ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

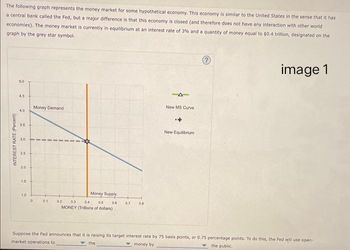

Transcribed Image Text:The following graph represents the money market for some hypothetical economy. This economy is similar to the United States in the sense that it has

a central bank called the Fed, but a major difference is that this economy is closed (and therefore does not have any interaction with other world

economies). The money market is currently in equilibrium at an interest rate of 3% and a quantity of money equal to $0.4 trillion, designated on the

graph by the grey star symbol.

image 1

INTEREST RATE (Percent)

5.0

45

9

4.0

3.5

3.0

25

20

15

1.0

0

Money Demand

01

Money Supply

02 0.3 0.4

0.5

MONEY (Trillions of dollars)

0.6 0.7

08

4-

New MS Curve

New Equilibrium

Suppose the Fed announces that it is raising its target interest rate by 75 basis points, or 0.75 percentage points. To do this, the Fed will use open-

market operations to

the public.

the

money by

Transcribed Image Text:Use the green line (triangle symbol) on the previous graph to illustrate the effects of this policy by placing the new money supply curve (MS) in the

correct location. Place the black point (plus symbol) at the new equilibrium interest rate and quantity of money.

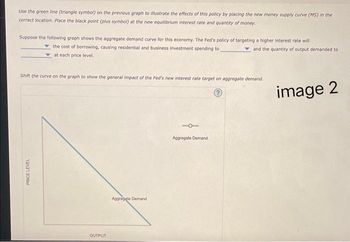

Suppose the following graph shows the aggregate demand curve for this economy. The Fed's policy of targeting a higher interest rate will

the cost of borrowing, causing residential and business investment spending to

and the quantity of output demanded to

at each price level.

Shift the curve on the graph to show the general impact of the Fed's new interest rate target on aggregate demand.

?

PRICE LEVEL

OUTPUT

Aggregate Demand

Aggregate Demand

image 2

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- The price level and the market for bank reserves The following graph shows the market for bank reserves in a hypothetical economy. Suppose the price level decreases from 110 to 70. Shift the appropriate curve on the following graph to show the impact of a decrease in the overall price level. Note: Select and drag one or both of the curves to the desired position. Curves will snap into position, so if you try to move a curve and it snaps back to its original position, just drags it a little farther. Analyze the effects of this change in the price level, then fill in the following table with these results. Effect Quantity of bank reserves supplied _________ (increase/ decreases/remains the same ) Quantity of real GDP demanded ___________ (increases/decreases/remain the same ) NOTE- THIS QUESTION IS A ONE QUESTION BUT IT IS DIVIDED INTO SUBPARTS . PLEASE ANSWER ALL QUESTUIONS WITH EXPLANATION.arrow_forwardTOPIC: A possible break in the Note: everything you need will be in the picturearrow_forwardScenario 2 Suppose the money demand is given by MdYx (0.4 - i) = where i is the interest rate. Suppose income Y totals 250. 9. Refer to Scenario 2. If the money supply is M³ = 25, what is the equilibrium interest rate? 10. Refer to Scenario 2. Suppose the Federal Reserve just met and decided they would like to decrease the interest rate by 4 percentage points (compared to the equilibrium rate you found in the previous question). What kind of monetary policy should it use, and what would the money supply have to equal to achieve that goal? (Your answer should be two items: first is expansion or contraction, the second is the actual amount the money supply should be.)arrow_forward

- how to calculate the equilibrium price.....arrow_forwardSuppose the Federal Reserve has set the money supply at $4 million. The table below shows the interest rate and total demand for money. Interest Rate Demand (in millions) 20% $1 15 2 10 3 5 4 0 5 What is the equilibrium interest rate? Multiple Choice 0 percent 20 percent 10 percent 5 percentarrow_forwardShow the impact of the increase in government purchases on the interest rate by shifting one or both of the curves on the following graph. INTEREST RATE 12 10 8 2 0 0 20 Money Supply known as the Money Demand 40 60 80 MONEY (Billions of dollars) 100 120 = Money Demand Money Supply ? Suppose that for every increase in the interest rate of one percentage point, the level of investment spending declines by $0.5 billion. Based on the changes made to the money market in the previous scenario, the new interest rate causes the level of investment spending to by Taking the multiplier effect into account, the change in investment spending will cause the quantity of output demanded to by at every price level. The impact of an increase in government purchases on the interest rate and the level of investment spending is effect. Use the purple line (diamond symbol) on the graph at the beginning of this problem to show the aggregate demand curve (AD3) after accounting for the impact of the increase…arrow_forward

- INTEREST RATE (Percent) 3 6 Suppose the money market for some hypothetical economy is given by the following graph, which plots the money demand and money supply curves Assume the central bank in this economy (the Fed) fixes the quantity of money supplied. Suppose the price level decreases from 90 to 75. Shift the appropriate curve on the graph to show the impact of a decrease in the overall price level on the market for money. 18 Money Supply 15 12 0 0 10 20 30 Money Demand 40 50 60 MONEY (Billions of dollars) Money Demand Money Supply Ⓡarrow_forwardHey, I need help with the following macro question. Thank you in advance! Imagine that the chair of the Federal Reserve announced that, as of the following day, all currency in circulation in the United States would be worth 10 times its face denomination. For example, a $10 bill would be worth $100; a $100 bill would be worth $1,000; and so forth. Furthermore, the balances in all checking and savings accounts would be multiplied by 10. So, for example, if you had $500 in your checking account, as of the following day your balance would be $5,000. Would you actually be 10 times better off on the day the announcement took effect? Why or why not?arrow_forwardAccording to the long-run relationship between money growth, income growth, and the change in the price level, if European inflation is higher than U.S. inflation but money growth is the same, it must be that: a) real income growth in Europe and the United States is the same. b) real income growth in Europe is larger than real income growth in the United States. c) real income growth in the United States is higher than in Europe. d) the level of nominal income is higher in Europe than in the United States.arrow_forward

- do fast.arrow_forwardTOPIC: Equilibrium in the money market NOTE: Everything you need will be in the picture. Thank youarrow_forwardSuppose the Federal Reserve wants to fix the U.S. exchange rate with the yen at $0.008 per yen. If the equilibrium market exchange rate were significantly lower at $0.007 per yen, what would the Fed need to do to maintain the fixed rate of $0.008 per yen? What would be the effect of these actions on the money supply in the U.S.? Explain.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education