FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

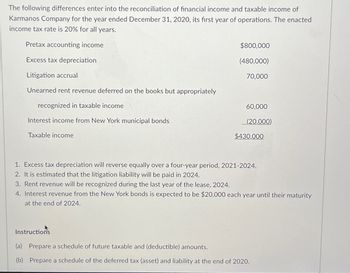

Transcribed Image Text:The following differences enter into the reconciliation of financial income and taxable income of

Karmanos Company for the year ended December 31, 2020, its first year of operations. The enacted

income tax rate is 20% for all years.

Pretax accounting income

Excess tax depreciation

Litigation accrual

Unearned rent revenue deferred on the books but appropriately

recognized in taxable income

Interest income from New York municipal bonds

Taxable income

$800,000

(480,000)

70,000

Instructions

60,000

(20,000)

$430,000

1. Excess tax depreciation will reverse equally over a four-year period, 2021-2024.

2. It is estimated that the litigation liability will be paid in 2024.

3. Rent revenue will be recognized during the last year of the lease, 2024.

4. Interest revenue from the New York bonds is expected to be $20,000 each year until their maturity

at the end of 2024.

(a) Prepare a schedule of future taxable and (deductible) amounts.

(b) Prepare a schedule of the deferred tax (asset) and liability at the end of 2020.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The pretax financial income of Tamarisk Company differs from its taxable income throughout each of 4 years as follows. Year PretaxFinancial Income Taxable Income Tax Rate 2020 $295,000 $180,000 35 % 2021 320,000 217,000 20 % 2022 335,000 264,000 20 % 2023 435,000 592,000 20 % Pretax financial income for each year includes a nondeductible expense of $29,300 (never deductible for tax purposes). The remainder of the difference between pretax financial income and taxable income in each period is due to one depreciation temporary difference. No deferred income taxes existed at the beginning of 2020. Prepare the Income stmt for 2021 beginning with income before income taxesarrow_forward6arrow_forwardDo not give answer in image and hand writingarrow_forward

- Beaver Dam Inc. (BDI) listed the following items to prepare a reconciliation between book and taxable income. GAAP net income before tax $700,000 Meal and entertainment expense 100,000 GAAP depreciation expense 110,000 Depreciation expense for tax purposes 120,000 c. Compute the net increase in BDI’s deferred tax assets or deferred tax liabilities for the year. d. Prepare the journal entry to record taxes for the year.arrow_forwardthe pretax financial income (or loss) figures for metlock company are as follows 2022- 77000; 2023-(49000); 2024-(44000); 2025-125000; 2026-95000. pretax financial income (or loss) and taxable (loss) were the same for all years involved. Assumed a 20% tax rate for all years. Prepare the journal entries for the years 2022 and 2026 to record income tax expense and the effects of the net operating loss carry forwards. all income and losses related to normal operations (in recording the benefits of a loss carry forward assume that no valuation account is deemed necessary Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forwardSherrod, Inc., reported pretax accounting income of $70 million for 2021. The following information relates to differences between pretax accounting income and taxable income: Income from installment sales of properties included in pretax accounting income in 2021 exceeded that reported for tax purposes by $4 million. The installment receivable account at year-end 2021 had a balance of $6 million (representing portions of 2020 and 2021 installment sales), expected to be collected equally in 2022 and 2023. Sherrod was assessed a penalty of $1 million by the Environmental Protection Agency for violation of a federal law in 2021. The fine is to be paid in equal amounts in 2021 and 2022. Sherrod rents its operating facilities but owns one asset acquired in 2020 at a cost of $60 million. Depreciation is reported by the straight-line method, assuming a four-year useful life. On the tax return, deductions for depreciation will be more than straight-line depreciation the first two years but…arrow_forward

- For the current year, LNS corporation reported the following taxable income at the end of its first, second, and third quarters. Quarter-End Cumulative Taxable Income First $ 1,850,000 Second 2,520,000 Third 3,600,000 What are LNS’s minimum first, second, third, and fourth quarter estimated tax payments, using the annualized income method?arrow_forwardAt the end of the year, a deductible temporary difference of $40 million has been recognised due to the difference between the carrying amount of a liability account for estimated expenses and its tax base. Taxable income is $50 million. No temporary differences existed at the beginning of the year, and the tax rate is 35%. Required: a. Prepare the journal entry(s) to record income taxes during the period. b.How much will income tax expense be shown in the income statement? c.arrow_forwardHelp mearrow_forward

- For the current year, LNS corporation reported the following taxable income at the end of its first, second, and third quarters. Quarter-End First Second Third Installment What are LNS's minimum first-, second-, third-, and fourth-quarter estimated tax payments, using the annualized income method? Note: Enter all amounts as positive values. Leave no answer blank. Enter zero if applicable. Round "Annualization Factor" for Fourth quarter to 7 places. Round other intermediate computations and final answers to the nearest whole dollar amount. First quarter Second quarter Third quarter Fourth Cumulative quarter Taxable Income $ 1,700,000 2,636,000 3,681,000 Taxable Income $ 1,700,000 $ 1,700,000 $ 2,636,000 $ 3,681,000 Annualization Factor 4 $ 4 $ 2 S $ 1.3333333 Annual Estimated Taxable Income 6,800,000 6,800,000 5,272,000 4,908,000 Answer is not complete. Tax on estimated taxable income $ 6,800,000 $ 6,800,000 $5,272,000 $ 4,895,730 Percentage of Tax Required To Be Paid 25 50 75 100 %0 %…arrow_forwardCarla Vista Corporation began 2025 with a $54,280 balance in the Deferred Tax Liability account. At the end of 2025, the related cumulative temporary difference amounts to $413,000, and it will reverse evenly over the next two years. Pretax accounting income for 2025 is $619,500 , the tax rate for all years is 20%, and taxable income for 2025 is $477,900. Compute income taxes payable for 2025arrow_forwardFor its first year of operations, Tringali Corporation's reconciliation of pretax accounting income to taxable income is as follows: Pretax accounting income $ 210,000 Permanent difference (14,700 ) 195,300 Temporary difference-depreciation (20,200 ) Taxable income $ 175,100 Tringali's tax rate is 25%. Assume that no estimated taxes have been paid. What should Tringali report as its income tax expense for its first year of operations? $52,500. $48,825. $43,775. $5,050.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education