FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Please don't provide answer in image format thank you

Hello. Can I get some assistance on what my closing entries should look like? I have included data that will help.

Transcribed Image Text:The following events occurred in March:

●

●

●

·

·

●

·

●

●

●

●

•

●

March 1: Owner borrowed $125,000 to fund/start the business. The loan term is 5 years.

March 1: Owner paid $250 to the county for a business license.

March 2: Owner signed lease on office space; paying first (March 20XX) and last month's rent of

$950 per month.

March 5: Owner contributed office furniture valued at $2,750 and cash in the amount of

$15,000 to the business.

March 6: Owner performed service for client in the amount of $650. Customer paid in cash.

March 8: Owner purchased advertising services on account in the amount of $500.

March 10: Owner provided services to client on account, in the amount of $1,725.

ACC 201 Accounting Data Appendix

March 15: Owner paid business insurance in the amount of $750.

March 20: The owner received first utility bill in the amount of $135, due in April.

March 20: Office copier required maintenance; owner paid $95.00 for copier servicing.

March 22: Owner withdrew $500 cash for personal use.

March 25: Owner paid $215 for office supplies.

March 25: Owner provided service to client in the amount of $350. Client paid at time of service.

March 30: Owner paid balance due for advertising expense purchase on March 8.

March 30: Received payment from customer for March 10 invoice in the amount of $1,725.

March 31: Last day of pay period; owner owes part-time worker $275 for the March 16 through

March 31 pay period. This will be paid on April 5.

March 31: Provided service for client on account in the amount of $3,500.

March 31: Record depreciation of the office furniture at $45.83.

This chart of accounts should help you identify

the appropriate accounts to record to as you

are analyzing and journaling transactions for

this workbook. There is nothing to complete on

this page; this is simply a resource for you.

Asset Accounts

Cash

Accounts Receivable

Prepaid Rent

Office Furniture

Office Supplies

Accumulated Depreciation (contra asset)

Acct #

Liability Accounts

101 Notes Payable

102 Accounts Payable

103 Wages Payable

104

105

106

Acct #

Equity Accounts

201 Owner's Capital

202 Owner Draws

203

Revenue Accounts

Service Revenue

Expense Accounts

Rent expense

Business License Expense

Insurance Expense

Repairs and Maintenance

Advertising Expense

Wages Expense

Utilities Expense

Depreciation Expense

Acct #

301

302

Acct #

401

Acct #

501

502

503

504

506

507

508

509

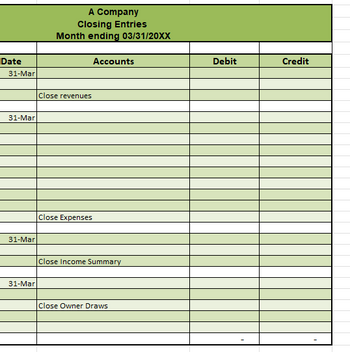

Transcribed Image Text:Date

31-Mar

31-Mar

31-Mar

31-Mar

A Company

Closing Entries

Month ending 03/31/20XX

Close revenues

Close Expenses

Accounts

Close Income Summary

Close Owner Draws

Debit

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- How would I calculate this problem? I just guessed on which answer made sense to me. Please help. thank you in advance.arrow_forwardWhat is the easiest way to complete a closing entry. Are there any shortcuts or techniques that are useful to remember?arrow_forwardDescribe how to close entries properly.arrow_forward

- True or false? In a manual system, it is proper to splits journal entry at the bottom page.arrow_forwardhow do you do adjusting entries?arrow_forwardHow do you get a report into PDF format? Select an answer: You need to email the report and then convert it to PDF. Click on the Export button and Click on Export as PDF. You cannot export reports into PDF. You have to print the report and then scan it as a PDF.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education