FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

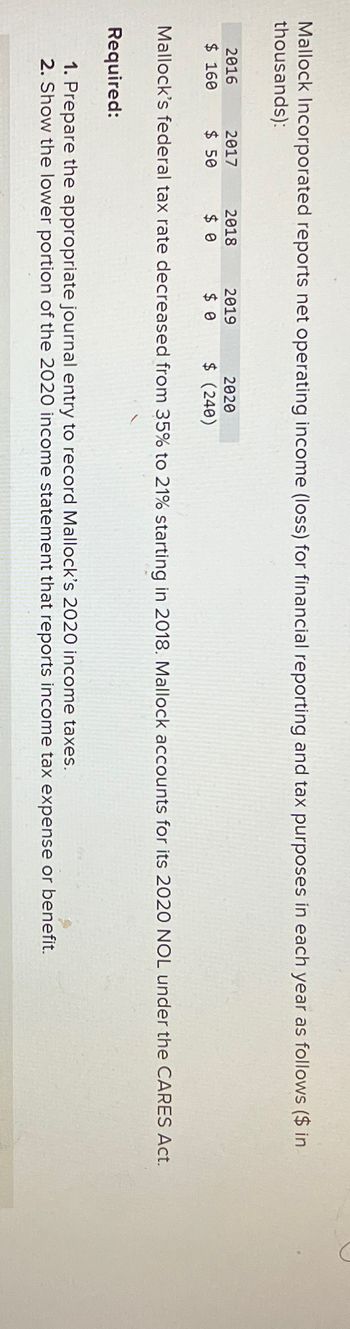

Transcribed Image Text:Mallock Incorporated reports net operating income (loss) for financial reporting and tax purposes in each year as follows ($ in

thousands):

D

Mallock's federal tax rate decreased from 35% to 21% starting in 2018. Mallock accounts for its 2020 NOL under the CARES Act.

Required:

1. Prepare the appropriate journal entry to record Mallock's 2020 income taxes.

2. Show the lower portion of the 2020 income statement that reports income tax expense or benefit.

2016

$ 160

2017

$ 50

2018

$ 0

2019

$ 0

2020

$ (240)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- fill in Xs' thank U!!!!!arrow_forwardA company issues 6% bonds with a par value of $100,000 at par on January 1. The market rate on the date of issuance was 5%. The bonds pay interest semiannually on January 1 and July 1. The cash paid on July 1 to the bond holder(s) is: Multiple Choice $6,000. $5,000 $3.000. 2500 aw 9:12 P pe here to search 96% 3/21/20arrow_forwardWhat did I do wrong ?arrow_forward

- Pleace no excel thank youarrow_forward6arrow_forwardC $ 25% O Maps Question (( [Solve [Solve C Solved [S X coursehero.com/tutors-problems/Finan... Answer & Explanation Related Questions at ant nad. 5.Suppose your credit card has an APR of 17% your daily rate would be 0.17/265. 6.In buying a set of household appliances costing 120,000. a family makes a down payment of 10,000 and there is an agreement to pay the balance in 18 monthly installments and interest is charged at 15.84% compounded monthly. a.) How much the total interest? b.) How much is the outstanding balance after the 6th periodic payment? c.) How much is the monthly installment? d.) How much interest payment was paid in the first 5 months? A e.) How much is the principal repayment on the 10th month? 7.A stock pays annual dividends of 0.33 per share. determine the dividends paid to a shareholder who has 1,200 shares of the company's stock. Accounting Business Financial Accounting Subscribe View answer & additonal benefits from the subscription tv Tue Jun 14 3:10 PM k Related…arrow_forward

- Multiple Choice Kearns Incorporated owned all of Burke Corporation. For 2024, Kearns reported net income (without consideration of its investment in Burke) of $350,000 while the subsidiary reported $127,000. There are no excess amortizations associated with this consolidation. The subsidiary had bonds payable outstanding on January 1, 2024, with a book value of $303,000. The parent acquired the bonds on that date for $285,000. During 2024, Kearns reported interest income of $32,000 while Burke reported interest expense of $29,000. What is consolidated net income for 2024? $498,000 $462,000 $456,000 M Saved Sep 16 Sul 4:5arrow_forwardHome Insent VOUL FILTELEME Protected View Office has detected a problem with this file. Editing it may harm your compute P19 ABC D F 1 2 Using the information provided in the following table, find the value of each asset. Cash Flow End of Amount Year (Php) Appropriate Required Return (%) 1 250,000 18 250,000 250,000 15,000 15 0 16 0 3 4 5 6 7 8 9 10 3 4 5 6 7 8 9 0 1 2 31 File Asset A BU E C WNP 2 3 1 through co 1 2 3 10 0 1,750,000 75,000 425,000 100,000 150,000 250.000 350,000 200,000 50,000 4 5 1 through 5 6 1 2 3 4 5 6 Solution and Answer: Sunima Shot on OnePlus te Powered by Triple Camera 12arrow_forwardPlease helparrow_forward

- Chapter 7 R E V I E W Write the letter of the best answer to each question. Find the original price for a kitchen table and chairs selling for $799.99 at 40% off. Round to the nearest dollar. A $800.00 B $1,120.00 C $1,333.00 D $2,000.00arrow_forwardRefer to the following selected financial information from Texas Electronics. Compute the company's working capital for Year 2. Year 1 $ 33,250 Year 2 $ 38,500 100,000 90,500 65,000 84,500 126,000 130,000 13,100 10,700 393,000 343,000 108,400 112,800 Cash Short-term investments Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets Accounts payable Net sales Cost of goods sold 716,000 395,000 681,000 380,000arrow_forwardnku.4 give in table format or i will give you down votearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education