expired during the current year, $630.

- Depreciation expense for the current year, $4,200.

- Wages earned by employees not yet paid on December 31, $560.

- Income tax expense, $5,780.

I missed few questions (pic 1) and posted them in Bartleby to assistance and got the attached (pic2) response. I still need some help with understanding the calcuation of few items.

Transcribed Image Text:Answer is complete but not entirely correct.

TUNSTALL, INC.

Balance Sheet

For the Current Year Ended December 31

Assets

Liabilities and stockholders' equity

Current assets

Current liablities

$

46,800

$ 2,200 X

Cash

Accounts payable

Accounts receivable

11,700

Wages payable

560

Supplies

550

Income taxes payable

5,780

Prepaid expenses

630

Service trucks

16,300

Total current assets

2$

75,980

Total current liabilities

$

8,540

Service revenue

Accumulated depreciation

85,680

Notes payable, long-term

15,000

(8,400) 8

Other assets

9,860

Total liabilities

$

23,540

Stockholders' equity

Common stock

1,936

Additional paid-in capital

17,424

Retained earnings

4,600

$

$

Total stockholders' equity

23,960

Total assets

163,120

Total liabilities and stockholders' equity

47,500

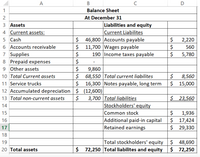

Transcribed Image Text:A

В

D

1

Balance Sheet

At December 31

3 Assets

Liabilities and equity

4 Current assets:

Current Liabilites

2$

46,800 |Accounts payable

11,700 Wages payable

190 Income taxes payable

5 Cash

2,220

6 Accounts receivable

560

7 Supplies

8 Prepaid expenses

9 Other assets

5,780

$

9,860

68,550 |Total current liabilites

$ 16,300 Notes payable, long term

10 Total Current assets

8,560

$ 15,000

11 Service trucks

12 Accumulated depreciation $ (12,600)

$ 23,560

3,700 Total liabilities

Stockholders' equity

13 Total non-current assets

14

Common stock

Additional paid-in capital

Retained earnings

$

1,936

$ 17,424

$ 29,330

15

16

17

18

Total stockholders' equity $ 48,690

$ 72,250

19

20 Total assets

$

$ 72,250 Total liabilites and equity

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forwardMaple Leafs Construction has the following data for the year ended December 31, Year 1: Accounts receivable (January 1, Year 1) $455,000 Credit sales 900,000 Collections from credit customers 825,000 Customer accounts written off as uncollected 15,000 Allowance for doubtful accounts (after write-off of uncollected accounts) 2,100 Estimated uncollected accounts based on an aging 29,200 analysis (December 31, Year 1) Refer to Maple Leafs Construction. What is the balance of accounts receivable at December 31, Year 1? O $455,000 O $511,900 O $515,000 O $440,000arrow_forwardPlease help me fill out this table. Thank you so much.arrow_forward

- Prior to recording the following, Elite Electronics, Incorporated, had a credit balance of $2,200 in its Allowance for Doubtful Accounts. Required: Prepare journal entries for each transaction. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) On August 31, a customer balance for $320 from a prior year was determined to be uncollectible and was written off. On December 15, the customer balance for $320 written off on August 31 was collected in full.arrow_forwardThe ledger of Larkspur Company at the end of the current year shows Accounts Receivable $92,000, Credit Sales $850,000, and Sales Returns and Allowances $37,000. (a) (b) (c) If Larkspur uses the direct write-off method to account for uncollectible accounts, journalize the entry if on July 7 Larkspur determines that Matisse company's $900 balance is uncollectible. Assume Larkspur uses the allowance method to account for uncollectible accounts. If Allowance for Doubtful Accounts has a credit balance of $1,500 in the trial balance, journalize the adjusting entry at December 31, assuming bad debts are expected to be 11% of accounts receivable. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) (b) Assume Larkspur uses the allowance method to account for uncollectible accounts. If Allowance for Doubtful…arrow_forwardPomona inc. uses the aging method in accounting for uncollectible accounts. On March 31, the company wrote off an uncollectible account of $2,600. What effect does the write-off have on the company's financial statements?arrow_forward

- At the end of the first year of operations, mayberry advertising had accounts receivable of $21100. Management of the company estimates that 8% of the accounts will not be collected What adjutment would mayberry advertising record to established allowance for uncollectible accounts Do the journal entry worksheetarrow_forwardQuantum Solutions Company, a computer consulting firm, has decided to write off the $33,550 balance of an account owed by a customer, Alliance Inc. Required: On March 1, journalize the entry to record the write-off, assuming that (a) the direct write-off method is used and (b) the allowance method is used. Refer to the Chart of Accounts for exact wording of account titles. CHART OF ACCOUNTS Quantum Solutions Company General Ledger ASSETS 110 Cash 111 Petty Cash 121 Accounts Receivable-Alliance Inc. 129 Allowance for Doubtful Accounts 131 Interest Receivable 132 Notes Receivable 141 Merchandise Inventory 145 Office Supplies 146 Store Supplies 151 Prepaid Insurance 181 Land 191 Store Equipment 192 Accumulated Depreciation-Store Equipment 193 Office Equipment 194 Accumulated Depreciation-Office Equipment LIABILITIES 210 Accounts Payable 211 Salaries Payable 213 Sales Tax Payable 214 Interest Payable 215…arrow_forwardRequired information [The following information applies to the questions displayed below.] Web Wizard, Inc., has provided information technology services for several years. For the first two months of the current year, the company has used the percentage of credit sales method to estimate bad debts. At the end of the first quarter, the company switched to the aging of accounts receivable method. The company entered into the following partial list of transactions during the first quarter. a. During January, the company provided services for $44,000 on credit. b. On January 31, the company estimated bad debts using 1 percent of credit sales. c. On February 4, the company collected $22,000 of accounts receivable. d. On February 15, the company wrote off a $150 account receivable. e. During February, the company provided services for $34,000 on credit. f. On February 28, the company estimated bad debts using 1 percent of credit sales. g. On March 1, the company loaned $2,200 to an…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education