Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

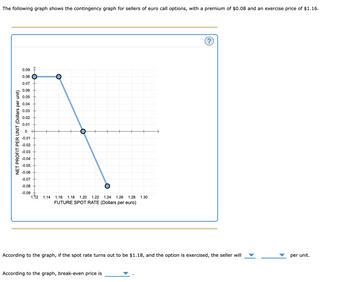

Transcribed Image Text:The following graph shows the contingency graph for sellers of euro call options, with a premium of $0.08 and an exercise price of $1.16.

NET PROFIT PER UNIT (Dollars per unit)

0.09

0.08

0.07

0.06

0.05

0.04

0.03

0.02

0.01

0

-0.01

-0.02

-0.03

-0.04

-0.05

-0.06

-0.07

-0.08

-0.09

1.12 1.14 1.16 1.18 1.20 1.22 1.24 1.26 1.28 1.30

FUTURE SPOT RATE (Dollars per euro)

According to the graph, if the spot rate turns out to be $1.18, and the option is exercised, the seller will

According to the graph, break-even price is

per unit.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Please answer fastarrow_forwardUse factors (from the tables) or a spreadsheet to determine the interest rate per period from the following equation: 0=-40,000 + 8000(P/IA,10) + 8000(P/F,*,15) 8.09% 13.50% 15.70% 5.04%arrow_forwardStudy Tools ons cess Tips cess Tips pack The following graph shows the contingency graph for sellers of euro call options, with a premium of $0.02 and an exercise price of $1.48. NET PROFIT PERUNT (Delars per un 0.03 0.02 O 0.01 -001 600 -0.01 14 145 180 182 154 155 156 180 182 FUTURE SPOT RATE (Dollars per euro) ? According to the graph, if the spot rate turns out to be $1.50, and the option is exercised, the seller will According to the graph, break-even price is per unit.arrow_forward

- Required: a. A firm currently offers terms of sale of 3/25, net 50. Calculate the effective annual rate. a-1. Calculate the effective annual rate if the terms are changed to 4/25, net 50. a-2. What effect does an increase in the discount rate have on the implicit interest rate charged to customers that pass up the discount? b-1. Calculate the effective annual rate if the terms are changed to 3/35, net 50. b-2. What effect does a decrease in the extra days of credit have on the implicit interest rate charged to customers that pass up the discount? c-1. Calculate the effective annual rate if the terms are changed to 3/25, net 40. c-2. Is there any difference between the implicit interest rate for terms of 3/35, net 50 and 3/25, net 40?arrow_forwardYen: Spot and Forward (\/$) Mid Rates Bid Spot Rates 129.87 Forward Rates 1 month 129.68 6 months 128.53 129.82 -20 -136 Ask 129.92 -18 -132 Pound: Spot and Forward ($/£) Mid Rates Bid 1.4484 1.4459 1.4327 1.4481 -26 -160 Ask 1.4487 -24 -154 According to the information provided in the table, the 6-month yen is selling at forward premium or discount? Please show your calculation and show the numbers of premium(or discount) in percentage.arrow_forwardThese are the quotes from the spot market. Citigroup Credit Suisse Deutsche Bank ¥122/€ ¥126/$ $0.99/€ If you have $1,000,000 to arbitrage, your profit is $_____________ (Please keep at least two decimal places.)arrow_forward

- aa.4arrow_forwardCalculate the forward discount or premium for the following spot and three-month forward rates: (a) Spot Rate = $2.00/£1 and Forward Rate = $2.01/£1 (b) Spot Rate = $2.00/£1 and Forward Rate = $1.96/£1arrow_forward(Related to Checkpoint 18.2) (Evaluating trade credit discounts) If a firm buys on trade credit terms of 5/15, net 90 and decides to forgo the trade credit discount and pay on the net day, what is the annualized cost of forgoing the discount (assume a 365-day year)? The annualized cost of the trade credit terms of 5/15, net 90 is %. (Round to two decimal places.)arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education