MACROECONOMICS

14th Edition

ISBN: 9781337794985

Author: Baumol

Publisher: CENGAGE L

expand_more

expand_more

format_list_bulleted

Question

Note:-

- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism.

- Answer completely.

- You will get up vote for sure.

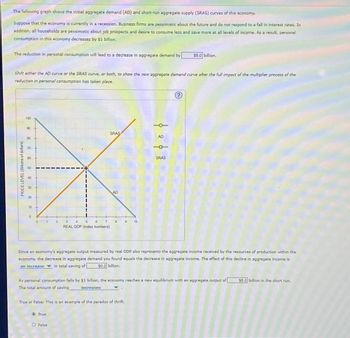

Transcribed Image Text:The following graph shows the initiall aggregate demand (AD) and short-run aggregate supply (SRAS) curves of this economy.

Suppose that the economy is currently in a recession. Business firms are pessimistic about the future and do not respond to a fall in interest rates. In

addition, all households are pessimistic about job prospects and desire to consume less and save more at all levels of income. As a result, personal

consumption in this economy decreases by $1 billion.

The reduction in personal consumption will lead to a decrease in aggregate demand by

PRICE LEVEL (Billions of dollars)

Shift either the AD curve or the SRAS curve, or both, to show the new aggregate demand curve after the full impact of the multiplier process of the

reduction in personal consumption has taken place.

1.00

90

18:0

2 8 8 9 88

10

0

0

1

ܢ ܡܫܢ ܘ

2

3

4

5

7

REAL GDP (Index numbers)

Ⓒ True

8

O False

SRAS

AD

8 19 10

True or False: This is an example of the paradox of thrift.

| |

AD

Since an economy's aggregate output measured by real GDP also represents the aggregate income received by the resources of production within the

economy, the decrease in aggregate demand you found equals the decrease in aggregate income. The effect of this decline in aggregate income is

an increase in total saving of $0.2 billion.

$5.0 billion.

SRAS

As personal consumption falls by $1 billion, the economy reaches a new equilibrium with an aggregate output of

The total amount of saving

increases

$5.0 billion in the short run.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 5 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Economics 1. Graphing the consumption function from the MPC Consider a hypothetical economy in which the marginal propensity to consume (MPC) is 0.75. That is, if disposable income increases by $1, consumption increases by 75c. Suppose further that last year disposable income in the economy was $500 billion and consumption was $400 billion. On the following graph, use the blue line (aircle symbol) to plot this economy's consumption function based on these data. (?) 700 600 300 -100 400 500 600 700 100 200 300 DISPOSABLE INCOME (Blions of dotans) From the preceding data, you know that the level of savings in the economy last vear was s billion and the marginal propensity to save in this economy is Suppose that this year, disposable income is projected to be $700 billion. Based on your analysis, you would expect consumption to be S billion and savings to be S billion, CONSUMPTION (Bilions of dolars)arrow_forwardEconomics 1. Graphing the consumption function from the MPC Consider a hypothetical economy in which the marginal propensity to consume (MPC) is 0.75. That is, if disposable income increases by $1, consumption increases by 75c. Suppose further that last year disposable income in the economy was $500 billion and consumption was $400 billion. On the following graph, use the blue line (aircle symbol) to plot this economy's consumption function based on these data. 700 600 300 -100 300 400 500 600 700 100 200 DISPOSABLE INCOME (Blions of dotani) From the preceding data, you know that the level of savings in the economy last vear was s billion and the marginal propensity to save in this economy is Suppose that this year, disposable income is projected to be $700 billion. Based on your analysis, you would expect consumption to be S billion and savings to be s billion, CONSUMPTION (Blions of dolars)arrow_forwardDue to some negative news concerning the impact of global warming on the economy, consumers are becoming more pessimistic about the future to the point of reducing autonomous consumption by 50. What is the immediate impact on income before the economy adjusts to its new equilibrium? What are the economy’s equilibrium level of output Y and interest rate r following the fall in autonomous consumption? Compute the equilibrium level of consumption and investment spending. With the help of the IS/LM graph, carefully explain what happens to the economy following the fall in consumer confidence.arrow_forward

