Concept explainers

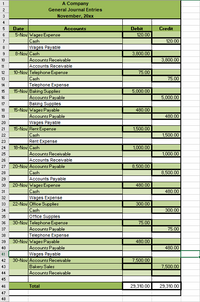

I have a big project due and I am unsure if I am doing this correctly. I am attaching the spreadsheet and accounting data. Can you please check over it for me and let me know if anything is calculated wrong?

Accounting Data Appendix

- The following events occurred in October:

October 1: The business owner used $25,000 from their personal savings account to buy common stock in their company.

October 1: Purchased $8,500 worth of baking supplies from vendor, on account.

October 3: The company borrowed $10,000 in cash, in exchange for a two-year, 6% note payable. Interest and the principal are repayable at maturity.

October 7: Entered into a lease agreement for bakery space. The agreement is for one year. The rent is $1,500 per month; the last month’s rent payment of $1,500 is required at the time of the lease agreement. The payment was made in cash. Lease period is effective October 1 of this year through September 30 of the next.

October 10: Paid $375 to the county for a business license.

October 11: Purchased a cash register for $250 (deemed to be not material enough to qualify as depreciable equipment).

October 13: The owner has baking equipment, including an oven and mixer, which they have been using for their home-based business and will now start using in the bakery. You estimate that the equipment is currently worth $5,000, and you transfer the equipment into the business in exchange for additional common stock. The equipment has a five-year useful life.

October 13: Paid $200 for business cards and flyers to use for advertising.

October 14: Paid $300 for office supplies.

October 15: Hired a part-time helper to be paid $12 per hour. One pay period is the first of the month through the fifteenth, and the other is the sixteenth through the end of the month. Paydays are the twentieth for the first pay period and the fifth of the following month for the second pay period. (No entry required on this date—for informational purposes only.)

October 30: Received telephone bill for October in amount of $75. Payment is due on November 10.

October 31: Paid $1,200 for a 12-month insurance policy. Policy effective dates are November 1 through October 31.

October 31: Accrued wages earned for employee for period of October 16 through October 31. (See Wage Calculation Data table at the end of this document.)

October 31: Total October bakery sales were $15,000 ($5,000 of these sales on

- The following events occurred in November:

November 5: Paid employee for period ending October 31.

November 8: Received payments from customers toward accounts receivable in amount of $3,800.

November 10: Paid October telephone bill.

November 15: Purchased additional baking supplies in amount of $5,000 from vendor, on account.

November 15: Accrued wages earned for employee from period of November 1 through November 15. (See Wage Calculation Data table at the end of this document.)

November 15: Paid rent on bakery space.

November 18: Received payments from customers toward accounts receivable in amount of $1,000.

November 20: Paid $8,500 toward baking supplies vendor payable.

November 20: Paid employee for period ending November 15.

November 22: Purchased $300 in office supplies.

November 30: Received telephone bill for November in amount of $75. Payment is due on December 10.

November 30: Accrued wages earned for employee for period of November 16 through November 30. (See Wage Calculation Data table at the end of this document.)

November 30: November bakery sales total was $20,000 ($7,500 of this total on accounts receivable).

- Many customers have been asking for more allergy-friendly products, so in December the bakery started carrying a line of gluten-free products on a trial basis. The information below relates to the purchase and sales of the new products.

Use the perpetual inventory method with the FIFO valuation method. Please see the “

There is also a Dec. workbook but it will only let me load two images that I need help with making sure it is correct. Then an unjusted trail budget I would like looked over. Can you help with those also?

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

- I need help filling out the excel template with this given information. Kate has just completed her first year of Kate's Cards. She has been preparing monthly income statements and balance sheets, so she knows that her company has been profitable and that there is cash in the bank. She has not, however, prepared a statement of cash flows. Kate's provides you with the year-end income statement and balance sheet and asks that you construct an statement of cash flows for Kate's Cards.Additional information:1. There were no disposals of equipment during the year2. Dividends in the amount of $1,300 were paid in cash during the year.3. Prepaid expenses relate to operating expenses.Requireda. Construct an statement of cash flows for Kate's Cards for the year-ended August 31, 2019, using the indirect method. Hint: Since this was Kate's first year of operations, the beginning balance sheet account balances were zero.b. Construct an statement of cash flows for Kate's Cards for the year ended…arrow_forwardAlthough Deborah Adefowope has run a small business for many years, she has never kept adequate accounting records. However, a need to obtain a bank loan for the expansion of the business has necessitated the preparation of ‘final’ accounts for the year ended 31 August 2009. As a result, the following information has been obtained after much careful research: Deborah Adefowope’s business assets and liabilities are as follows: As at 1/09/08 31/08/09 Stock in trade GHS8,600 GHS16,800 Debtors for sales 3,900 4,300 Creditors for purchases 7,400 8,900 Rent prepaid 300 420 Electricity accrued due 210 160 Balance at bank 2,300 1,650 Cash…arrow_forwardA retail store normally has three people working in the evening. All of the employees have access to the same cash register. For the last month, the cash count at the end of the evening has been recording losses. The losses range from $5 to $300. So, the manager has decided to be the only one to count the cash at the end of the evening to keep the losses from happening. Discuss if the change made by the manager is a good one. Will the losses keep happening, or will this change prevent losses due to theft? What other recommendations and changes should be considered by this manager?arrow_forward

- This problem is based on the transactions for the Kind Matters Company in your text. Prepare journal entries for each transaction and identify the financial statement impact of each entry. The financial statements are automatically generated based on the journal entries recorded. December 1 On December 1, Jim Kennedy forms a consulting business, named Kind Matters. Kind Matters receives $42,000 cash from Jim Kennedy as an owner contribution. December 2 Kind Matters pays $3,100 cash for supplies. The company's policy is to record all prepaid expenses in asset accounts. December 3 Kind Matters pays $38,000 cash for equipment. December 4 Kind Matters purchases $8,050 of supplies on credit from a supplier, CalTech Supply. December 5 Kind Matters provides consulting services and immediately collects $4,800 cash. December 6 Kind Matters pays $1,600 cash for December rent. December 7 Kind Matters pays $1,300 cash for employee salary. December 8 Kind Matters provides…arrow_forwardKate has just completed her first year running Kate’s Cards. She has been preparing monthly income statements and balance sheets, so she knows that her company has been profitable and that there is cash in the bank. She has not, however, prepared a statement of cash flows. Kate provides you with the year-end income statement and balance sheet and asks that you prepare a statement of cash flows for Kate’s Cards.Additional information:1. There were no disposals of equipment during the year. 2. Dividends in the amount of $1,300 were paid in cash during the year. 3. Prepaid expenses relate to operating expenses.Required. Prepare a statement of cash flows for Kate’s Cards for the year ended August 31, 2019, using the indirect method. Hint: Since this was Kate’s first year of operations, the beginning balance sheet account balances were zero. The second picture where it shows pink is what needs to be filled in.arrow_forwardHi! My name is Jessica and I have a income chart I need to fill out but... I don't know where to put anything and I feel like some things are out of place because it isn't balanced. Can you help me?arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education