- a) About Country A, what is your estimate of the country's marginal propensity to consume (MPC) based on the following information on its GDP (Y) and the components thereof (in billion dollars) for two past years? Show calculation. Year 1 Year 2 c) GDP C I 11200 8000 2200 12000 8500 2400 G 800 880 The next few parts are about Country B, whose government plans to cut taxes by $24 billion as a measure to fight the current recession. The marginal propensity to consume (MPC) in Country B is known to be 34. There will be no crowding-out effect. e) NX 200 220 b) What is the initial effect (in billion dollars) of the tax cut on Country B's aggregate demand? (The "initial effect" here refers to the effect on AD after only the first round of increased spending.) What is the total effect of the tax cut on aggregate demand? Explain why it is different from the initial effect. d) How does the total effect of this $24 billion tax cut compare to the total effect of a $24 billion increase in…arrow_forwardCS 24 Economicsarrow_forwardConsider a hypothetical economy in which the marginal propensity to consume (MPC) is 0.50. That is, if disposable income increases by $1, consumption increases by 50c. Suppose further that last year disposable income in the economy was $400 billion and consumption was $350 billion. On the following graph, use the blue line (arcle symbol) to pict this economy's consumption function based on these data. CONSUMPTION (Bions of dollars) ) 700 600 500 400 300 200 100 0 -100 9 100 200 300 400 500 000 DISPOSABLE INCOME (Billions of dollars) 700 000 From the preceding data, you know that the level of savings in the economy last year was 3 economy is billion and the marginal propensity to save in this Suppose that this year, disposable income is projected to be $600 billion. Based on your analysis, you would expect consumption to be 3 billion and savings to be S billion,arrow_forward

- Question #2. 13 On April 27, 2023, the U.S. Bureau of Economic Analysis (BEA) released the data on GDP growth for the US economy for the first quarter of 2023 and revealed that the economy grew sluggisly by only 1.1 percent. Based on this report, suppose the U.S. consumers and businesses start to become pessimistic about the direction of the economy and eventually cut consumer and business spending, analyze using the IS-LM and AD-AS frameworks the short and long-run h effects of such a shock on prices, output, and real interest rate. # 3 E $ 4 Q Search R 15 % 5 f6 E L 6 17 4+ lyje Y 18 7 90 * 19 Page of 2 9 O f 112arrow_forwardMacroeconomics Question No.2 Suppose the consumption function is given by C = 100 + 0.8YD and that I = 50, while G=200, TR=62.5 and t=0.25. What is the equilibrium level of income? What is the level of saving in equilibrium? If investment were to rise to 150, what would be the effect be on equilibrium income. What is the value of multiplier in part a. and c. Draw a diagram indicating the equilibrium in part a. and c.arrow_forwardThe diagram below shows desired aggregate expenditure for a hypothetical economy. Assume the following features of this economy: •marginal propensity to consume (mpc) = 0.75 •net tax rate (t) = 0.20 •no foreign trade Desired Aggregate Expenditure (AE) •fixed price level • all expenditure and income figures are in billions of dollars. 250 175 100 0 450 AE I + G I Actual National Income (Y)arrow_forward

- Please answer ASAParrow_forwardConsumption and Saving- End of Chapter Problem Which one of the following reasons makes it easier to forecast the impact of an income change on consumption for hand-to-mouth consumers than for consumption smoothers? It is easier because hand-to-mouth consumers only spend their permanent income. hand-to-mouth consumers save a large portion of their income. the marginal propensity to consume is 1 for consumption smoothers. hand-to-mouth consumers spend their entire income as they earn it.arrow_forwardNeed help with this, please show me where to plot the two points on the graph as well. Thanks!arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you